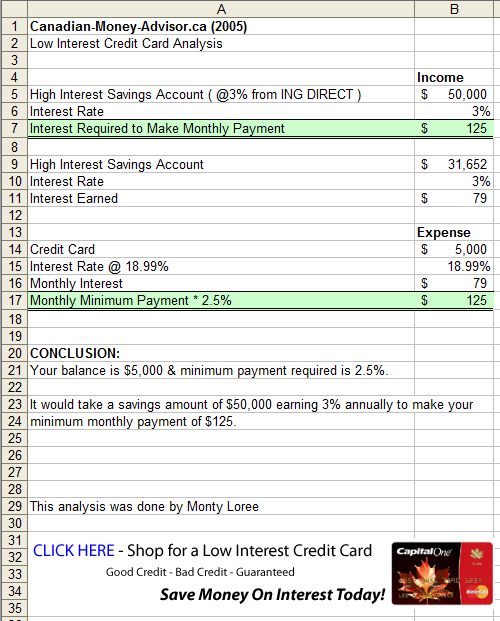

Low Interest Credit Cards Canada - Illustration - How much Savings Interest would it take to make your payments? - Canada

10 Posts • Page 1 of 1 •

1

RE: Beware of Credit Card Introductory Rate

An introductory rate is an interest rate charged to a customer during the initial stages of a loan. The rate, which can be as low as 0%, is not permanent. It has an expiration after a specified period of time.

Alysa Lee

- AlysaLee

- Member

- Posts: 67

- Joined: Wed Aug 10, 2011 11:27:50 PM

- Province: ON

RE: Beware of Credit Card Introductory Rate

You could be one of those people who got promotional offers for a low interest credit card and immediately enrollled before reading the contract. A few years ago, Greg Lipinski applied for a couple of low interest credit card offers but he didn't read the contract to make sure he knows what he is applying for.

His application was immediately accepted and he got his credit in just a couple of weeks. He was even given a huge credit limit, which sounded so good, and within a year, after the offer expires, his APR skyrocketed and he was laden with debt when he couldn't keep up with his payments.His interest rate went from 1.5% to 29% in just a span of nine months, he had to ask his mother to co-sign a loan so that he can pay his debts.

To make matters worse, he used his other credit card to pay the balance of the other credit card, which helped him stabilize his credit history but buried him deeper into debt.

His application was immediately accepted and he got his credit in just a couple of weeks. He was even given a huge credit limit, which sounded so good, and within a year, after the offer expires, his APR skyrocketed and he was laden with debt when he couldn't keep up with his payments.His interest rate went from 1.5% to 29% in just a span of nine months, he had to ask his mother to co-sign a loan so that he can pay his debts.

To make matters worse, he used his other credit card to pay the balance of the other credit card, which helped him stabilize his credit history but buried him deeper into debt.

- JeanKarla

- Moderator

- Posts: 214

- Joined: Mon May 03, 2010 07:35:12 AM

- Province: ON

RE: Beware of Credit Card Introductory Rate

hi..

thanks for the explanation. i know now what prime rates do with the interest rate. i have another question to ask, do the Capital One inform their clients about the change in the rate after the 3 year of 5.99% guaranteed rate is over?

i just want to make sure that i will be aware with interest changes to be safe from high interest rate charges. i don't consider paying off interest from any credit card as it is a liability on my part. it is a loss on my money and i waste on my hard work to earn such amount.

i have been keeping on track with my payables especially when end of a month comes. i take note of all my payments and the balances on my billing statement.

thanks for the explanation. i know now what prime rates do with the interest rate. i have another question to ask, do the Capital One inform their clients about the change in the rate after the 3 year of 5.99% guaranteed rate is over?

i just want to make sure that i will be aware with interest changes to be safe from high interest rate charges. i don't consider paying off interest from any credit card as it is a liability on my part. it is a loss on my money and i waste on my hard work to earn such amount.

i have been keeping on track with my payables especially when end of a month comes. i take note of all my payments and the balances on my billing statement.

- jonathanpaul

- Moderator

- Posts: 350

- Joined: Tue Jun 29, 2010 08:08:20 AM

- Province: SK

RE: Beware of Credit Card Introductory Rate

if you're accepted to have this card, you are guaranteed to have that 5.99% rate for 3 years... after the 3rd year they will give you a different rate based on prime +3.75% currently prime in Canada is around 2.25%... so...

prime +3.75 = 2.25 + 3.75 =6%...

In the future, prime could be higher or lower... and most likely it will be higher...

For this card, I would take the opportunity with the low interest rate to pay off your balance.

prime +3.75 = 2.25 + 3.75 =6%...

In the future, prime could be higher or lower... and most likely it will be higher...

For this card, I would take the opportunity with the low interest rate to pay off your balance.

- montyloree

- Moderator

- Posts: 3772

- Joined: Sat Jul 16, 2005 10:52:47 AM

- Province: SK

RE: Beware of Credit Card Introductory Rate

hi..

thanks for your post.

im a bit confused with one feature of the Capital One Smartline Platinum card. after 3 years the rate would not be the same as 5.99% right? what would be the rate then?

what do you mean about this phrase "rate will stay low and become a variable rate of Prime +3.75% on purchases and balance transfers"?

thanks for your post.

im a bit confused with one feature of the Capital One Smartline Platinum card. after 3 years the rate would not be the same as 5.99% right? what would be the rate then?

what do you mean about this phrase "rate will stay low and become a variable rate of Prime +3.75% on purchases and balance transfers"?

- jonathanpaul

- Moderator

- Posts: 350

- Joined: Tue Jun 29, 2010 08:08:20 AM

- Province: SK

RE: Beware of Credit Card Introductory Rate

hey Jonathan,

As we mentioned in the other post 0% APR credit cards are not a reality in Canada. You can get as little as 1.99% with only lasts for six months.

Capital one's low interest credit card has the following benefits

* Capital One - SmartLine™ Platinum MasterCard - 5.99%

* No Annual Fee, Annual interest rate for cash advances is 19.8%

* Enjoy our lowest long-term rate of 5.99% on purchases and balance transfers guaranteed for 3 years (as long you pay your bills on time)

* After that your rate will stay low and become a variable rate of Prime +3.75% on purchases and balance transfers

* Save money when you transfer high-interest debt with our no-fee balance transfer service

* Subject to credit approval

* Low Interest Rate for Canadians!!

/low-interest-credit-cards.html

The thing I like about it is it's 5.99% for three years guaranteed. That should be enough time to pay down your balance

As we mentioned in the other post 0% APR credit cards are not a reality in Canada. You can get as little as 1.99% with only lasts for six months.

Capital one's low interest credit card has the following benefits

* Capital One - SmartLine™ Platinum MasterCard - 5.99%

* No Annual Fee, Annual interest rate for cash advances is 19.8%

* Enjoy our lowest long-term rate of 5.99% on purchases and balance transfers guaranteed for 3 years (as long you pay your bills on time)

* After that your rate will stay low and become a variable rate of Prime +3.75% on purchases and balance transfers

* Save money when you transfer high-interest debt with our no-fee balance transfer service

* Subject to credit approval

* Low Interest Rate for Canadians!!

/low-interest-credit-cards.html

The thing I like about it is it's 5.99% for three years guaranteed. That should be enough time to pay down your balance

- montyloree

- Moderator

- Posts: 3772

- Joined: Sat Jul 16, 2005 10:52:47 AM

- Province: SK

RE: Beware of Credit Card Introductory Rate

hi..

thats totally true.. 0% APR credit cards are very tempting for any person as it gives the low rate possible but beware of the grace period that such offer is given.. usually, it would only take month for the offer to be effective and once it is surpassed, the rate will go back to its regular rate which is to high to handle. it is commonly at around 19.99%.

you should really read on the fine print before you get to apply for the credit card and weigh out things if you can manage to keep the card or just search for a different type of credit card.

this kind of credit card mostly puts a card holder in trouble of paying off the interest charges because they are not aware of the credit card features. what is on their minds is the low rates that the card offers.

always be careful when you are applying for a credit card as card companies do a lot of strategies to attract customers and they are surely getting something out of you even though they are offering the lowest possible rates a credit card could have.

thats totally true.. 0% APR credit cards are very tempting for any person as it gives the low rate possible but beware of the grace period that such offer is given.. usually, it would only take month for the offer to be effective and once it is surpassed, the rate will go back to its regular rate which is to high to handle. it is commonly at around 19.99%.

you should really read on the fine print before you get to apply for the credit card and weigh out things if you can manage to keep the card or just search for a different type of credit card.

this kind of credit card mostly puts a card holder in trouble of paying off the interest charges because they are not aware of the credit card features. what is on their minds is the low rates that the card offers.

always be careful when you are applying for a credit card as card companies do a lot of strategies to attract customers and they are surely getting something out of you even though they are offering the lowest possible rates a credit card could have.

- jonathanpaul

- Moderator

- Posts: 350

- Joined: Tue Jun 29, 2010 08:08:20 AM

- Province: SK

Beware of Credit Card Introductory Rate

It sounds tempting to sign up when you see a 0% APR offer. But remember, some deals sounds too good to be true. So before you sign up, watch out for the following in the fine print of your credit card agreement.

Default Rate - Your introductory APR rate could default to this rate when you're late in your payment.

How long will the low-rate apply? Make sure you find out so you can pay your balance before it defaults to the variable rate.

What's the rate for the other Charges Does the low-rate apply to transferred balances only or does it apply to all your purchases?

Can you credit card company raise the interest rate at any time?> This will affect mostly your transfer balances if you have a 0% APR Offer.

Default Rate - Your introductory APR rate could default to this rate when you're late in your payment.

How long will the low-rate apply? Make sure you find out so you can pay your balance before it defaults to the variable rate.

What's the rate for the other Charges Does the low-rate apply to transferred balances only or does it apply to all your purchases?

Can you credit card company raise the interest rate at any time?> This will affect mostly your transfer balances if you have a 0% APR Offer.

- bebzkohsev

- Member

- Posts: 14

- Joined: Mon Mar 15, 2010 09:04:31 AM

- Province: ON

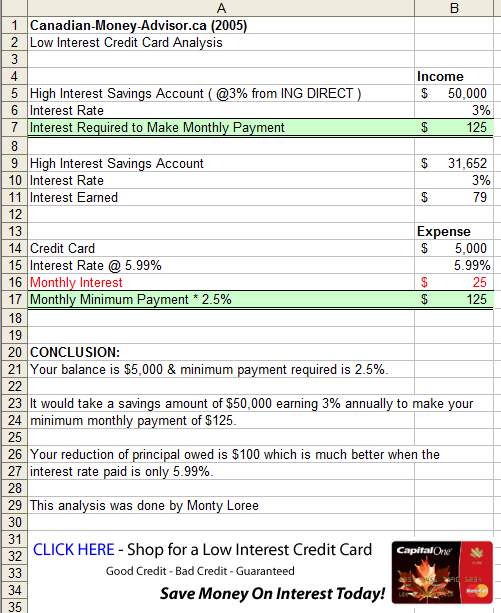

RE: Illustration - How much Savings Interest would it take to make your payments?

This is the same analysis as the one below.

Instead of paying $79 in interest, you're only paying $25 ... thus your principal reduction is $100 ... This will get you to your goal of paying of the debt faster.

This is why it's good to have good credit, as it ultimately costs less. Good credit means you can be approved for lower interest credit cards.

Instead of paying $79 in interest, you're only paying $25 ... thus your principal reduction is $100 ... This will get you to your goal of paying of the debt faster.

This is why it's good to have good credit, as it ultimately costs less. Good credit means you can be approved for lower interest credit cards.

- montyloree

- Moderator

- Posts: 3772

- Joined: Sat Jul 16, 2005 10:52:47 AM

- Province: SK

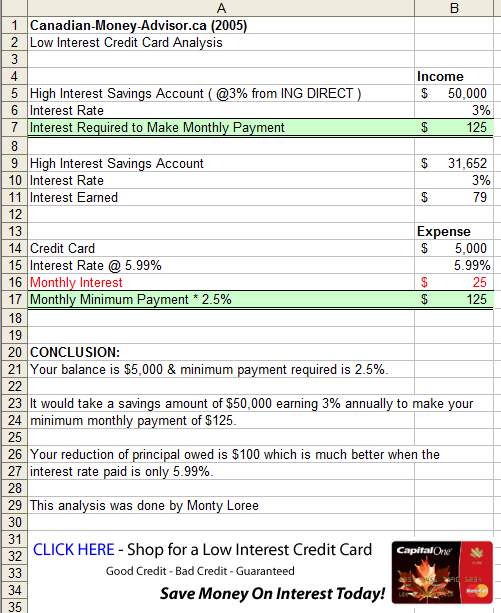

Illustration - How much Savings Interest would it take to make your payments?

This is an illustration of why low interest credit cards are important. Your interest paid @18.99% is $79. Your minimum payment is $125. Only $46 is going to pay off principal.

It's also important to see that if you got laid off, you would need $50,000 in the bank to make your minimum monthly payments. That isn't based on your interest rate, but your minimum payment percentage requirement.

If you're carrying a balance, you would want to pay it off faster.. so paying less interest would definitely help this out.

It's also important to see that if you got laid off, you would need $50,000 in the bank to make your minimum monthly payments. That isn't based on your interest rate, but your minimum payment percentage requirement.

If you're carrying a balance, you would want to pay it off faster.. so paying less interest would definitely help this out.

- montyloree

- Moderator

- Posts: 3772

- Joined: Sat Jul 16, 2005 10:52:47 AM

- Province: SK

Return to Low Interest Credit Cards Canada - Discussion Area