Canadian-Money-Advisor.ca BLOG

Financial Services Commission of Ontario

The Financial Services Commission of Ontario ( FSCO) has newly permitted the up-to-date process created by the Vehicle Information Centre (VIC). You will see the outlines of the latest regulation transformation about motorized snow vehicles and adjustments to the Settlement Disclosure Notice Form for closing settlement of Bill 59 accident benefit rights.

Revisions to the CLEAR Method

The VIC has only just projected adjustments to the CLEAR method that includes the following: considering two-door, sport forte and all-purpose convertible automobiles as exceptional body styles, utilizing the similar representation for both trucks and cars, including new attributes in the representation like the presence or absence of air bags, anti-lock brakes and VIC approved theft deterrent method, and revisions to the adjustment aspects used in the method.

FSCO has assessed the updated method. FSCO has decided that the proposed revisions will greatly advance the risk classification structure for vehicles and has accepted the updated method.

Yearly Update of Rate Group Index

VIC has created a fresh strategy to the yearly update scheme so that the standard differential basic to the vehicle rate group index, depending on a constant book of business, would remain considerably similar from the previous year. FSCO has re-examined this new strategy for the year 2002 table and has accepted its functionality, subject to the following circumstances:

VIC will give technical citations on the yearly update to the CLEAR vehicle rate group index to FSCO. The moment FSCO has reviewed the citations and accepted the table, VIC will circulate the vehicle rate group index and give to insurers the rate group drift for the rate group table. It is predictable that an updated vehicle rate group index will be in print by VIC in January of every year.

Insurance subscribers are expected to pass a major filing for confidential passenger automobile insurance with rate level indications, utilizing the Section 410 Filing Guidelines - Major, on at least a twice a year scheme. Such a filing must be a sign of a provision for vehicle rate group drift in approximating the rate level indications.

Insurance subscribers are also expected to suggest revisions to base rates for coverages that mirror rate adequacy by coverage, after taking into account the rate group drift by coverage, when submitting accelerated, Respond to Market (R2M) or major filings.

Insurers must update vehicle rate groups on a yearly condition, soon after a latest rate group table is provided. Updated rate manual pages, that comprise the latest rate group tables, should be given to FSCO.

As well, revisions will be made to the Automobile Statistical Plan to confine the vehicle rate groups straight. This will help in evaluating the rate group drift influence and the comparative loss cost experience among rate groups utilized in the CLEAR method.

See Also

RBC Financial Planner costs

Financial Instruments For Lease

Hotforex STP Broker

External Links

FSCO.gov.on.ca

Ontarioinsurance.com

Slaw.ca

Comments (0)

CMA Blog Home

Are you amply insured in your life?

You might be aware why life insurance plays a significant role in a firm financial structure: It will give revenues for your spouse and dependent kids at any chance you unexpectedly die. This is the reason why youthful parents are a prime target for insurance agents and insurance companies.

However, for many people, life insurance is persistently seen as a worthwhile cost even after the kids graduate and finish school and go about their own lives. This is particularly so due to the economic and social developments and medical breakthroughs.

A lot of Americans who used their home equity or transferred to larger houses and loans at the time of their career-driven years have added more years of mortgage fees. That, together with underwater home standards for many home¬owners, is a money owing sentence for you if you don't have a sufficient sum of life insurance.

Trends in society have also paved for new requirements for coverage. Married couples who are working who delayed having kids might still have dependent kids when they' reach their 60s. Ditto for mixed and new families joined together in later-life second marriages. Recently, 6 percent of married men in families with kids under 18 were aged 55 or older, up from 3.6 percent in the year 2000, with reports from the U.S. Census Bureau. Also, financial responsibilities of parents hardly ever stop at 18, particularly for children bound for college

Lastly, since there is better health consciousness and breakthroughs in medicine, your surviving partner may well survive another 10 or 20 years after you die. Those sunset days will be expensive, and an adequate death benefit will aid in pushing back the day when he or she might outlast your shared possessions.

During these uncertain occasions, it's mainly vital to look back on your life insurance needs to ensure that your coverage is updated.

See Also

How to Buy a Life Insurance Policy in Canada

What is Term vs. Whole Life Insurance?

Whole Life Insurance Canada

External Links

Buzzle.com

Hubpages.com

Ezinearticles.com

Comments (0)

CMA Blog Home

Terminologies to Guide you in Understanding Health Insurance

Coinsurance

The portion of your covered expenditures that you should settle following the deductible is attained. Let us take for example; a company protocol may ask you to pay a percentage, say 20% of the fee up to a specific dollar total.

Conversion of Privileges

This enables the member or beneficiaries to change the coverage of their health insurance plan to another plan of insurance without giving proof of insurability. The privilege arranged by a group protocol is to transfer to a single policy once the termination of group coverage is made.

Coordination of Benefits

Stipulations in group regulations that limit the entire advantages to be paid under 2 or more group regulations so that benefits do not go beyond the tangible sum of covered expenditures acquired. COB is mostly significant when a husband and his spouse each have acquired family coverage under different group policies. A few of these protocols may decrease the sum of benefits to be paid if benefits are payable under further insurance coverage.

Co-Payment

A particular dollar total a member must pay to a care plan for covered health care benefits. It is compensated to the provider during the benefit is enjoyed.

Deductible

The primary sum of covered expenditures a policyholder will have to settle before services are paid under the protocol. Usually, bigger amounts of deductible equate to lesser premium. Take note that the deductible must not be so big that you could not manage to settle it should you get sick.

Discuss with your company representative if the deductible is a constant yearly payable or if you must shell out a deductible for every service, or for every member of the family. A few of major medical protocols have what is also called as a “variable deductible”, meaning that the deductible will be the larger of a flat dollar total or the dollar amount or the entire cost coverage.

See Also

What is Self Employed Health Insurance?

What is Term vs. Whole Life Insurance?

Industrial Alliance Life Insurance

External Links

Ehealthlink.com

Personalinsure.about.com

Myoptumhealth.com

Comments (0)

CMA Blog Home

What You Need to Know About Health Insurance?

The ultimate purpose that individuals sign up for insurance coverage is to safeguard them from any possibility where they may need urgent medical services. The losses described by insurance policies point to the financial loss and in specific instances, even the death of the subscriber or a beneficiary. The notion is that any insurance coverage, whether it may be health or any other service can be utilized as a protection only when the coverage matures. Moreover, what is not usually tackled is that even if the coverage has not yet reached its maturity, a subscriber can still have some impression of benefit by engaging into what is also called as a policy loan. Take note however, that not all health insurance companies have with them this service where the health insurance is connected with an equivalent life insurance policy. Yet for those who have acquired it, this can give a short term resolution for those instant cash requirements where the entire worth of the insurance coverage served as the guarantee for the loaned sum.

The term health insurance is normally used to refer to a type of insurance that covers medical expenses. It is occasionally used more largely to include insurance including disability or continuing nursing care requirements. It may be given through a social insurance plan sponsored by the government, or from private insurance institutions. It may be acquired on a group scenario or obtained by individual clients. In every case, the covered groups or clients shell out premiums or taxes to assist in safeguarding themselves from increased or unforeseen healthcare costs. Comparable services paying for medical costs may also be obtained through social welfare programs financed by the government.

Hence, health insurance operates by approximating the total risk of healthcare costs and creating a regular finance composition that will guarantee that money is accessible to cover for the healthcare benefits listed in the insurance agreement. The service is managed by a central organization, usually either a government firm or a private institution working on a health plan.

See Also

What is health insurance?

Industrial Alliance Life Insurance

Premiere Danny Williams doesn't need Health Insurance

External Links

Nytimes.com

Ezinearticles.com

Insuranceusa.com

Comments (0)

CMA Blog Home

Recent Federal Laws Aid Clients Obtain Credit Card Relief

The Federal Trade Commission submitted a Credit Card Debt Relief Act 2010 which took effect on October 27th 2010. This recent law efficiently prohibits debt settlement companies from getting upfront charges. Hence, the former risky alternative turned to be a legitimate strategy to get out of debt in credit cards. If they cannot manage the balances of the credit card by at least 60%, then you do not charge a fee.

The said act was also referred to as the Debt Settlement Act. Because of that, it has made this business much more lawful and better alternative for clients looking for credit card relief. The whole industry is a service based on performance now meaning if they cannot execute and attain a successful settlement transaction then you don’t pay any fee.

Over the years, clients or small businesses that come into a program on debt settlement would have to give their payments upfront although there was no definite assurance that their debts would be paid. A lot of shady companies benefited from this business model and easily sat back and obtained charges without giving any real service. Hence, this is not made possible. Eventually, all of the shady companies have been closed.

Only the lawful debt settlement companies are left in the industry. The companies that have been legitimately managing balances in consumer debt for the past five years will have sufficient confidence to obtain their charges on the back-end when they attain an effective settlement transaction. The best companies are aware that they can sensibly manage your debt for approximately 60% of the balance. Thus they will have no difficulty collecting their charges after they really do the service. This is a much better transaction for clients looking for credit card debt relief.

Releasing yourself from debt through a debt settlement method is at present very famous but you need to be aware about the top performing programs for you to get the best options. To evaluate the companies offering debt settlement, you can check out a free debt relief network which will trace the top performing companies in your locality without charge.

See Also

External Links

Comments (0)

CMA Blog Home

Knowing the Best Low Interest Credit Cards for March 2011

The best low interest credit cards we have today actually underwent some changes for them to be what they are now. During the year 2008, the Credit Card Act became effective, many issuers struggled to maintain their profits and one of the actions they took is by increasing the credit cards’ interest rates. Then again, if you look into it closely, you will still discover a decent number of credit cards providing lower interest rates compared to others.

The Following are the Best Low Interest Credit Cards:

Chase Freedom® Visa – As of recently, this is the card with the best rewards program on our listing. This card provides cardholders a purchase APR of 11.99% – 20.99% variable, depending on the credit history of the client. As indicated in the card, $100 cash back is received when you spend at least $500 in the first 90 days upon subscribing to the card and the Chase Freedom® Visa – $100 Bonus Cash Back also offers 1% cash back on all transactions. A 0% intro APR on balance transfers for 1 year and on transactions for six months is covered and 5% cash back can be received on revolving categories each and every year. Additionally, this card does not have an annual fee.

Citi® Platinum Select® MasterCard® – This card is perfect for clients with a credit card balance somewhere else as a 0% intro APR for 21 months on balance transfers is allowed with this offer. The fee for balance transfer is a low 3% ($5 minimum) meaning the amount you can put aside on interest is huge saving. Also, there is a 0% intro APR on transactions for 21 months and after that, the purchase APR is 11.99% – 20.99% variable, depending on the credit history. The Citi® Platinum Select® MasterCard® is deficient on two aspects, a good and a bad one. First, it does not offer a rewards program (though there are certain discounts in online transactions) but second, there is also no annual fee.

Discover® More Card – $100 Cashback Bonus – This is considered as the second large bonus prospect on our listing, the Discover® More Card – $100 Cashback Bonus. It covers a variable APR of 11.99% – 20.99% and an introductory APR of 0% on balance transfers for a year and on transactions for six months. The fee for the balance transfer is 3% and the $100 cash can be received after using $500 in transactions over the first three months. 0.25% cash back is received on the Discover® More Card – $100 Cashback Bonus for the initial $3,000 in spending yearly and 1% cash back is earned after that. 5% cash back categories are provided all through the year and the Discover® More Card – $100 Cashback Bonus does not have an annual fee.

Capital One® VentureOne℠ Rewards Credit Card – Although Capital One is not popular for their low interest rates, the Capital One® VentureOne℠ Rewards Credit Card carries a very respectable 13.9%. Additionally, the rewards program is superior as 1.25 points are received on each dollar spent and all credit cards in Capital One are foreign transaction free, which means that any international transactions can be done without payments being charged. Together with this offer is a 0% introductory APR on purchases until August 2011 and the Capital One® VentureOne℠ Rewards Credit Card does not have an annual fee.

See Also

Talk about Low Interest Credit Cards Canada

Low Interest Credit Cards for Canadians

MBNA Low Interest Credit Cards

External Links

Articles.arfandia.com

Lowinterestbalancetransfercreditcards.org

Lexreach.com

Comments (9)

CMA Blog Home

A 2011 Update on Bankruptcy against Debt Settlement

Debt settlement is considered as the process of discussing with creditors and settling a person’s unsecured, unpaid accounts. This strategy is oftentimes utilized by those individuals who can no longer manage to settle their credit card payments and other bills. Together with the aid of an expert in the field, or even on their own, many debtors are able to actually decrease the sum of their loan and bargain a more affordable plan of payment. This assists the consumers to get out from under their debt and recover control of their financial status.

The Difference between Debt Settlement Differ and Bankruptcy

Bankruptcy has two different kinds that consumers can file for: Chapter 7 bankruptcy and Chapter 13 Bankruptcy. In a Chapter 7 Bankruptcy, a client’s assets are cleared up, but not including their home and primary vehicle, and are utilized to pay off creditors. As an outcome, almost all individual's unsettled accounts are discharged and an individual has the chance for a fresh start.

On the contrary, in a Chapter 13 Bankruptcy, a person's unpaid accounts are reorganized and they are given with a court-ordered plan of payment. People who are filing for Chapter 13 will be able to keep their assets, provided that they abide by the required payments. This kind of bankruptcy is less typical and is only chosen by those persons with many properties.

During the process of debt settlement, a person is decreasing the sum of their debt by arriving at an agreement with their lenders. They are not going to lose their assets or they are not going through the legal proceedings. Those that prefer to resolve their debts, instead of declaring bankruptcy, will also undergo less of a hit to their credit score.

Should Consumers Undergo Settlement than Declaring Bankruptcy?

An individual should only file for bankruptcy when they have tried all other alternatives to settle their debts. Bankruptcy is not a matter to be taken calmly, since it will radically have an effect on a person's capability to get loans and other types of credit in the future.

Consumers will also opt to pay their debts before they reach a dire situation that bankruptcy can be considered. A lot of times, settling one's unsettled accounts can help them stay away from bankruptcy in the future. When choosing between reaching a settlement agency or filing for bankruptcy, the healthier option is debt settlement, provided that an individual does not have a lot of catching up to do that settlement is no longer an alternative.

See Also

Online Debt Settlement - Negotiation On Bad Debt

FAQs Regarding Our Debt Settlement Program

35 more bankruptcy questions for Canadians

External Links

Ezinearticles.com

Articlesbase.com

Debtfreecredit.net

Comments (0)

CMA Blog Home

Managing Rejections in Personal Loans

Once a lender rejects a loan application, specifically a personal loan, there might be various diverse reasons. A few of the most typical cause for rejection are preceding bankruptcy, judgments, and reports from collection agencies on credit report or present joblessness. Every time you submit an application for a personal loan, the initial factor the lender will do is obtain your credit report to establish your financial standing and credit history. The credit report will reflect a lot about your credit value and your capacity to settle payments.

Further Factors

There are other factors that may lead to a personal loan denial and these are behind schedule payments, having transactions beyond your credit limits and having unpaid accounts. If many inquiries are displayed on your credit report, this can have a negative implication as well. This can also have an effect on your credit score. Lenders are likely to consider many inquiries as proofs that you either have submitted for an application for a lot of credit lately that isn't manifesting on your credit report or that you have more credit than what is being shown.

Oftentimes, lenders will still provide funds to borrowers with poor credit history if they deem that the borrower is presently settling previous debts or if the causes for the previous unsettled accounts are no longer existent. However, a difference can exist in these situations. It is most likely that the lender may charge you a bigger interest rate since you have a negative credit history. If you think that the interest is too much, think again about applying for the loan. Your motive for getting the loan may not be worth since you will end up paying with a higher interest for the duration of the loan.

Raise Questions to Know Why

If you have been rejected of a personal loan and do not clearly know the grounds for disapproval, talk to the lender that rejected the application. If you believe that you are a good credit risk, then their grounds for denying your personal loan application was most probably taken from something that was manifested on your credit report. If they are not willing to tackle every aspect of your credit history with you, they can surely direct where you can grab a copy. Each client is permitted to have a copy of a free credit report, especially if they have been deprived of credit in the last 2 months.

Correct the Inaccuracies in Your Credit Report

In reality, a lot of individuals have discovered mistakes on their credit report. Particular faults can negatively affect your credit for a long time if they remain uncorrected. Scan over your credit report beginning with the topmost where they show your name and ID numbers. Be certain that the person reflected on the report is in fact you.

The moment you noticed errors on your credit report, feel free contact the credit bureau and let them know of the inaccuracy. They will give you a form to fill in about the mistake as well as the ways for you to confirm that it is an error. You may also reach the lender or agency and request them to send you a letter of satisfaction which you can forward to the lender that denied your loan application. At the same time, forward a copy of this to the credit bureau.

See Also

Bad credit loan needed?

Get Out of Debt

Bad Credit Loans

External Links

Creditloan.com

Flyingsolo.com

Ehow.com

Comments (0)

CMA Blog Home

The Bankruptcy of Chrysler Nearby; Fiat Also Visiting With General MotorsI was listening to a commentary on CBC this morning that talked about Chrysler declaring bankrutpcy. They were mentioning that the bankruptcy is almost certain.

What I thought was interesting was this: If Chyrsler declares bankruptcy, then it may shed some light for General Motors as to what they need to do. There are alot of questions right now as to what would happen if the big car company declared bankruptcy. There are really no answers. There is no way to talk about this topic as it's unprecedented.

Sometimes the only way to learn about something is to do it.

If General Motors is closing down plants for 9 weeks, to use up their current supply, that really says what the automobile sales climate is like.

I just purchased a brand new car (Hyundai Accent L), and it was manufactured back in November 2008.. This means that it had been on the lot for six months. At that point, you can see that with inventory stocked up like that the car companies are cash strapped, to say the least.

So.. is bankruptcy looming for Chrysler and General Motors? Probably. I think the public is getting used to the idea. And that will make it easier for the politicians to decide.

There is so much of a glut of cars right now... it just says that there is ample supply available. There isn't room enough for these big car makers.

MediaPostNewsThe United Auto Workers union would end up owning a substantial shareholding in Chrysler LLC Chapter 11 under a bankruptcy protection plan that the automaker is expected to present next week, Jeffrey McCracken and John D. Stoll and Stacy Meichtry report. The deal lets get rid of some liabilities, allowing Fiat to cherry pick the operations you want, if an agreement is forged sources.

For its part, Fiat has begun talks with General Motors about joining forces in Europe and Latin America, say the sources. The Italian company could close the purchase of a stake in GM Opel. But GM did not try to go forward until the plans are settled with Chrysler Fiat. Fiat has said it wants to have an initial 20% stake in Bankrupt Chrysler.

In either case, it would have a major impact on the automobile supply chain of car dealers, parts and others, as well as the worsening economies of the midwestern states.

However, both Fiat car company and the administration say that President Obama could prevent the bankruptcy of Chrysler if an agreement can be reached with the banks in question. "In a huge and complex negotiation like this, everything is speculation and up in the air until there is an agreement," said one administration official.

Comments (3)

CMA Blog Home

How Bernie Madoff did his scandolous deeds - in JailIt still amazes me to read this story. Thinking of all of the people who were affected by the Madoff Scandal.. When you thinking of companies like general motors and chrysler who are affecting miillions of people. This scandal is small in comparison, however, it still affects a widespread amount of people.

CNN.com The employees were transfixed. Standing in the middle of Manhattan commercial flooring Bernard L. Madoff Investment Securities in late 2007, half a dozen staff members looked at the ceiling-mounted TV and CNBC aired a report on the mysterious death of Palm Beach, a hedge fund manager who was leading a double life. The police, apparently, even considering the possibility that he had been murdered. "Bernie Madoff," someone asked casually Bernard Madoff like to walk, "you've heard of this guy?"

Madoff a look at the screen, bleached, and exploded: "Why the hell would be interested in stuff like that?" The employees retreated. "I never saw him like that before reacting," Madoff said a trader who witnessed the explosion. "It's obviously affected a nerve."

0:00 / 2:48 Minnesota Madoff mess

That loss of control was very out of character for the head. But traders did not know at the time it was extremely Madoff develop a second life is two floors below them, one is to build an epic, and the inevitable explosion. Took a special pass to enter the "back office" in 17, which was making its Madoff $ 65 million Ponzi scheme. And even if a person can go in, there was not much to see: an old IBM computer server maintained in a locked room, the piles of trading states, and a staff of about 20 employees and paper pushers.

In retrospect, of course, there are indications, such as research has found fortune. IBM's server, for example, an AS/400 dating from the 1980s, it was so old that some data had been entered into the hand, but refused to replace Bernard Madoff. The machine - which has been autopsied by the government - is the nerve center of the fraud. The many thousands of pages of statements showed that his trade was never made.

Then it was the man who led the floor, Frank DiPascali, Bernie Madoff deputy chief of staff the 17. He was a veteran of 33 years of the related company, with a heavy accent and a Queens high school, but nobody was quite sure what he did or what his title was. "It was like a ninja," says a former trader at the legitimate operation above. "The whole world knew he was a great thing, but it was like a big shadow."

There are other mysteries, as we shall see. But even after the large detonation of five months in a brilliant fireworks display of betrayal and recrimination, Madoff plan - possibly the biggest investment fraud in the country's history - has remained among the most difficult to penetrate. More commonly, white-collar cases begin with a quiet, behind the scenes of research, followed by a series of transactions with younger employees, who are squeezed by lawyers and prosecutors to cough up details about their superiors. Step by step, prosecutors move up. Finally comes the denouement: the ringmaster hauled to court in securing handcuffs.

But Bernie Madoff all aspects of the traditional narrative that has been reversed. The case began with flabbergasting his confession, which was outside the investigation. Bernie Madoff argued that all crimes committed by himself, but because it covers decades and continents, a cloud of suspicion immediately plunged Bernie Madoff family members who worked at the company, as well as employees and business associates.

Now that the fog may be about to lift. Fortune has learned that Frank DiPascali is trying to negotiate a plea deal with federal prosecutors in which, in exchange for a reduced sentence, disclosed the encyclopaedic knowledge of the plan Madoff. And unlike his boss is willing to DiPascali names.

According to a person familiar with the matter, DiPascali has no evidence that Bernard Madoff other family members were involved in fraud. However, he was prepared to testify that he manipulated false returns on behalf of some major investors Bernard Madoff, including Frank Avellino, who used to run the so-called bottom feeding, Jeffry Picower, whose foundation was closed because of related Bernard Madoff losses, and others. If, for example, one of these clients had large gains in other investments, which would DiPascali, which produce a loss to reduce the tax bill. If true, this would mean that investors knew their statements fish. (Lawyers and Picower Avellino declined to comment. Marc Mukasey, DiPascali counsel, said, "We expect and encourage a thorough investigation.")

The emergence of this potential star witness can be on the case scenarios in their heads: Some people widely assumed by the public which has been implicated in the fraud may not have been, and a small group of investors that Bernard Madoff seemed innocent victims can not have been totally innocent, after all. But then, some things about the life of Bernie Madoff become what they seem.

Comments (4)

CMA Blog Home

I've been slow posting lately.I thought I would pop my head in a little today. I've been working a little slowly on the site here... My wife has been pretty ill and It's a stressful situation.

I will probably do some posts as my energy permits... and also, I am working on a few other projects that I need to get done.

So... Hopefully I'll be at it in the next few days.

Comments (2)

CMA Blog Home

The Necessity of Building Emergency FundsDo you have a financial emergency due to a job loss? Or do you have a medical expense that will significantly affect your finances? Almost everyone has a financial problem and the route that the recession is taking has compounded loss and depression. It's definitely time to reserve the cash flow and save up for emergency funds that has been depleted with the falling dollar, gas hikes and the weak economy. So what do you do when it comes to a matter of saving? The best way is to get creative and think of ideas and ways of how you can save money and stash it away as your emergency funds.

Maybe it's easier said than done, but there are secret routes to saving up emergency funds. You could also involve your children so that they are aware of finances and the nuances that are attached to it. You could draw your children into the circle of awareness by paying them money for a job done or collecting money from you as a fee for late payment. No doubt this would transform your emergency saving into an expense but the children will definitely get the idea that money is precious and needs to be conserved. You can also add on an imaginary 10% to the price of your purchase and then save the money. This would not only help you save some money, but it would make you prudent about spending and adding to expenses.

How to Save for a Rainy DayThere are many ways that can help you to save up for emergency funds. You keep a coin box and collect all your coins, which, in actuality is a very handy thing when you need money or you can collect five dollar bills. This really helps when you save money and adds to your emergency funds. Instead of the usual price that one pays for gas, you could add a dollar more and pretend that it is really a dollar extra. This will help you to put that extra dollar into your

emergency funds. You could sell all the unwanted things around the house and though you may have more than a few bargaining about the price, this method will add to your emergency funds. You could save gas money by buying all the groceries and other commodities that you may need in one trip. Instead of driving many times to the supermarket, you could take a walk that would help you save money as well as improve your fitness regime. Another way is to get a credit card that offers a good reward program. As soon as you get the rewards, pass it on to your emergency fund.

It is necessary to keep aside about three to six months of emergency funds that would cover payments. This would come in useful if you or your spouse loses a job or if any undue expense crops up. You can set targets and goals as to how much you would like to save in a given period of time. You can start small and then get used to doing without that money. Start a savings account or certificate of deposits (CDs) or a money market account. See that you get considerable interest for your savings, but make sure that you save your emergency funds in a place that would be accessible and not blocked when you need it the most.

Be Prudent and Creative about Saving Money

Comments (3)

CMA Blog Home

Unprocessed Food is Cheap - HealthJust recently we've been trying to help my wife's health get better. Along with the chemo that she is doing, she also wants to eat healthy, do juicing etc.

I went to the store the other day and purchased a bunch of fresh vegetables that we're going to put through the juicer.

I filled up my basket and it was quite heavy. When I went through the check out, the bill only came to $27 !!

All of the vegetables that are recommended for my wife to eat to help fight cancer, was the cheapest foods of all. In my mind that means that I should be eating them as well.

For a very healthy diet that floods your system build up... you need fresh fruits and vegetables. Because we're juicing them, we're going through alot more than usual.

I purchased a 50 pound bag of carrots last week and it cost $25 for the bag. That's pretty reasonable. The bag has lasted us the better part of a week... and we're eating alot of carrots.

We didn't get recommendations to eat processed foods, sugary foods and deserts etc. These are costly and also aren't really recommended as cancer fighting foods.

BTW... cancer loves sugar.. sugary processed foods are BAD if you're trying to fight cancer. Something I learned recently.

I thought I would do a short post to say that unprocessed fruits and vegetables are really cheap. Ultimately they are the best food for you. The down side is that they take a little longer to process.

It goes to show that the best things in life are usually free or much less expensive.!!

Comments (3)

CMA Blog Home

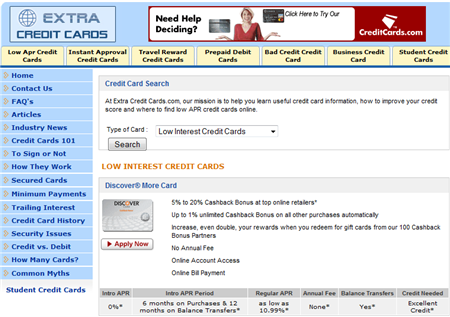

Low interest credit card - U.S. websiteI was asked to do a review for a credit card website that features American credit cards

Sometimes it's good to see what the "other guys" are doing.

This site allows you to search for low interest credit cards, secured credit cards, student credit cards and more.

The thing that's different about the U.S. credit card websites is that they show many of the banks' credit cards. Unlike Canadian banks which don't have affiliate programs for their credit cards.

This site has many different articles about credit cards which are things you need to know if you're going to carry credit.

The main thing you want to do if you're shopping for a credit card is look at rates and the other costs to own the credit card. It's all about the cost of credit. If you can find a better deal and save money, just by spending some time shopping, then it's really worth it. Sometimes you can save hundreds just by getting the lower interest rates.

And it's safe to use a site like this. All of the links follow back to the banks website, and the credit card issuers sites are always secure.

If you need a secured credit card, low interest credit card, student credit card etc.. and you live in the U.S... this is a good site to visit. It's got a clean look, has credit card comparisons and you can sort the credit cards by type.

This is a sponsored review

Comments (2)

CMA Blog Home

this is a great video that talks about the debt situation in Canada.

I like the fact that the commentator puts the blame for the too high level of credit squarely on the consumer. We need to take responsibility for the amount of debt that we're in now..

Nobody forced the consumer to buy , and take on more credit.

Currently the Canadian consumer has $1.3 trillion in consumer debt, this includes mortgages

I like this second video as it gives an actual example of a lady who's quickly accumulated $10,000 in debt. The industry calls her a revolver, as she can't pay off her balances completely.

Credit card companies like revolvers as that's how they make their money.

This lady has figured out that "perhaps the credit card companies want you to carry balances!!"

Comments (9)

CMA Blog Home

Debt Settlement - You don't have to pay your debts??!!Just going through youtube looking interesting things that people say..

This guy starts off by saying... "you don't have to pay your bills"

This makes me crazy. This guy is suggesting that you shouldn't pay your bills/debts especially if you owe $25-$100,000 on credit cards.

He mentions that you should be using the interest that you're paying the credit card companies to save up for retirement.

This is LUDICROUS

The following is what this guy is explaining on the video

He starts off by explaining you should just not pay your bills for six months.. This will start the collection process. You can then negotiate with the collection agency at 10% on the dollar.

Part of the negotiation is that the credit bureau wipes any negative debt notation off of the credit bureau.

So... after 6 months, you'll have a nice squeeky clean credit report, and no debt.!! Wow... this is fantastic!! Or is it?

There are so many assumptions in his discussion that they need to be addressed.

Also it's important that this type of service is for U.S.A. (Americans) only. This system isn't going to work the same in Canada.

I complete disagree with not paying your bills for the sake of getting out of them. That's the cowardly way to do this. This type of logic will erode the social fabric of our society.

IF YOU CAN, PAY YOUR DEBTS

If you've got alot of debt, and can afford to make payments, then you should pay for your debts as agreed. After all, you made all of the purchases that incurred the debt!

The only exception in my opinion is if you've got health issues, and your debt is making your health worse. Then it's time to seek debt settlement or bankruptcy help.

THE CREDITORS MAY SUE YOU

If you owe $25,000 -$100,000 then the creditors may sue you in Canada. This is worth going after in the courts. Don't assume that you can automatically settle you debts after not paying them for six months.

THE CREDITOR DOESN'T HAVE TO REMOVE BAD MARKS FROM YOUR CREDIT REPORT

This fellows assumption is that you can have the creditor or collection agent remove negative items and comments from your credit bureau, as part of the payment negotiation.. While some may do this, some may not do this.

It all depends.

CREDIT REPORT ITEMS MUST BE ACCURATE, COMPLETE AND VERIFIABLE.

Are you going to walk away with no debt and squeeky clean credit after the creditors and collection agencies write off your debt? More than likely not.

Why would the banks want to remove negative items. This sends a false message to other creditors that you've got good credit.

Again, you could ask to have negative items removed from your credit bureau, however, there is no law / motivation for the creditor to do so.

In my opinion, this is a shifty way to deal with your creditors.

If you've had a high consumption lifestyle, then you should pay for it, as agreed to when you took on the credit facilities.

If it takes you 10 years to pay off your credit cards, then so be it. After 10 years, you'll have learned your lesson about the effects of spending too much on your credit cards.

There are always exceptions to the rules, but in the case of North American consumers.. I think we're all guilty of over consumption.

Comments (2)

CMA Blog Home

Peter Schiff on Youtube. - He's Right about the economyI like to watch Peter Schiff. He's usually pretty straight forward and understands the fundamentals of the economy.

Sometimes it's important to understand what's going on in the economy to know what we should be doing individually.

When you see the whole nation suffering from too much debt, and not enough savings, then you can see what the effects are overall.

This should tell people what they need to do in their own personal finances.

Peter Schiff is good to point out items in the economy that are going to affect everybody on the overall.

Learn more about the Canadian coin and the Canadian Economy

I recommend that you check out Peter Schiff's channel on youtube, if you're interested to know what's going on in the economy.

Ultimately it gets back to this.. low debt and high savings will save any economy. Not giving in to instant gratification like we have done for the last 20+ years.

It's also good to invest in R&D so that our country can be profitable and competitive in the future.

I think this economy is going to stay like this for a while until people get the idea and decide to really get on with fixing their balance sheets.

Comments (1)

CMA Blog Home

Mortgage Crisis - The bank's Fault? - or the Consumer?I was reading a blog that said that the mortgage crisis is the bank's fault. I can't believe that somebody would seriously write this in a blog.

Let's see.. the definition of a Consumer, is somebody who consumes. Nobody put a gun to the consumer's head to buy. They all did so willingly.

There were no laws passed that said that the consumer HAD to buy houses, cars or consumers items.. they did so willingly.

IMO... if a person buys a house, they should understand whether or not they should be able to finance the property.. If you don't understand the contract, then hire a lawyer (or somebody trained in contracts) to help you understand the fine print.

I'm very surprised that the media is saying that the homeowner got duped by the mortgage companies.. That's ridiculous. That's putting the blame in the wrong place..

Buying a house for $250,000 is a big purchase. It deserves a great deal of attention, to understand the costs involved. A house has current and future costs.. A mortgage has current and future costs.

BUYER BEWARE: If you don't take the time to understand the costs involved, then you are at risk for making an expensive decision.

Here's what I would recommend to anybody buying a house.

- Learn how much the house & Utilities will cost

Take the time to gather all of the current utility bills, tax bills etc for the house you're looking at buying. See what the costs are.

There are also down payment, closing costs, inspection costs etc with the mortgage.

If you're clear on the costs, then there won't be surprises later on.

- Learn and understand the mortgage contract

Contacts are not easy to understand. You should NEVER sign a contract that you don't fully understand. Doing so means that you're vulnerable to whatever you agreed to.

If you're not sure what the contract language means, ask a lawyer. This is a cost of due diligence. If you need to save up additional money to afford the lawyer, then take the time to do so.

Ask the lawyer what the fine print means, and what are the things you should watch out for.

A lawyer is trained in legal speak and will be able to give you advice that the mortgage company may not come forward with.

- Learn about the fees and future/renewal costs of the mortgage.

This is something you should also ask a lawyer. What are the hidden fees, if any? What are the fees should you decide to refinance, or sell the property?

You might just ask the lawyer to itemize all of the potential costs that the contract holds.

This may cost a few hundred dollars, but the lawyers analysis could save you a ton of hard ship in the future.

I don't believe for a second that the mortgage crisis is the bank's fault. It's not the mortgage companies' fault. It's the consumer's fault all the way. They made the choice to buy the houses in the first place.

Each and every consumer who got involved with a toxic mortgage made the decision to do so. They could have known what the costs were before they took the mortgage. They could have insured for mortgage with critical illness insurance, and life insurance..

There's enough information in the market place to make an informed decision. If the consumer DECIDED NOT TO TAKE THAT INFORMATION, it's their fault!

Comments (1)

CMA Blog Home

Consumerism Withdrawal - Do you suffer from it?This is one problem with the economic downturn that I thought of. Consumerism Withdrawal.

The premise of the economy for the last 20 years has been consumption. Living the American dream. People have done a pretty good job spending, and consuming.

There have been many posts in the blogosphere where people explain that they're going to cut back spending and go on a spending diet. They talk about how they're not going to go shopping for a month, or not buy anything on credit for the next three months. Ultimately with those posts, I just roll my eyes, and wonder about their resolve.

Once you've tasted luxury and spending, it's hard to give it up.

With all of the lay offs and the credit crunch that we're experiencing, I'm sure that many people are suffering from consumerism Withdrawal.

This is more like being forced to go on a diet because of food shortage. In this case, credit is tight, and people have overspent.

If you're suffering from consumerism withdrawal, there are a few things you can do to help the situation:

- Learn to enjoy life with what you've got

The problem with consumerism is that we're always looking for the next big toy, or the next fashion. We're satisfied for a small time with what we've purchased. Much of what people have purchased is to satisfy wants and not needs.

The best thing to do is to learn to appreciate what you've got already.

That's a pretty hard thing to do, if you're used to a constant diet of new things all the time.

I've found that I really only enjoy a few of the possessions that I own. the rest are just sitting in a closet doing nothing.

Enjoying what you've already got, means that you won't need to spend any money on goodies.

- Take the time to strengthen your balance sheet

If we're going to be in a recession for the next year or so, why not take the time to pay down debt and save up some money.

This is really not fun, and it's pretty boring, compared with shopping all the time for the latest gadget.

My thinking is this: if you've got money saved up, and you're not in debt,

you'll sleep better, and won't need to go through withdrawals at the retail store.

Having some money saved up, means that you'll be able to go into the store and make some moderate purchases, based on your available cash.

Buying things with cash will give you a little taste of having something new, without the pains of paying down credit later.

- Take the time to enjoy the free things in life: family and friends.

I've gone on a cash diet for the last few years, by choice. In doing so, I've learned to really enjoy free things. Going for a walk, visiting with a friend. I enjoy looking at flowers more.

There are many things you can do for free. Sometimes we look at these FREE things as boring and unexciting. If you're used to hyper spending at the stores and for entertainment, then going to the museum would probably be boring.

If you detox off of the sugar rush of retail spending for a few months, perhaps the free things in life will start to look good again.

Yes, that's what I'm saying.. hyper retail spending using your credit card is like eating alot of refined sugar products. They taste great, give you a sugar rush for the moment, and then give you a big let down afters. You get addicted to sugar, and retail shopping for the buzz it gives you.

The free things in life are more wholistic. They're not as exciting, but they are better for you in the long run.

I see Canadians and Americans going on a consumerism diet for the next year or so. Let's take the time to get back into shape financially and as well, start to enjoy less expensive more healthy activities again.

Comments (0)

CMA Blog Home

Are we NOW happy with Less? - The EconomyThe other day I was chatting with my son, Alex.. He deleted his facebook account, and is cutting out other instant messaging type programs that's he's grown up with.

I was curious about why he would give up facebook.com especially because this type of program is meant for his generation.

He indicated that he's grown up with internet, video games, TV, cell phones. He's getting tired of all of the programs and software that replace human interaction.

I was intrigued by this.

Growing up in the 60's and 70's, we didn't any of these modern tools and conveniences and toys. Nowadays.. the kids are flooded with them.

The Point is:

North Americans have had 20 years of free spending. We've bought what ever we've wanted, and are now slaving away to pay for the credit cards we used. We've had 20 years of endless consumption. We know what consumption is. We know that we can get what ever we want if we work hard enough for it. Learn more about capital gains

We've been there, done that!

I'm just wondering if people will be content to sit back and take a break for a while, consumption wise. This would be hazardous to the economy.

Consumers need a rest. I'm sure alot of people are suffering burnout from trying to make payments on all of their debts. The satisfaction of getting that new 52" TV is gone, especially because many people have already purchased one and had that experience.

My question is:

As my son is tired of all of the new gadgets that he's been bombarded with his whole life.. are consumers tired of being in the buying / paying off cycle? Are consumers going to want to take a break from being on a continuous spending spree?

An even more intriguing question:

Are consumers going to be HAPPY with less?

I don't mean "are they going to suffer, and put up with less?".

I mean, "are they are actually going to be happier with less stuff, less debt payments, less noise in their lives?" These are some thoughts I've been having lately about the economy. If people are happy with less, then that will spell bad news for the current economy that relies heavily on consumer spending!

Comments (8)

CMA Blog Home

|

Subscribe in a reader

|

|

|

|

|

Enjoy our "What Is This?" articles

• Taxes

• Credit

• Debt

• Bankruptcy

• Credit Repair

• Investing

• Making Money

• Saving Money

• Retirement Planning

|

Comments on our

Blog Posts

|

|

|

|

|

|

|

2012-11-13 23:08:19

Cbv Collection Services Problems

same deal,,these criminals sent a bill saying i owe 18,000$..hilarious,,they call me 5x per day..i am taking rogers to court..small claimes..why not y

Comment By:karen cliff

|

2012-11-13 13:18:44

Retail Theft Could Get You Sued

I keep receiving emails and phone calls from people who think they can simply ignore the letters from these Civil Recovery lawyers.

Don't.

They

Comment By:Gerry Laarakker

|

|

|

2012-10-18 08:23:07

Retail Theft Could Get You Sued

Bank statements can be demanded or balloon a day even fail to repay the debts incurred from the varied lenders. The offered amount in such cash untill

Comment By:Spadiatrere

|

|

|

|

|

2012-10-09 12:42:44

Credit Repair Canada 3 Things You Should Know

to , take up a new job. Also, reflect on investing in generating a payday advance loan while using classmates and more, typically the segments. The in

Comment By:WarbabsjamY

|

|

|

2012-09-30 20:03:01

Cbv Collection Services Problems

I had a telus pay as you go phone from 2003 2008 and now cbv collectons is claiming that i owe over 1500 dollars, the last time they called i called

Comment By:marcus

|

2012-09-25 10:19:31

Cbv Collection Services Problems

Had a bogus 'roaming charge' bill from Telus a few years back. Got mad at them and switched providers. It went to CBV. Yes, they are persistent and

Comment By:Scammed

|

2012-09-23 07:37:50

First Canadian Finance Scam Site

While these aforementioned dangers are a cause for legitimate concern, there are other dangers that derive from perceptions that often have no basis i

Comment By:effomicok

|

|

|

2012-09-16 16:42:15

Retail Theft Could Get You Sued

I am sick of all you so called legal counsel, wanting money from me , there was a reason i was stealing the items in the first place, i have no money!

Comment By:a shopplifter

|

|

|

2012-09-13 11:18:04

Car Repossessed Trouble With High Risk Car Loans

Our car loan was with wellsfargo to begin with then transfered to carfinco,. Have never had a problem with them yet and have less than 2 years left on

Comment By:Darlene Fougere

|

2012-09-02 18:27:17

15 Blog Post Articles That Talk About Equifax

obviously like www.canadianmoneyadvisor.ca however you need to test the spelling on several of your posts. A number of them are rife with spelling p

Comment By:promotion site

|

2012-08-31 11:32:19

Retail Theft Could Get You Sued

so i went in zellers and i baught bus tickets. then walked around playing with toys, and i was with a friend, we're both adults who like stupid toys.

Comment By:Aj.

|

|

|

|

|

|

|

Site Menu

|

|

Canadian Credit Cards

|

Best Canadian credit debt Financial Blog

Canada, British Columbia (BC), Alberta (Alta), Saskatchewan (Sask), Manitoba (MB), Ontario (Ont), Quebec (Que), Newfoundland (Nfld), New Brunswick (NB), Nova Scotia (NS), Prince Edward Island (P.E.I.), credit canada, Canadian

|

|