Canadian-Money-Advisor.ca BLOG

The Bankruptcy of Chrysler Nearby; Fiat Also Visiting With General MotorsI was listening to a commentary on CBC this morning that talked about Chrysler declaring bankrutpcy. They were mentioning that the bankruptcy is almost certain.

What I thought was interesting was this: If Chyrsler declares bankruptcy, then it may shed some light for General Motors as to what they need to do. There are alot of questions right now as to what would happen if the big car company declared bankruptcy. There are really no answers. There is no way to talk about this topic as it's unprecedented.

Sometimes the only way to learn about something is to do it.

If General Motors is closing down plants for 9 weeks, to use up their current supply, that really says what the automobile sales climate is like.

I just purchased a brand new car (Hyundai Accent L), and it was manufactured back in November 2008.. This means that it had been on the lot for six months. At that point, you can see that with inventory stocked up like that the car companies are cash strapped, to say the least.

So.. is bankruptcy looming for Chrysler and General Motors? Probably. I think the public is getting used to the idea. And that will make it easier for the politicians to decide.

There is so much of a glut of cars right now... it just says that there is ample supply available. There isn't room enough for these big car makers.

MediaPostNewsThe United Auto Workers union would end up owning a substantial shareholding in Chrysler LLC Chapter 11 under a bankruptcy protection plan that the automaker is expected to present next week, Jeffrey McCracken and John D. Stoll and Stacy Meichtry report. The deal lets get rid of some liabilities, allowing Fiat to cherry pick the operations you want, if an agreement is forged sources.

For its part, Fiat has begun talks with General Motors about joining forces in Europe and Latin America, say the sources. The Italian company could close the purchase of a stake in GM Opel. But GM did not try to go forward until the plans are settled with Chrysler Fiat. Fiat has said it wants to have an initial 20% stake in Bankrupt Chrysler.

In either case, it would have a major impact on the automobile supply chain of car dealers, parts and others, as well as the worsening economies of the midwestern states.

However, both Fiat car company and the administration say that President Obama could prevent the bankruptcy of Chrysler if an agreement can be reached with the banks in question. "In a huge and complex negotiation like this, everything is speculation and up in the air until there is an agreement," said one administration official.

Comments (3)

CMA Blog Home

How Bernie Madoff did his scandolous deeds - in JailIt still amazes me to read this story. Thinking of all of the people who were affected by the Madoff Scandal.. When you thinking of companies like general motors and chrysler who are affecting miillions of people. This scandal is small in comparison, however, it still affects a widespread amount of people.

CNN.com The employees were transfixed. Standing in the middle of Manhattan commercial flooring Bernard L. Madoff Investment Securities in late 2007, half a dozen staff members looked at the ceiling-mounted TV and CNBC aired a report on the mysterious death of Palm Beach, a hedge fund manager who was leading a double life. The police, apparently, even considering the possibility that he had been murdered. "Bernie Madoff," someone asked casually Bernard Madoff like to walk, "you've heard of this guy?"

Madoff a look at the screen, bleached, and exploded: "Why the hell would be interested in stuff like that?" The employees retreated. "I never saw him like that before reacting," Madoff said a trader who witnessed the explosion. "It's obviously affected a nerve."

0:00 / 2:48 Minnesota Madoff mess

That loss of control was very out of character for the head. But traders did not know at the time it was extremely Madoff develop a second life is two floors below them, one is to build an epic, and the inevitable explosion. Took a special pass to enter the "back office" in 17, which was making its Madoff $ 65 million Ponzi scheme. And even if a person can go in, there was not much to see: an old IBM computer server maintained in a locked room, the piles of trading states, and a staff of about 20 employees and paper pushers.

In retrospect, of course, there are indications, such as research has found fortune. IBM's server, for example, an AS/400 dating from the 1980s, it was so old that some data had been entered into the hand, but refused to replace Bernard Madoff. The machine - which has been autopsied by the government - is the nerve center of the fraud. The many thousands of pages of statements showed that his trade was never made.

Then it was the man who led the floor, Frank DiPascali, Bernie Madoff deputy chief of staff the 17. He was a veteran of 33 years of the related company, with a heavy accent and a Queens high school, but nobody was quite sure what he did or what his title was. "It was like a ninja," says a former trader at the legitimate operation above. "The whole world knew he was a great thing, but it was like a big shadow."

There are other mysteries, as we shall see. But even after the large detonation of five months in a brilliant fireworks display of betrayal and recrimination, Madoff plan - possibly the biggest investment fraud in the country's history - has remained among the most difficult to penetrate. More commonly, white-collar cases begin with a quiet, behind the scenes of research, followed by a series of transactions with younger employees, who are squeezed by lawyers and prosecutors to cough up details about their superiors. Step by step, prosecutors move up. Finally comes the denouement: the ringmaster hauled to court in securing handcuffs.

But Bernie Madoff all aspects of the traditional narrative that has been reversed. The case began with flabbergasting his confession, which was outside the investigation. Bernie Madoff argued that all crimes committed by himself, but because it covers decades and continents, a cloud of suspicion immediately plunged Bernie Madoff family members who worked at the company, as well as employees and business associates.

Now that the fog may be about to lift. Fortune has learned that Frank DiPascali is trying to negotiate a plea deal with federal prosecutors in which, in exchange for a reduced sentence, disclosed the encyclopaedic knowledge of the plan Madoff. And unlike his boss is willing to DiPascali names.

According to a person familiar with the matter, DiPascali has no evidence that Bernard Madoff other family members were involved in fraud. However, he was prepared to testify that he manipulated false returns on behalf of some major investors Bernard Madoff, including Frank Avellino, who used to run the so-called bottom feeding, Jeffry Picower, whose foundation was closed because of related Bernard Madoff losses, and others. If, for example, one of these clients had large gains in other investments, which would DiPascali, which produce a loss to reduce the tax bill. If true, this would mean that investors knew their statements fish. (Lawyers and Picower Avellino declined to comment. Marc Mukasey, DiPascali counsel, said, "We expect and encourage a thorough investigation.")

The emergence of this potential star witness can be on the case scenarios in their heads: Some people widely assumed by the public which has been implicated in the fraud may not have been, and a small group of investors that Bernard Madoff seemed innocent victims can not have been totally innocent, after all. But then, some things about the life of Bernie Madoff become what they seem.

Comments (4)

CMA Blog Home

I've been slow posting lately.I thought I would pop my head in a little today. I've been working a little slowly on the site here... My wife has been pretty ill and It's a stressful situation.

I will probably do some posts as my energy permits... and also, I am working on a few other projects that I need to get done.

So... Hopefully I'll be at it in the next few days.

Comments (2)

CMA Blog Home

The Necessity of Building Emergency FundsDo you have a financial emergency due to a job loss? Or do you have a medical expense that will significantly affect your finances? Almost everyone has a financial problem and the route that the recession is taking has compounded loss and depression. It's definitely time to reserve the cash flow and save up for emergency funds that has been depleted with the falling dollar, gas hikes and the weak economy. So what do you do when it comes to a matter of saving? The best way is to get creative and think of ideas and ways of how you can save money and stash it away as your emergency funds.

Maybe it's easier said than done, but there are secret routes to saving up emergency funds. You could also involve your children so that they are aware of finances and the nuances that are attached to it. You could draw your children into the circle of awareness by paying them money for a job done or collecting money from you as a fee for late payment. No doubt this would transform your emergency saving into an expense but the children will definitely get the idea that money is precious and needs to be conserved. You can also add on an imaginary 10% to the price of your purchase and then save the money. This would not only help you save some money, but it would make you prudent about spending and adding to expenses.

How to Save for a Rainy DayThere are many ways that can help you to save up for emergency funds. You keep a coin box and collect all your coins, which, in actuality is a very handy thing when you need money or you can collect five dollar bills. This really helps when you save money and adds to your emergency funds. Instead of the usual price that one pays for gas, you could add a dollar more and pretend that it is really a dollar extra. This will help you to put that extra dollar into your

emergency funds. You could sell all the unwanted things around the house and though you may have more than a few bargaining about the price, this method will add to your emergency funds. You could save gas money by buying all the groceries and other commodities that you may need in one trip. Instead of driving many times to the supermarket, you could take a walk that would help you save money as well as improve your fitness regime. Another way is to get a credit card that offers a good reward program. As soon as you get the rewards, pass it on to your emergency fund.

It is necessary to keep aside about three to six months of emergency funds that would cover payments. This would come in useful if you or your spouse loses a job or if any undue expense crops up. You can set targets and goals as to how much you would like to save in a given period of time. You can start small and then get used to doing without that money. Start a savings account or certificate of deposits (CDs) or a money market account. See that you get considerable interest for your savings, but make sure that you save your emergency funds in a place that would be accessible and not blocked when you need it the most.

Be Prudent and Creative about Saving Money

Comments (3)

CMA Blog Home

Unprocessed Food is Cheap - HealthJust recently we've been trying to help my wife's health get better. Along with the chemo that she is doing, she also wants to eat healthy, do juicing etc.

I went to the store the other day and purchased a bunch of fresh vegetables that we're going to put through the juicer.

I filled up my basket and it was quite heavy. When I went through the check out, the bill only came to $27 !!

All of the vegetables that are recommended for my wife to eat to help fight cancer, was the cheapest foods of all. In my mind that means that I should be eating them as well.

For a very healthy diet that floods your system build up... you need fresh fruits and vegetables. Because we're juicing them, we're going through alot more than usual.

I purchased a 50 pound bag of carrots last week and it cost $25 for the bag. That's pretty reasonable. The bag has lasted us the better part of a week... and we're eating alot of carrots.

We didn't get recommendations to eat processed foods, sugary foods and deserts etc. These are costly and also aren't really recommended as cancer fighting foods.

BTW... cancer loves sugar.. sugary processed foods are BAD if you're trying to fight cancer. Something I learned recently.

I thought I would do a short post to say that unprocessed fruits and vegetables are really cheap. Ultimately they are the best food for you. The down side is that they take a little longer to process.

It goes to show that the best things in life are usually free or much less expensive.!!

Comments (3)

CMA Blog Home

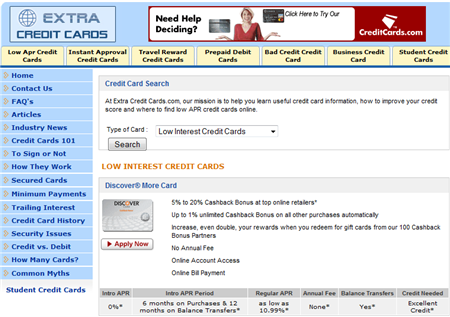

Low interest credit card - U.S. websiteI was asked to do a review for a credit card website that features American credit cards

Sometimes it's good to see what the "other guys" are doing.

This site allows you to search for low interest credit cards, secured credit cards, student credit cards and more.

The thing that's different about the U.S. credit card websites is that they show many of the banks' credit cards. Unlike Canadian banks which don't have affiliate programs for their credit cards.

This site has many different articles about credit cards which are things you need to know if you're going to carry credit.

The main thing you want to do if you're shopping for a credit card is look at rates and the other costs to own the credit card. It's all about the cost of credit. If you can find a better deal and save money, just by spending some time shopping, then it's really worth it. Sometimes you can save hundreds just by getting the lower interest rates.

And it's safe to use a site like this. All of the links follow back to the banks website, and the credit card issuers sites are always secure.

If you need a secured credit card, low interest credit card, student credit card etc.. and you live in the U.S... this is a good site to visit. It's got a clean look, has credit card comparisons and you can sort the credit cards by type.

This is a sponsored review

Comments (2)

CMA Blog Home

this is a great video that talks about the debt situation in Canada.

I like the fact that the commentator puts the blame for the too high level of credit squarely on the consumer. We need to take responsibility for the amount of debt that we're in now..

Nobody forced the consumer to buy , and take on more credit.

Currently the Canadian consumer has $1.3 trillion in consumer debt, this includes mortgages

I like this second video as it gives an actual example of a lady who's quickly accumulated $10,000 in debt. The industry calls her a revolver, as she can't pay off her balances completely.

Credit card companies like revolvers as that's how they make their money.

This lady has figured out that "perhaps the credit card companies want you to carry balances!!"

Comments (9)

CMA Blog Home

Debt Settlement - You don't have to pay your debts??!!Just going through youtube looking interesting things that people say..

This guy starts off by saying... "you don't have to pay your bills"

This makes me crazy. This guy is suggesting that you shouldn't pay your bills/debts especially if you owe $25-$100,000 on credit cards.

He mentions that you should be using the interest that you're paying the credit card companies to save up for retirement.

This is LUDICROUS

The following is what this guy is explaining on the video

He starts off by explaining you should just not pay your bills for six months.. This will start the collection process. You can then negotiate with the collection agency at 10% on the dollar.

Part of the negotiation is that the credit bureau wipes any negative debt notation off of the credit bureau.

So... after 6 months, you'll have a nice squeeky clean credit report, and no debt.!! Wow... this is fantastic!! Or is it?

There are so many assumptions in his discussion that they need to be addressed.

Also it's important that this type of service is for U.S.A. (Americans) only. This system isn't going to work the same in Canada.

I complete disagree with not paying your bills for the sake of getting out of them. That's the cowardly way to do this. This type of logic will erode the social fabric of our society.

IF YOU CAN, PAY YOUR DEBTS

If you've got alot of debt, and can afford to make payments, then you should pay for your debts as agreed. After all, you made all of the purchases that incurred the debt!

The only exception in my opinion is if you've got health issues, and your debt is making your health worse. Then it's time to seek debt settlement or bankruptcy help.

THE CREDITORS MAY SUE YOU

If you owe $25,000 -$100,000 then the creditors may sue you in Canada. This is worth going after in the courts. Don't assume that you can automatically settle you debts after not paying them for six months.

THE CREDITOR DOESN'T HAVE TO REMOVE BAD MARKS FROM YOUR CREDIT REPORT

This fellows assumption is that you can have the creditor or collection agent remove negative items and comments from your credit bureau, as part of the payment negotiation.. While some may do this, some may not do this.

It all depends.

CREDIT REPORT ITEMS MUST BE ACCURATE, COMPLETE AND VERIFIABLE.

Are you going to walk away with no debt and squeeky clean credit after the creditors and collection agencies write off your debt? More than likely not.

Why would the banks want to remove negative items. This sends a false message to other creditors that you've got good credit.

Again, you could ask to have negative items removed from your credit bureau, however, there is no law / motivation for the creditor to do so.

In my opinion, this is a shifty way to deal with your creditors.

If you've had a high consumption lifestyle, then you should pay for it, as agreed to when you took on the credit facilities.

If it takes you 10 years to pay off your credit cards, then so be it. After 10 years, you'll have learned your lesson about the effects of spending too much on your credit cards.

There are always exceptions to the rules, but in the case of North American consumers.. I think we're all guilty of over consumption.

Comments (2)

CMA Blog Home

Peter Schiff on Youtube. - He's Right about the economyI like to watch Peter Schiff. He's usually pretty straight forward and understands the fundamentals of the economy.

Sometimes it's important to understand what's going on in the economy to know what we should be doing individually.

When you see the whole nation suffering from too much debt, and not enough savings, then you can see what the effects are overall.

This should tell people what they need to do in their own personal finances.

Peter Schiff is good to point out items in the economy that are going to affect everybody on the overall.

Learn more about the Canadian coin and the Canadian Economy

I recommend that you check out Peter Schiff's channel on youtube, if you're interested to know what's going on in the economy.

Ultimately it gets back to this.. low debt and high savings will save any economy. Not giving in to instant gratification like we have done for the last 20+ years.

It's also good to invest in R&D so that our country can be profitable and competitive in the future.

I think this economy is going to stay like this for a while until people get the idea and decide to really get on with fixing their balance sheets.

Comments (1)

CMA Blog Home

Mortgage Crisis - The bank's Fault? - or the Consumer?I was reading a blog that said that the mortgage crisis is the bank's fault. I can't believe that somebody would seriously write this in a blog.

Let's see.. the definition of a Consumer, is somebody who consumes. Nobody put a gun to the consumer's head to buy. They all did so willingly.

There were no laws passed that said that the consumer HAD to buy houses, cars or consumers items.. they did so willingly.

IMO... if a person buys a house, they should understand whether or not they should be able to finance the property.. If you don't understand the contract, then hire a lawyer (or somebody trained in contracts) to help you understand the fine print.

I'm very surprised that the media is saying that the homeowner got duped by the mortgage companies.. That's ridiculous. That's putting the blame in the wrong place..

Buying a house for $250,000 is a big purchase. It deserves a great deal of attention, to understand the costs involved. A house has current and future costs.. A mortgage has current and future costs.

BUYER BEWARE: If you don't take the time to understand the costs involved, then you are at risk for making an expensive decision.

Here's what I would recommend to anybody buying a house.

- Learn how much the house & Utilities will cost

Take the time to gather all of the current utility bills, tax bills etc for the house you're looking at buying. See what the costs are.

There are also down payment, closing costs, inspection costs etc with the mortgage.

If you're clear on the costs, then there won't be surprises later on.

- Learn and understand the mortgage contract

Contacts are not easy to understand. You should NEVER sign a contract that you don't fully understand. Doing so means that you're vulnerable to whatever you agreed to.

If you're not sure what the contract language means, ask a lawyer. This is a cost of due diligence. If you need to save up additional money to afford the lawyer, then take the time to do so.

Ask the lawyer what the fine print means, and what are the things you should watch out for.

A lawyer is trained in legal speak and will be able to give you advice that the mortgage company may not come forward with.

- Learn about the fees and future/renewal costs of the mortgage.

This is something you should also ask a lawyer. What are the hidden fees, if any? What are the fees should you decide to refinance, or sell the property?

You might just ask the lawyer to itemize all of the potential costs that the contract holds.

This may cost a few hundred dollars, but the lawyers analysis could save you a ton of hard ship in the future.

I don't believe for a second that the mortgage crisis is the bank's fault. It's not the mortgage companies' fault. It's the consumer's fault all the way. They made the choice to buy the houses in the first place.

Each and every consumer who got involved with a toxic mortgage made the decision to do so. They could have known what the costs were before they took the mortgage. They could have insured for mortgage with critical illness insurance, and life insurance..

There's enough information in the market place to make an informed decision. If the consumer DECIDED NOT TO TAKE THAT INFORMATION, it's their fault!

Comments (1)

CMA Blog Home

Consumerism Withdrawal - Do you suffer from it?This is one problem with the economic downturn that I thought of. Consumerism Withdrawal.

The premise of the economy for the last 20 years has been consumption. Living the American dream. People have done a pretty good job spending, and consuming.

There have been many posts in the blogosphere where people explain that they're going to cut back spending and go on a spending diet. They talk about how they're not going to go shopping for a month, or not buy anything on credit for the next three months. Ultimately with those posts, I just roll my eyes, and wonder about their resolve.

Once you've tasted luxury and spending, it's hard to give it up.

With all of the lay offs and the credit crunch that we're experiencing, I'm sure that many people are suffering from consumerism Withdrawal.

This is more like being forced to go on a diet because of food shortage. In this case, credit is tight, and people have overspent.

If you're suffering from consumerism withdrawal, there are a few things you can do to help the situation:

- Learn to enjoy life with what you've got

The problem with consumerism is that we're always looking for the next big toy, or the next fashion. We're satisfied for a small time with what we've purchased. Much of what people have purchased is to satisfy wants and not needs.

The best thing to do is to learn to appreciate what you've got already.

That's a pretty hard thing to do, if you're used to a constant diet of new things all the time.

I've found that I really only enjoy a few of the possessions that I own. the rest are just sitting in a closet doing nothing.

Enjoying what you've already got, means that you won't need to spend any money on goodies.

- Take the time to strengthen your balance sheet

If we're going to be in a recession for the next year or so, why not take the time to pay down debt and save up some money.

This is really not fun, and it's pretty boring, compared with shopping all the time for the latest gadget.

My thinking is this: if you've got money saved up, and you're not in debt,

you'll sleep better, and won't need to go through withdrawals at the retail store.

Having some money saved up, means that you'll be able to go into the store and make some moderate purchases, based on your available cash.

Buying things with cash will give you a little taste of having something new, without the pains of paying down credit later.

- Take the time to enjoy the free things in life: family and friends.

I've gone on a cash diet for the last few years, by choice. In doing so, I've learned to really enjoy free things. Going for a walk, visiting with a friend. I enjoy looking at flowers more.

There are many things you can do for free. Sometimes we look at these FREE things as boring and unexciting. If you're used to hyper spending at the stores and for entertainment, then going to the museum would probably be boring.

If you detox off of the sugar rush of retail spending for a few months, perhaps the free things in life will start to look good again.

Yes, that's what I'm saying.. hyper retail spending using your credit card is like eating alot of refined sugar products. They taste great, give you a sugar rush for the moment, and then give you a big let down afters. You get addicted to sugar, and retail shopping for the buzz it gives you.

The free things in life are more wholistic. They're not as exciting, but they are better for you in the long run.

I see Canadians and Americans going on a consumerism diet for the next year or so. Let's take the time to get back into shape financially and as well, start to enjoy less expensive more healthy activities again.

Comments (0)

CMA Blog Home

Are we NOW happy with Less? - The EconomyThe other day I was chatting with my son, Alex.. He deleted his facebook account, and is cutting out other instant messaging type programs that's he's grown up with.

I was curious about why he would give up facebook.com especially because this type of program is meant for his generation.

He indicated that he's grown up with internet, video games, TV, cell phones. He's getting tired of all of the programs and software that replace human interaction.

I was intrigued by this.

Growing up in the 60's and 70's, we didn't any of these modern tools and conveniences and toys. Nowadays.. the kids are flooded with them.

The Point is:

North Americans have had 20 years of free spending. We've bought what ever we've wanted, and are now slaving away to pay for the credit cards we used. We've had 20 years of endless consumption. We know what consumption is. We know that we can get what ever we want if we work hard enough for it. Learn more about capital gains

We've been there, done that!

I'm just wondering if people will be content to sit back and take a break for a while, consumption wise. This would be hazardous to the economy.

Consumers need a rest. I'm sure alot of people are suffering burnout from trying to make payments on all of their debts. The satisfaction of getting that new 52" TV is gone, especially because many people have already purchased one and had that experience.

My question is:

As my son is tired of all of the new gadgets that he's been bombarded with his whole life.. are consumers tired of being in the buying / paying off cycle? Are consumers going to want to take a break from being on a continuous spending spree?

An even more intriguing question:

Are consumers going to be HAPPY with less?

I don't mean "are they going to suffer, and put up with less?".

I mean, "are they are actually going to be happier with less stuff, less debt payments, less noise in their lives?" These are some thoughts I've been having lately about the economy. If people are happy with less, then that will spell bad news for the current economy that relies heavily on consumer spending!

Comments (8)

CMA Blog Home

I just signed up for Clickbooth, which is a Cost Per Acquisition (CPA) based advertising portal.

This is all about making money on the internet. If you're a internet advertiser or publisher http://www.clickbooth.com is a site that you should have a look at.

ClickBooth is big enough that they're dealing with Google, Yahoo!, MSN. If they're dealing with the big guys they must have a pretty good system in place.

Cost per acquisition (CPA) is an advertising model where you only pay for leads received. You don't pay for clicks or impressions, only qualified leads. This is good because the publisher makes sure they've got enough good quality traffic to give to the advertisers.

I was also impressed with some of the advertisers that deal with clickbooth.com. BlockBuster, Efax, VistaPrint, AOL, and many more. Again, with a line up of advertisers like this, you know that Clickbooth.com has a pretty robust system in place.

I have yet to figure out how many advertisers are looking for space on Canadian sites. But in the meantime, I'm sure there is a ton of U.S. business there.

I would say that if you're into internet advertising or publishing, you should definitely check out http://www.clickbooth.com.

Comments (0)

CMA Blog Home

With Gas Prices,

What's your next car going to be?As I've been riding my bicycle around I've been thinking about my next car purchase.

It scares me to be honest. There are the cars you'd like to have and cars you should have.

I'm curious to know what our visitors think they will drive the next time you buy a car?

I get a sense that there are many families thinking to themselves, "this car was really nice 3-4 years ago when we first leased it. However, now with sky high gas prices, we will definitely get something more economical with the next lease or purchase."

Many people have 4 year leases, or 3-5 year purchase contracts that are going to run out this year or next. It will be really interesting to see what their next choice of car will be.

Will people keep up with the same lifestyle car, or go with something more practical.?!!

What are your thoughts?

For now, my bicycle is paid for, there is no insurance costs, and no gas costs. I may upgrade to new narrower tires for $100 but that will be my major vehicle expense for the year.

Comments (2)

CMA Blog Home

Have you saved up money?

-Looking for more Money HerosI am currently looking for people who have gone from having $0 cash saved up to having saved up 3-6 months of cash reserve.

I would like to interview people who have gone from no savings to saving up enough money to keep the wolves from the door for a while.

I'm interested to hear your journey along the way along with the problems and successes you encountered.

Questions I would have regarding saving up money:

- What motivated you to start saving money?

- What did you purchase less of

- What were you able to get at reduced prices?

- What did you friends and family say when you started to make progress?

- Did you pay off some debt at the same time?

- How did you feel when you finally got 3 months of cash reserve saved up?

- How did you feel about the overall process of saving up money?

- Would you recommend saving money to everybody?

If you've saved up $10,000, $15,000 or $20,000+ I would really like to interview you for this blog.

Let me know in the comment section if you're interested.

NOTE: These savings are not part of your company's benefit program, or part of your retirement savings. These are short term savings that you saved up for "emergencies".

Comments (1)

CMA Blog Home

Shanel Yang - Money Hero?

- Paid off $50,000 in credit card debt in 1 year!I went looking for other bloggers who did remarkable things with their money.

According to her blog, Shanel Yang paid off $50,000 in debt in one year! I am thoroughly impressed with that kind of persistence and creativity.

I was interested to read about how she got into so much debt, and as well how she felt when she was in over her head. She mentioned that, "I tried to console myself with even more spending. "What's the point in trying?" I rationalized. "I might as well have a good time!"

Isn't that the way you feel for a while. You're so much in debt and while your head is spinning you try to rationalize it away while you're trying to figure it out.

I think Shanel is a Money Hero because she decided to take responsibility for paying down her debts and found creative ways to do so.

She had to become creative and frugal. On her blog she lists 11 different ways that she used to pay down her debt. All of them range from cutting out frivolous purchases to making more money. She also figured out how to do the same types of things for less money.

Shanel was critized for being frugal.

I scratch my head at this. Being frugal is like being on a money diet. If you're over weight financially, you need to go on a diet. That's what Shanel did. She mentions that she was called names for being frugal: "Yet, try to be frugal, and suddenly you'll hear "tightwad," "miser", "cheapskate", or "Scrooge."

I think that this is probably true but pretty sad at the same time. If people have debt and are paying 18.9% on that debt, they need to start paying down their debts. Buy things with cash instead of credit cards if they're really necessary.

In the over all I thing that Shanel Yang has paid down her debts and bought herself peace of mind, along with freeing up that monthly cash flow.

Well done Shanel Yang, you're the Money Hero for today!

Comments (1)

CMA Blog Home

Minimum Payments

- How Do Credit Cards Companies Calculate Them?I was doing some research for the previous article

Which credit card debts should you pay off first? and realized that I should talk about something else that is relevant making credit card payments.

It seems that credit card minimum payments are sometimes calculated differently by each credit card company. I was under the impression that each credit card company wanted you to pay 3% of the ending statement balance, and that this was the rule across the board.

I found out that the minimum credit card payment are calculated differently as per the following examples:

TD Visa Credit Cards: 2% of Ending balance.

Presidents Choice Mastercard: 2.2% of Ending balance.

American Express Gold Card: 3% or $10 which ever is greater

Canadian Tire MasterCard: 3% or $10 which ever is greater

MBNA: Interest Calculated on ending balance +penalties +service charges + $10

ASSUMPTIONS:

Let's assume that each had an ending balance of $5,000 outstanding with and interest rate of 18.99%.

MINIMUM PAYMENTS CALCULATED

TD Visa Credit Cards: $100

Presidents Choice Mastercard: $110

American Express Gold Card: $150

Canadian Tire MasterCard: $150

MBNA MasterCard: $88.75

Monthly interest calculated = $5,000 x (18.9% / 12) = $78.75

At first glance it seems better if you're making smaller minimum payments, but in the long run you'll pay much more interest for those cards.

PRINCIPAL PAYMENTS CALCULATED

TD Visa Credit Cards: $21.25

Presidents Choice Mastercard: $31.25

American Express Gold Card: $71.75

Canadian Tire MasterCard: $71.75

MBNA MasterCard: $10.00

42 YEARS TO PAY OFF CREDIT CARDS?!!?

If you paid only minimum payments on MBNA Mastercard, it would take you 500 months ( 42 years ) to pay off the credit card.

If you paid off monthly payments @3% of ending balance as with American Express Canada it would take you approx 439 months ( 37 years ) to pay off this debt.

UPDATE: I found this interesting article about credit card minimum payments rising in the U.S. from 2% to 4%. According to this article: Did you know your minimum credit card payment is rising? A new government program working to get Americans out of credit card debt is pushing credit card issuers to raise minimum monthly payments. Will you be able to make the higher monthly payment? Here are some tips for getting by.

This is to help credit card users to pay off their debts faster. Is this going to cause alot of strain on the average American family?

Comments (2)

CMA Blog Home

Car Repossessed? Trouble with high risk car loans?If you've had any trouble with high risk car loans and / or have had your car repossessed, I would like to hear from you. I am doing some research of our members and readers about the topic of subprime auto loans for a national newspaper chain, and would like to have input from our visitors.

The trouble you may have had is that you had bad credit, or new credit and you signed up for a high interest loan with a local car lot. Maybe one of those car lots that said that you could fix your credit if you got one of their car loans.

You may not have understood the terms of the agreement, and/or were not able to make payments for some other reason.

If you have had any problems at all with a car loan, or have had your car repossessed and would like to discuss it, please let me know.

Please leave a comment here if you're interested.

Comments (58)

CMA Blog Home

Which credit card debts should you pay off first?I've been thinking about how to save money on debt. It's a cost cutting type of topic that will help you pay off your debt faster.

As I was looking at some of the other personal finance sites, I came across a good article on fivecentnickel.com that talks about "If you’re familiar with Dave Ramsey, then you’ve no doubt heard of his ’snowball’ approach to paying down your debt. In short, Ramsey suggests that you make minimum payments on all but the debt with the lowest balance."

I disagree with Dave Ramsey's approach in that it's not the most cost effective way to pay off debt. He's suggesting that you pay off the credit cards with the lowest balance first. This psychologically is a good way to go as it gives you a sense of accomplishment. It's also a great way if you're paying the same interest rates on all of your credit cards. You can say, "I paid off a credit card in full!"

Pay off the most expensive credit cards first

Different credit cards charge different amounts of interest. Capital One's Prime +0.9 card is much cheaper than a HBC Card at 28.99% interest.

If you're paying minimum payments on your highest interest cards, you're pouring money down the drain, especially if you can afford to make higher payments.

EXAMPLE #1: Make regular payments

ASSUMPTIONS: Example #1:

- The payments assume that you're paying 3% of the initial balance throughout the whole payment time IE. 292.50.

- You're not making any extra payments at this moment.

- If one credit card is paid off early, you're NOT using the freed up payment money to pay off the other card.

NOTE:

- I'm using Visa's credit card calculator

- These are highly simplified calculation for the purposes of illustration only.

Credit Card #1

Interest Rate: 19%

Balance Outstanding: $9,750.00

Minimum Payments: $292.50

Months to pay in full: 48

Total Interest Costs: $4,220.35

Credit Card #2

Interest Rate: 29%

Balance Outstanding: $3,500.00

Minimum Payments: $97.00

Months to pay in full: 73

Total Interest Costs: $4,119.07

TOTAL INTEREST PAID: $8,339.42

Assuming that we have an extra $200 per month to pay down these credit cards, which would be the best way to go? Should we pay down $100 on each card equally, or should use the full $200 to pay down either credit card?

EXAMPLE #2: Pay off $100 on each card equally

ASSUMPTIONS: Example #2

- The payments assume that you're paying 3% of the initial balance throughout the whole payment time IE. 292.50.

- You're going to pay $100 extra on each credit card until the first one is paid off.

- You've got $200 to make extra payments with.

- If one credit card is paid off early, you ARE using the freed up payment money to pay off the other card.

TimeLine #1 Months 1 to 24

Credit Card #1 -

Interest Rate: 19%

Balance Outstanding: $9,750.00

Minimum Payments: $392.50

Months to pay in full: 24

Total Interest Costs: $2,736.13

Credit Card #2

Interest Rate: 29%

Balance Outstanding: $3,500.00

Minimum Payments: $197.00

Months to pay in full: 24

Total Interest Costs: $1,128.09

TimeLine #2 Months 1 to 11

Credit Card #1

Interest Rate: 19%

Balance Outstanding: $5,783.26

Minimum Payments: $589.50

Months to pay in full: 11

Total Interest Costs: $551.50

Credit Card #2

Interest Rate: 29%

Balance Outstanding: $0.00

Minimum Payments: $0.00

Months to pay in full: 0

Total Interest Costs: $0

TOTAL INTEREST PAID: $4,415.72

Example #3: Pay off $200 on the more expensive credit card first

ASSUMPTIONS: EXAMPLE #3:

- The payments assume that you're paying 3% of the initial balance throughout the whole payment time IE. 292.50.

- You've got $200 to make extra payments with.

- You're going to pay $200 on the most expensive credit card each month until it's paid off, and then use that $200 per month to pay off the other credit card.

- If one credit card is paid off early, you ARE using the freed up payment money to pay off the other card.

TimeLine #1 Months 1 to 14

Credit Card #1 - 1st 15 months

Interest Rate: 19%

Balance Outstanding: $9,750.00

Minimum Payments: $292.00

Months to pay in full: 14

Total Interest Costs: $1,950.56

Credit Card #2

Interest Rate: 29%

Balance Outstanding: $3,500.00

Minimum Payments: $297.00

Months to pay in full: 14

Total Interest Costs: $668.85

TimeLine #2 Months 1 to 14.6

Credit Card #1 - 1st 15 months

Interest Rate: 19%

Balance Outstanding: $7,619.19

Minimum Payments: $ 589.50

Months to pay in full: 14.6

Total Interest Costs: $ 972.83

Credit Card #2

Interest Rate: 29%

Balance Outstanding: $0

Minimum Payments: $0

Months to pay in full: 0

Total Interest Costs: $0

TOTAL INTEREST PAID: $ 3,592.24

SUMMARY:

You SAVE THE MOST MONEY on credit card interest by paying down your most expensive credit card first and then applying the freed up payments to the other outstanding credit cards. You're also paying off your credit cards in a total of 29 months! See example #3

Interest Paid: $ 3,592.24

Example #1 is by far the most expensive as you're paying $8,339.42 in interest payments. You also take much longer to pay off your credit cards as it takes up to a full 73 months to complete the payments on both credit cards.

Comments (2)

CMA Blog Home

Are you a Money Hero?Lately I've been doing some searching for regular people who have done extraordinary things with their personal finances. I'm calling these people Money Heros.

What is a Money Hero?

A money hero is a person who has been in trouble financially and pulled themselves out of it. They've been in debt and paid off all of it and / or they've had very little savings and have stashed away a sizable reserve.

Why are these folks heros? Anytime somebody goes above and beyond, I like to think of them as a good example.

Example 1: Somebody who has got themself into $50,000+ worth of credit card debt and then decides to pay off these burdensome credit cards until there is nothing owing on them.

Example 2: A family who has no savings decides to start putting money in to a savings account. Within a few years they accumulate $30,000 in savings.

Example 3: A couple who is $50,000 in debt and has no savings. They decide to pay off their credit cards and put away an emergency reserve. After alot of cost cutting and scrimping and saving, they pay off their credit cards and put away $15,000 in cash savings.

I found this link on fool.com of a person who has paid off $100,000 in credit card debt.

I also found this blog that is dedicated to a person who is in the process of paying off $100,000 in debt.

These people are money heros.

I call these people heros as they set an example for the rest of us. They made a decision to better their financial situation and then worked the plan until they had success.

I am looking for Money Heros!

Are you a financial hero? I am looking for people who have done the extraordinary with regards to saving money, paying off debts or a combination of both. I would like to interview these people for my blog.

If you've done one of these wonderful things let me know right away. We can set up an interview so that you can let your light shine to those who are not in as good financial shape.!

If you're interested, leave a comment in this post.

UPDATE: I found another blogger using the terminology Money Hero here

Comments (0)

CMA Blog Home

- Posted April 21, 2008 by Monty Loree

|

|

Leveraging a Secured Line of Credit - What does it Mean for You?

Sometimes a credit crisis happens and it negatively impacts our credit rating and our credit score. A bad credit history makes it difficult to obtain an auto loan or a home loan. A bad credit history also makes it difficult to be approved for future credit cards.

-->

But now it is easier to secure a new credit card even with a poor or inadequate credit history. It is possible if you want to use a secured credit card.

So what are secured credit cards? Secured credit cards are similar to your traditional credit cards but the cardholder has to pay a deposit to purchase the credit card. That is the "secured" portion of the credit card. Depending on the credit card company and how bad the applicant's prior credit history is, the deposit amount will vary anywhere from between 100% and 300% of the approved credit line.

The actual credit line offered by the issuing bank is often less than the deposit amount. The excess funds from the deposit are retained by the issuing bank to cover any future unpaid debt owed to them by the cardholder. Some credit card companies will issue secured credit cards with higher fees, so be careful and read all the fine print.

Aside from the deposit, a secured credit card functions like any traditional credit card. For example, if a payment is late or missed completely, the interest rate will increase just as in a normal credit card. However at the start of the program, most secured credit cards carry a higher interest rate versus regular unsecured credit card.

-->

Most Canadians that apply for a secured credit card are considered risky applicants who either have a poor credit history, or do not have an adequate amount of credit history. And yet despite the additional cost of the deposit amount, obtaining a secured credit card is a very good way for someone to build or repair their damaged credit history. Again, always read the fine print to understand all the fees involved with a secured credit card.

And if a cardholder has maintained timely payments, they will often reap other rewards and benefits from their credit card issuer. In some rare cases,

the cardholder may also be able to apply for an unsecured credit card. It take

Comments (2)

CMA Blog Home

American Express Canada- The Status SymbolYou’re entertaining a client and want to impress them. You want to buy your wife a special anniversary gift she won’t forget. You’re almost ready to retire and want to spend your days traveling around the globe. Whatever that special occasion or event will be, avoid an embarrassing moment of having your bill returned to you because your credit card exceeding its spending limit. With an American Express card, there’s no worry about pre-set spending limit. And, with as many as 15 cards to choose from, there’s definitely an American Express card to fit the lifestyle of every Canadian.

Membership benefits for personal card members vary from card to card and may include:

- Zero pre-set spending limits

- Zero annual fees

- Upgraded travel amenities

- Aeroplan air mile rewards with a sign-up bonus between 15,000 to 25,000 miles

- Cash rebates

- A low interest rate on some cards

- Preferential ticket access to some of the hottest shows around

- American Express cheques that good all over the world

- The privilege of having global customer service 24 hours per day for 7 days a week

- Payment flexibility

- Credit limit increases

- Supplementary cards that help you earn rewards even faster.

- Plus there are security services that include purchase protection, travel emergency assistance, and online fraud protection guarantee.

With such a variety available to you, it’s easy to find an American Express card that will fulfill your needs. This is a lifestyle credit card that rewards you just for enjoying your Canadian life in style.

Do you have a Canadian small business, or are thinking of starting one?

American Express has several small business cards which feature simplified management control of your business’ expenses. Your small business card can even help you manage your business by finding ways to streamline your processes, or find ways to reduce costs, as well as reward your employees with Aeroplan Miles while earning cash back. All of these amenities and more are available to you when you apply for an American Express small

business credit card.

As if these benefits are not enough for personal and business card members,

American Express features the AMEX InfoAssist service that protects all your credit card numbers and personal details in one private, secure location that is accessible to you 24 hours a day, 7 days a week, from anywhere in the world.

AMEX InfoAssist will replace lost cell phones or lost airlines tickets, and can even replace lost or stolen money with an emergency money transfer. They can help you plan a trip and even act as your personal messaging service by forwarding phone calls and handling any change of address. You can even cancel the InfoAssist within the first 60 days for a full refund if you’re unhappy with the service.

But American Express is more than just a card services company. They offer many insurance plans to fit your lifestyle needs. They can provide you or your family with term life insurance, a health and dental plan, an accidental protection plan, a critical illness recovery plan, as well as a hospital and recovery cash plan. And, if you’re traveling American Express can provide travel assurance and automatic flight insurance.

You can even do your banking with American Express. They offer four different financial products to fit your personal banking needs. While their business bank financial product offers security and flexibility plus a higher rate of return with zero fees.

For the frequent traveler, American Express Travel services provides Traveller’s cheques, which are welcome all over the world, Travel Gift Certificates, which make a memorable gift for any occasion, Membership Rewards Travel Certificates which allow members to redeem reward points for travel certificates, and, finally, Gift Cheques which are redeemable almost anywhere and NEVER ever expire.

See More Canadian Credit Cards

Comments (2)

CMA Blog Home

Banks Can Take Your Money Without Asking - How a Right of Offset WorksBy Richard G Cooper

The collection of debt is a stressful event. Phone calls, nasty letters and constant threats of legal action are often enough to drive you crazy. Creditors have a trick up their sleeve that most people don't know about, and when it happens it's even more disastrous then an irritating bill collector phone call.

The person in debt to the bank often calls it stealing money. The creditor calls it a right of offset. And it's perfectly legal. A right of offset can be described as: a banks legal right to seize funds that a debtor may have on deposit to cover a loan in default.

In Canada, it happens quite often, and people in debt to their bank are frequently left wondering how they are going to account for this money and get it back. Having money offset from your bank account when your rent or mortgage payment is due can be extremely stressful.

Creditors can take money out of your bank account and in some cases without asking your permission if you are sufficiently delinquent in your payments on a credit card or loan to them. Most of the big banks in Canada have the concept of a right of offset written into their credit card and loan agreements. It's a level of protection you usually give them when you sign for and borrow unsecured money from your bank in the form of a credit card or loan.

Most people are oblivious to this fact and when a regular paycheque goes into your account, it can disappear as quickly as it arrived. Remember your bank can view your cycle of deposits and withdrawals, so they know when to go in and get their money back.

Can you get the money back? Sometimes, the bank will work with you and return it if you can talk to the right person. Your branch manager or the banks Ombudsman can help. But they usually don't have to. There are also in some cases certain restrictions on the types of deposits that can be offset from your account. You should also be aware that if you owe bank "A" a balance on a credit card, they cannot offset money out of an account from bank "B". The account has to be with the same financial institution.

The best protection is not exposing yourself to having money offset from your bank account by staying up to date in loan and credit card payments. But for some people this is not a reality. I know first hand that bad things do happen to good people and that most folks who end up in debt did not intend for it to happen.

There are further steps you can take to protect yourself, not depositing new money into an account you owe credit card or loan debts is a start. But this is not a solution to debt. Seek help from a reputable debt settlement company if you are drowning in debt, and not able to deal with it. But do something today!

Richard Cooper is Founder & CEO at Total Debt Freedom Inc. Canada's most respected debt settlement company. Total Debt Freedom offers debt settlement plans that can save you 50-70% of what you owe and get you debt free in 1 - 3 years.

www.totaldebtfreedom.ca

Comments (4)

CMA Blog Home

Ways to Get Rid of your Personal DebtAn increasing number of Canadians today spend more than they can afford to. The bills keep piling up and they just can’t seem to pay back the personal loan they took out to finance their kitchen’s redecoration. Eventually, they end up with a mountain of personal debt and a bad credit rating. Anxiety and desperation overwhelms them because they see no way of getting out of their predicament.

Does this sound like you? If you are one of the many Canadians that just can’t seem to keep up with their debts, you’ll love what comes next. The truth is, you can get out of your debt and it doesn’t have to be as torturous as you imagine. But first, you have to take a step back and make it a point to change some of your habits and be more proactive. You can start catching up with your debts by sticking to some of these simple techniques:

Get rid of your credit cards. Credit cards and store cards create the temptation for you to spend money on unnecessary things at ridiculously high interest rates. Get rid of your credit and store cards immediately by cutting them up. Of course, you need to keep the credit card that charges you the lowest rate of interest for emergency situations, but the rest of them have to go.

Setting up a direct debit. You can set up a direct debit system that automatically charges your bank account in such a way that your debt payments are settled on the same day you receive your monthly salary. It is a great way to discipline yourself and stops you from spending money you don’t have.

Visit your lenders personally. Too many debtors make the mistake of avoiding their lenders and the discussion of their default. That is the wrong approach. If you owe your bank money, visit your account manager personally and let him or her know that you are aware of your mistakes. Also communicate your intention to repay the loan. Lenders appreciate this much more than you think and they may even help you in setting up a more lenient repayment plan.

Try to get promoted. Did you know that one out of every two Canadians who ask their bosses for a promotion actually get one? Put in a little more effort at work and find the right opportunity to discuss the possibility of promotion with your boss. What do you have to lose? The worst that can happen is you’ll get a negative answer.

Save on Utilities. There are many Canadian utility companies that will perform a home energy audit for you free of charge or for a very low fee. This can save you hundreds of dollars in energy bills per year. Also, try to find utility suppliers that charge the best rates and switch suppliers if you have to. It helps immensely to do some research on the internet to compare prices.

These techniques are very simple and easy to implement. If you put in the effort and time needed, things should get better for you in no time at all. Remember, there is always hope for those who choose to take action.

Comments (0)

CMA Blog Home

Three Easy Ways to Save MoneyIf someone gave you a dollar for every Canadian person you met that wished he or she had more money, you’d be pretty rich by now. Why’s that? Because the majority of Canadian people have a great desire to improve their current financial status. Now, unless you win the grand jackpot in the Canadian national lottery, there are only two ways for you to increase your bank account balance: you either increase your income or you save money. Increasing your income can be a sticky issue sometimes. After all, it’s not like you can just walk into your boss’s office and ask for a raise. And that hot new job isn’t always waiting for you around the next corner.

Saving money, on the other hand, is a lot less sticky. You have complete control over your actions. All it takes is a little creativity and discipline. Apart from the lack of discipline, most Canadians find it hard to save money because they overlook the most basic expenses in their lives. If you take a closer look at the way you spend your money on a daily basis, you may find some simple ways to save. For starters, you could try these three:

Want to

- Cooking at Home

Many Canadians come home feeling too tired to cook, so they either eat out or order in. Did you ever think about how much money you could actually save if you took the time to cook your own meals at home? Cooking at home does not mean you have to do it everyday. The trick is to cook in bulk – you only cook once or twice a week but make sure the meals last for the rest of the week. You freeze daily portions and just pop them in the microwave when the time comes. Not only is this economically smart, it is also healthier than eating mass-produced food.

- Cut down on driving

Let’s face it, gas and car insurance is expensive. Being stuck in traffic isn’t all too pleasant either. Have you ever thought about walking or bicycling to work instead of driving? Not only will you save several thousand dollars every year with this, but you may also lose a couple of pounds and become more fit. And if you live too far away from work for walking or biking to be a possibility, how about car pooling?

- Housing repairs – do it yourself

How difficult is it really to give the kitchen a new coat of paint?. And is it really impossible for you to put in a new bedroom carpet? Many of the home improvements and repairs that people usually hire contractors for are simple enough that you can do them yourself. There are plenty of Canadian hardware and DIY stores that have trained personnel who will give you advice and tips on home repair issues. Set some time aside on the weekends to make those small repairs instead of paying a contractor to do them for you. Sure, you will save quite a bit of money, but you will also feel much more proud of yourself.

It's time to

Comments (1)

CMA Blog Home

How to Assess your Personal Financial PositionCanadians go for regular medical check-ups every year to make sure they are in good shape and to detect medical complications early on. The same concept that applies to your health also applies to your wealth. You need to know where you stand financially in the present if you want to make sure that you can maintain your current lifestyle and determine how much you can afford to spend in the future.

Did you know you can apply the financial methods that are use by large corporations to the assessment of your own personal financial status? You can easily set up your own financial statements that will tell you how well-off you really are. It isn’t as hard as you think. You just have to locate and organize some of your financial documents, that is all.

The Income Statement

On a personal level, the income statement is used to determine whether or not your income exceeds your expenses. In other words, are you in the black or in the red?

First, make a list of all your sources of monthly income. Your monthly income will usually be comprised of more than just your salary. It may include what you earn from renting out property, interest payments on your saving account, and profits from the sale of stocks. If you are earning money from any extra jobs or sideline activities, such as translations, tutoring, and selling items on eBay, you must also put them on the list. When you are sure you have thought of everything, add up your total monthly income.

Next, make a list of all your monthly expenses. These may include the monthly payments for your car, your monthly mortgage installments, your weekly shopping, your utility bills, your credit card bills, your medical bills, your monthly taxes, money you spend going out with friends, and even donations you make. When your list is complete, add up your total monthly expenses.

Now simply put the two lists and their totals on a piece of paper (preferably with the income list and total on top) and calculate your net income:

net income = total monthly income – total monthly expenses

If your net income turns out to be positive, it means that you earn enough to cover your monthly expenses and can afford to maintain your current lifestyle. If it is negative, it means you need to cut costs and live less lavishly.

The Balance Statement

The balance statement is used to determine how wealthy you are. In other words, it answers the question of how much you are worth (that is, only in terms of money, of course).

First, make a list of all your assets and how much they are worth. Assets are things you own, such as your cash, your properties, the stocks you bought, your investment in mutual and pension funds, and your car. Now add up your total assets.

Next, make a list of all your liabilities and their amount. Liabilities are things you owe, such as what’s left to repay on your mortgage, car, or education loan. It also includes your outstanding tax obligations. Now add up your total liabilities.

When you are done with both, put the two lists and their totals on another piece of paper (preferably with the assets list on the left and liabilities list on the left) and calculate your net worth:

net worth = total Assets – total Liabilities

If your net worth turns out to be positive, you can be considered well-off. If it is negative, you are not financially fit and need to start thinking of ways to cut down on what you owe other people.

As you can see, setting up your personal financial statements is not rocket science. If you set some time aside to really think about the four lists, you are well on your way to assessing your current financial position.

Comments (0)

CMA Blog Home

Advance Fee Loan Scam Conversation with Renee - Part 3This is Part 3 of 3 of my conversation with Renee regarding Advanced Fee Loan scams.

The original post and podcast for this discussion was here:

Advance Fee Loan Scams are alive and well

Renee: Yeah, there, these criminals are upset, we have made a very difficult for them to run their latest scams, we have had cooperation with the phone companies, we let them know of the new company loan scams, they go ahead and they shut down their phone service. They know who we are, they know everything about us, we have had our computers hacked in to, we have had our bank accounts accessed, I have had fraudulent mails come to my house that’s supposedly what’s from my banking facility which was not, which would have meant it was a request for a W8 then formed, which is a non-resident alien form and with this form I would have had to fill it out and send the copy of my birth certificate and to whom it has been addressed not belong to my bay.

Monty Loree: How was their ID?

Renee: You know they have shut off utility in our name, they threatened our children, it’s very scary.

Monty Loree: And they are doing this because you are starting to make some progress with shutting them down?

Renee: I think so, I think that, that’s what it is. I mean they know who I am, I am not afraid to tell him who I am. I mean if they are going to come to my house, they can come to my house, I mean they know where I live. They know my banking information. They have my social security number, they have my picture from my license, they know who I am, you know but I am not going to be one of these victims that’s is the I lost money, no big deal, [miscellaneous voice] lot of people don’t even report it because there are ashamed of the fact that they are ripped off, it is nothing to be ashamed off. People need to stand up together and have some law enforcements listen to us and have us demand for them to look in to this. We deserve that, we are actually going to it, we don’t get a response. We are actually planning on posting a link somewhere saving that on the same day at the same time we are going to have some one from every single a victim from every single state stand out in front of an FBI office till some one listens to us.

Monty Loree: How was that rated?

Renee: Yeah, that we have that, it has to come down for that, it’s that, you are acting with the little person, I am not very computer smart, and I have so much research and so much information that if it’s put in the right law enforcement agencies hands, it’s very useful.

Monty Loree: Yeah, yeah by all means, yeah I mean with other types of crime, if people get the money stolen and the police are all over, but in this case it seems like because it is an advance fee loan scam, but you know it’s a big problem, so they got to address it anyway, you wanted to give some contact information, what is the contact information that people can get a hold of you with?

Renee: Okay there is a phone number, the lady’s name is Gill and her phone # is area code 248 -673-0531, she is also a victim.

Monty Loree: Okay so yeah just say that again.

Renee: It’s Gill and her phone is 248/673-0531.

Monty Loree: Okay and what is the, what is the URL or the website address for ripoff reports?

Renee: That is ripoffreport.com

Monty Loree: So that’s rip off reports for home, so R-I-P-O-F-F-R-E-P-O-R-T.com, okay.

Renee: Yeah.

Monty Loree: And that’s where they are going to go and see all of these, where you have done all of your work with the advance fee loans scams?

Renee: Yup, you can punch in, there is a little bar that you have to click on or even pipe in and you will either punch in a loan scam, you can punch in Canadian cross border scams to American, and you will see, I mean as just report after report, after report. There is something that I would like people to be aware of, there is two websites online that when you click on to their website, it actually puts a virus in to your computer.

Monty Loree: Oh, was that right?

Renee: Yeah and your typical protection on your computer does not detected, the only program that’s detected is AVG and what is doing is putting a Trojan virus in your computer.

Monty Loree: Oh yeah, okay, so what is the URL that people can avoid that?

Renee: So that one is www.loansfast.com and also www.statewideloans.net and both of those websites have these viruses on them.

Monty Loree: So yeah, so base and the reason again I just want to confirm the reason we said those is so that you know not to owe to them, sounds good, sounds good, well is there anything else that you want to close up here, is there anything else you want to mention to people while we got a minute here?

Renee: I think the only thing for people to know is if you cannot go to a local bank and get a loan, you can get loan any where else, that’s about and that’s the bottom line. If you cannot get a loan at a bank, you are not able to get a loan anywhere else.

Monty Loree: So what you are saying is if these guys are asking you, if it seems like it’s too good to be true, it probably is,

Renee: Oh, it definitely is.

Monty Loree: And if these folks were asking you for money up front that’s illegal, they can’t do that, even in Canada they can’t do that.

Renee: And they can’t in the United States either. The only type of fee that you should be paying for a loan is a closing cost on a real mortgage loan which you are going to have to meet people face to face for anyways or if they are asking for a see to do an inspection on your home and again if you can’t meet these people face to face then they are not the real thing.

Monty Loree: Right, exactly, okay let’s just close here by giving Jill’s phone number, Jill is your contact, who is taking calls and information and what is Jill’s phone number again?

Renee: It’s 248/673-0531.

Monty Loree: Sounds good alright. Well on the one side I am glad that you called them, on the other side, I am sad that you got ripped off there and but it sounds like you are doing a lot of work on this and I am quite impressed with that and so I want to thank you for contacting us and I hope that I would like to invite people, I will do a post on this on my blog, and if people want to start posting and if you got websites and if you heard of advance fee loan scams, Canadian money advisor is the site that you want to post them on as well for Canada and in the US there. So we will close off with that and I want to say thanks again Renee for getting with us.

Renee: Well, thank you.

Monty Loree: All right, and we will talk to you again later on, okay bye bye.

Renee: Bye.

The original post and podcast for this discussion was here:

Advance Fee Loan Scams are alive and well

Comments (3)

CMA Blog Home

Advance Fee Loan Scam Conversation with Renee Part 2This is part 2 of 3 of my conversation with Renee about advanced fee loan scams

The original post and podcast for this discussion was here:

Advance Fee Loan Scams are alive and well

Renee: Let think I think, people here doing a research inside the United States and also in Canada they are victimizing their own people from their own country, but they are preying on people that are debt and dire desperate need for this loan to either get out of debt or not lose their home or still forced.

Monty Loree: Yeah, as we talked about that you mentioned that it is for people with bad credit but I am just thinking with, with the sub prime problem in the USA, this is all of a sudden really scary to me because there is a lot of people that are losing their homes and they want some desperate cash in order to save their homes before they get foreclosed on and so on, and so oh my goodness. I have just a question for you. How many people you said you have gone with the group of people, how many people are there that you have coordinated with?

Renee: There are 15 of us so far, and we are still approaching re-battles on every single person’s report on rip off report waiting for a response. Some people go back a rip-off reports and lots to see that another victims are an update so we are waiting for people to respond back to us, we are posted a fax number for people to call or phone number for people to call so we can all come together and find that what their stories are and what people do they deal with, and what does their contract look like compared to ours and we give them all the information of everything single police report, government agency, News Station any person to contact about their situation because we are finding that if we can all come together that may be something can be done.

Monty Loree: Right, so something that you mentioned to me that was interesting and was little bit more advanced than what we are doing here in Canada, but you said that some of this, some of the criminals are leaving back traces, they are getting sloppy, can you talk about that?

Renee: I think what it is, is that they have got from the research that we have done, we have found that they are running 3-4 scams at the same time, where when one is found to be the people are starting to realize that it is the scam and they are starting to post comments about their company, they have already started their next and starting to post, starting to get other people’s money from another company name so, they are making all these phone calls and I think that they are, I really think that they feel that other victims because we are falling for the scams that we have got like stupid posted on our forehead and they forget to block their phone call when they call us and this happened to me, they forgot to post it. They forgot to block the number so, in that case you can do a trace so far by yourself but with out the help of law enforcement, you can’t get that further information but they are there so leaving behind phone numbers that are real phone numbers that aren’t linked to their company, they are linked to a person, they are just unlisted phone number.

Monty Loree: Okay when your?

Renee: They got the signal off the phone, but you can’t get actual name of the real owner, you get the fake company name of this phone number and no physical address.

Monty Loree: Right and so you mentioned that you have also being that you have combined a whole bunch of contract, you are seeing the same names and same sort of company IDs or what ever same, same information about the criminals, all went over again and so you are sort of seeing your pattern there?

Renee: These contracts are the exact same contract word per word except the company name is different and the little logo that the use on top of the contract is different, everything is word for word is the same, exact same contract and in some cases they will use “gentlemen I doubt with data miller” and in another company’s scams different name it’s David, whatever but it’s the same voice and their extension number, it’s the same voice because you as a victim I could say I am in a room of 2000 people and if I heard this guy’s voice, I would now attempt.

Monty Loree: Okay, all right.

Renee: I played his voice in my head over and over again. I would be able to pick him out of room full of people and he even just said hello.

Monty Loree: Right, so did you say you had recordings of these other voices?

Renee: We do we have, we have their voice mail messages, that they are lasting our transactions of our take loan, we have actually done three way calls us victims, calling on their next companies scam actually recording the full scams so, we have been actually approaching us for you need to make a deposit to this person by moneygram through Walmart, we have a special relationship with Walmart so that’s why we need you to use Walmart for your moneygram, you need to send it to this person and this state in Canada, we have all of this on takes. I am not the type of person to just roll over and play data for I have been victimized, I am going to try to track down the person behind this, even if it is the little, little runner man of this scam. These people involved to know that they are ripping people off.

Monty Loree: Yeah other these guys…

Renee: And it needs to be stopped.

Monty Loree: Right.

Renee: And it needs to be stopped and that I know other victims, most victims understand that they are never going to see their money ever, ever I mean I am never going to see my money back and at this point that’s not what matters to me, what matters to me is that my self as a victim I deserve the right to an investigation as that every other victim, criminals get the right to a trail, why can’t we have the right to an investigation.