Canadian-Money-Advisor.ca BLOG

The Bankruptcy of Chrysler Nearby; Fiat Also Visiting With General MotorsI was listening to a commentary on CBC this morning that talked about Chrysler declaring bankrutpcy. They were mentioning that the bankruptcy is almost certain.

What I thought was interesting was this: If Chyrsler declares bankruptcy, then it may shed some light for General Motors as to what they need to do. There are alot of questions right now as to what would happen if the big car company declared bankruptcy. There are really no answers. There is no way to talk about this topic as it's unprecedented.

Sometimes the only way to learn about something is to do it.

If General Motors is closing down plants for 9 weeks, to use up their current supply, that really says what the automobile sales climate is like.

I just purchased a brand new car (Hyundai Accent L), and it was manufactured back in November 2008.. This means that it had been on the lot for six months. At that point, you can see that with inventory stocked up like that the car companies are cash strapped, to say the least.

So.. is bankruptcy looming for Chrysler and General Motors? Probably. I think the public is getting used to the idea. And that will make it easier for the politicians to decide.

There is so much of a glut of cars right now... it just says that there is ample supply available. There isn't room enough for these big car makers.

MediaPostNewsThe United Auto Workers union would end up owning a substantial shareholding in Chrysler LLC Chapter 11 under a bankruptcy protection plan that the automaker is expected to present next week, Jeffrey McCracken and John D. Stoll and Stacy Meichtry report. The deal lets get rid of some liabilities, allowing Fiat to cherry pick the operations you want, if an agreement is forged sources.

For its part, Fiat has begun talks with General Motors about joining forces in Europe and Latin America, say the sources. The Italian company could close the purchase of a stake in GM Opel. But GM did not try to go forward until the plans are settled with Chrysler Fiat. Fiat has said it wants to have an initial 20% stake in Bankrupt Chrysler.

In either case, it would have a major impact on the automobile supply chain of car dealers, parts and others, as well as the worsening economies of the midwestern states.

However, both Fiat car company and the administration say that President Obama could prevent the bankruptcy of Chrysler if an agreement can be reached with the banks in question. "In a huge and complex negotiation like this, everything is speculation and up in the air until there is an agreement," said one administration official.

Comments (3)

CMA Blog Home

How Bernie Madoff did his scandolous deeds - in JailIt still amazes me to read this story. Thinking of all of the people who were affected by the Madoff Scandal.. When you thinking of companies like general motors and chrysler who are affecting miillions of people. This scandal is small in comparison, however, it still affects a widespread amount of people.

CNN.com The employees were transfixed. Standing in the middle of Manhattan commercial flooring Bernard L. Madoff Investment Securities in late 2007, half a dozen staff members looked at the ceiling-mounted TV and CNBC aired a report on the mysterious death of Palm Beach, a hedge fund manager who was leading a double life. The police, apparently, even considering the possibility that he had been murdered. "Bernie Madoff," someone asked casually Bernard Madoff like to walk, "you've heard of this guy?"

Madoff a look at the screen, bleached, and exploded: "Why the hell would be interested in stuff like that?" The employees retreated. "I never saw him like that before reacting," Madoff said a trader who witnessed the explosion. "It's obviously affected a nerve."

0:00 / 2:48 Minnesota Madoff mess

That loss of control was very out of character for the head. But traders did not know at the time it was extremely Madoff develop a second life is two floors below them, one is to build an epic, and the inevitable explosion. Took a special pass to enter the "back office" in 17, which was making its Madoff $ 65 million Ponzi scheme. And even if a person can go in, there was not much to see: an old IBM computer server maintained in a locked room, the piles of trading states, and a staff of about 20 employees and paper pushers.

In retrospect, of course, there are indications, such as research has found fortune. IBM's server, for example, an AS/400 dating from the 1980s, it was so old that some data had been entered into the hand, but refused to replace Bernard Madoff. The machine - which has been autopsied by the government - is the nerve center of the fraud. The many thousands of pages of statements showed that his trade was never made.

Then it was the man who led the floor, Frank DiPascali, Bernie Madoff deputy chief of staff the 17. He was a veteran of 33 years of the related company, with a heavy accent and a Queens high school, but nobody was quite sure what he did or what his title was. "It was like a ninja," says a former trader at the legitimate operation above. "The whole world knew he was a great thing, but it was like a big shadow."

There are other mysteries, as we shall see. But even after the large detonation of five months in a brilliant fireworks display of betrayal and recrimination, Madoff plan - possibly the biggest investment fraud in the country's history - has remained among the most difficult to penetrate. More commonly, white-collar cases begin with a quiet, behind the scenes of research, followed by a series of transactions with younger employees, who are squeezed by lawyers and prosecutors to cough up details about their superiors. Step by step, prosecutors move up. Finally comes the denouement: the ringmaster hauled to court in securing handcuffs.

But Bernie Madoff all aspects of the traditional narrative that has been reversed. The case began with flabbergasting his confession, which was outside the investigation. Bernie Madoff argued that all crimes committed by himself, but because it covers decades and continents, a cloud of suspicion immediately plunged Bernie Madoff family members who worked at the company, as well as employees and business associates.

Now that the fog may be about to lift. Fortune has learned that Frank DiPascali is trying to negotiate a plea deal with federal prosecutors in which, in exchange for a reduced sentence, disclosed the encyclopaedic knowledge of the plan Madoff. And unlike his boss is willing to DiPascali names.

According to a person familiar with the matter, DiPascali has no evidence that Bernard Madoff other family members were involved in fraud. However, he was prepared to testify that he manipulated false returns on behalf of some major investors Bernard Madoff, including Frank Avellino, who used to run the so-called bottom feeding, Jeffry Picower, whose foundation was closed because of related Bernard Madoff losses, and others. If, for example, one of these clients had large gains in other investments, which would DiPascali, which produce a loss to reduce the tax bill. If true, this would mean that investors knew their statements fish. (Lawyers and Picower Avellino declined to comment. Marc Mukasey, DiPascali counsel, said, "We expect and encourage a thorough investigation.")

The emergence of this potential star witness can be on the case scenarios in their heads: Some people widely assumed by the public which has been implicated in the fraud may not have been, and a small group of investors that Bernard Madoff seemed innocent victims can not have been totally innocent, after all. But then, some things about the life of Bernie Madoff become what they seem.

Comments (4)

CMA Blog Home

I've been slow posting lately.I thought I would pop my head in a little today. I've been working a little slowly on the site here... My wife has been pretty ill and It's a stressful situation.

I will probably do some posts as my energy permits... and also, I am working on a few other projects that I need to get done.

So... Hopefully I'll be at it in the next few days.

Comments (2)

CMA Blog Home

The Necessity of Building Emergency FundsDo you have a financial emergency due to a job loss? Or do you have a medical expense that will significantly affect your finances? Almost everyone has a financial problem and the route that the recession is taking has compounded loss and depression. It's definitely time to reserve the cash flow and save up for emergency funds that has been depleted with the falling dollar, gas hikes and the weak economy. So what do you do when it comes to a matter of saving? The best way is to get creative and think of ideas and ways of how you can save money and stash it away as your emergency funds.

Maybe it's easier said than done, but there are secret routes to saving up emergency funds. You could also involve your children so that they are aware of finances and the nuances that are attached to it. You could draw your children into the circle of awareness by paying them money for a job done or collecting money from you as a fee for late payment. No doubt this would transform your emergency saving into an expense but the children will definitely get the idea that money is precious and needs to be conserved. You can also add on an imaginary 10% to the price of your purchase and then save the money. This would not only help you save some money, but it would make you prudent about spending and adding to expenses.

How to Save for a Rainy DayThere are many ways that can help you to save up for emergency funds. You keep a coin box and collect all your coins, which, in actuality is a very handy thing when you need money or you can collect five dollar bills. This really helps when you save money and adds to your emergency funds. Instead of the usual price that one pays for gas, you could add a dollar more and pretend that it is really a dollar extra. This will help you to put that extra dollar into your

emergency funds. You could sell all the unwanted things around the house and though you may have more than a few bargaining about the price, this method will add to your emergency funds. You could save gas money by buying all the groceries and other commodities that you may need in one trip. Instead of driving many times to the supermarket, you could take a walk that would help you save money as well as improve your fitness regime. Another way is to get a credit card that offers a good reward program. As soon as you get the rewards, pass it on to your emergency fund.

It is necessary to keep aside about three to six months of emergency funds that would cover payments. This would come in useful if you or your spouse loses a job or if any undue expense crops up. You can set targets and goals as to how much you would like to save in a given period of time. You can start small and then get used to doing without that money. Start a savings account or certificate of deposits (CDs) or a money market account. See that you get considerable interest for your savings, but make sure that you save your emergency funds in a place that would be accessible and not blocked when you need it the most.

Be Prudent and Creative about Saving Money

Comments (3)

CMA Blog Home

Unprocessed Food is Cheap - HealthJust recently we've been trying to help my wife's health get better. Along with the chemo that she is doing, she also wants to eat healthy, do juicing etc.

I went to the store the other day and purchased a bunch of fresh vegetables that we're going to put through the juicer.

I filled up my basket and it was quite heavy. When I went through the check out, the bill only came to $27 !!

All of the vegetables that are recommended for my wife to eat to help fight cancer, was the cheapest foods of all. In my mind that means that I should be eating them as well.

For a very healthy diet that floods your system build up... you need fresh fruits and vegetables. Because we're juicing them, we're going through alot more than usual.

I purchased a 50 pound bag of carrots last week and it cost $25 for the bag. That's pretty reasonable. The bag has lasted us the better part of a week... and we're eating alot of carrots.

We didn't get recommendations to eat processed foods, sugary foods and deserts etc. These are costly and also aren't really recommended as cancer fighting foods.

BTW... cancer loves sugar.. sugary processed foods are BAD if you're trying to fight cancer. Something I learned recently.

I thought I would do a short post to say that unprocessed fruits and vegetables are really cheap. Ultimately they are the best food for you. The down side is that they take a little longer to process.

It goes to show that the best things in life are usually free or much less expensive.!!

Comments (3)

CMA Blog Home

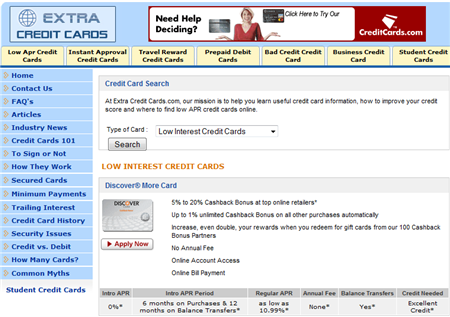

Low interest credit card - U.S. websiteI was asked to do a review for a credit card website that features American credit cards

Sometimes it's good to see what the "other guys" are doing.

This site allows you to search for low interest credit cards, secured credit cards, student credit cards and more.

The thing that's different about the U.S. credit card websites is that they show many of the banks' credit cards. Unlike Canadian banks which don't have affiliate programs for their credit cards.

This site has many different articles about credit cards which are things you need to know if you're going to carry credit.

The main thing you want to do if you're shopping for a credit card is look at rates and the other costs to own the credit card. It's all about the cost of credit. If you can find a better deal and save money, just by spending some time shopping, then it's really worth it. Sometimes you can save hundreds just by getting the lower interest rates.

And it's safe to use a site like this. All of the links follow back to the banks website, and the credit card issuers sites are always secure.

If you need a secured credit card, low interest credit card, student credit card etc.. and you live in the U.S... this is a good site to visit. It's got a clean look, has credit card comparisons and you can sort the credit cards by type.

This is a sponsored review

Comments (2)

CMA Blog Home

this is a great video that talks about the debt situation in Canada.

I like the fact that the commentator puts the blame for the too high level of credit squarely on the consumer. We need to take responsibility for the amount of debt that we're in now..

Nobody forced the consumer to buy , and take on more credit.

Currently the Canadian consumer has $1.3 trillion in consumer debt, this includes mortgages

I like this second video as it gives an actual example of a lady who's quickly accumulated $10,000 in debt. The industry calls her a revolver, as she can't pay off her balances completely.

Credit card companies like revolvers as that's how they make their money.

This lady has figured out that "perhaps the credit card companies want you to carry balances!!"

Comments (9)

CMA Blog Home

Debt Settlement - You don't have to pay your debts??!!Just going through youtube looking interesting things that people say..

This guy starts off by saying... "you don't have to pay your bills"

This makes me crazy. This guy is suggesting that you shouldn't pay your bills/debts especially if you owe $25-$100,000 on credit cards.

He mentions that you should be using the interest that you're paying the credit card companies to save up for retirement.

This is LUDICROUS

The following is what this guy is explaining on the video

He starts off by explaining you should just not pay your bills for six months.. This will start the collection process. You can then negotiate with the collection agency at 10% on the dollar.

Part of the negotiation is that the credit bureau wipes any negative debt notation off of the credit bureau.

So... after 6 months, you'll have a nice squeeky clean credit report, and no debt.!! Wow... this is fantastic!! Or is it?

There are so many assumptions in his discussion that they need to be addressed.

Also it's important that this type of service is for U.S.A. (Americans) only. This system isn't going to work the same in Canada.

I complete disagree with not paying your bills for the sake of getting out of them. That's the cowardly way to do this. This type of logic will erode the social fabric of our society.

IF YOU CAN, PAY YOUR DEBTS

If you've got alot of debt, and can afford to make payments, then you should pay for your debts as agreed. After all, you made all of the purchases that incurred the debt!

The only exception in my opinion is if you've got health issues, and your debt is making your health worse. Then it's time to seek debt settlement or bankruptcy help.

THE CREDITORS MAY SUE YOU

If you owe $25,000 -$100,000 then the creditors may sue you in Canada. This is worth going after in the courts. Don't assume that you can automatically settle you debts after not paying them for six months.

THE CREDITOR DOESN'T HAVE TO REMOVE BAD MARKS FROM YOUR CREDIT REPORT

This fellows assumption is that you can have the creditor or collection agent remove negative items and comments from your credit bureau, as part of the payment negotiation.. While some may do this, some may not do this.

It all depends.

CREDIT REPORT ITEMS MUST BE ACCURATE, COMPLETE AND VERIFIABLE.

Are you going to walk away with no debt and squeeky clean credit after the creditors and collection agencies write off your debt? More than likely not.

Why would the banks want to remove negative items. This sends a false message to other creditors that you've got good credit.

Again, you could ask to have negative items removed from your credit bureau, however, there is no law / motivation for the creditor to do so.

In my opinion, this is a shifty way to deal with your creditors.

If you've had a high consumption lifestyle, then you should pay for it, as agreed to when you took on the credit facilities.

If it takes you 10 years to pay off your credit cards, then so be it. After 10 years, you'll have learned your lesson about the effects of spending too much on your credit cards.

There are always exceptions to the rules, but in the case of North American consumers.. I think we're all guilty of over consumption.

Comments (2)

CMA Blog Home

Peter Schiff on Youtube. - He's Right about the economyI like to watch Peter Schiff. He's usually pretty straight forward and understands the fundamentals of the economy.

Sometimes it's important to understand what's going on in the economy to know what we should be doing individually.

When you see the whole nation suffering from too much debt, and not enough savings, then you can see what the effects are overall.

This should tell people what they need to do in their own personal finances.

Peter Schiff is good to point out items in the economy that are going to affect everybody on the overall.

Learn more about the Canadian coin and the Canadian Economy

I recommend that you check out Peter Schiff's channel on youtube, if you're interested to know what's going on in the economy.

Ultimately it gets back to this.. low debt and high savings will save any economy. Not giving in to instant gratification like we have done for the last 20+ years.

It's also good to invest in R&D so that our country can be profitable and competitive in the future.

I think this economy is going to stay like this for a while until people get the idea and decide to really get on with fixing their balance sheets.

Comments (1)

CMA Blog Home

Mortgage Crisis - The bank's Fault? - or the Consumer?I was reading a blog that said that the mortgage crisis is the bank's fault. I can't believe that somebody would seriously write this in a blog.

Let's see.. the definition of a Consumer, is somebody who consumes. Nobody put a gun to the consumer's head to buy. They all did so willingly.

There were no laws passed that said that the consumer HAD to buy houses, cars or consumers items.. they did so willingly.

IMO... if a person buys a house, they should understand whether or not they should be able to finance the property.. If you don't understand the contract, then hire a lawyer (or somebody trained in contracts) to help you understand the fine print.

I'm very surprised that the media is saying that the homeowner got duped by the mortgage companies.. That's ridiculous. That's putting the blame in the wrong place..

Buying a house for $250,000 is a big purchase. It deserves a great deal of attention, to understand the costs involved. A house has current and future costs.. A mortgage has current and future costs.

BUYER BEWARE: If you don't take the time to understand the costs involved, then you are at risk for making an expensive decision.

Here's what I would recommend to anybody buying a house.

- Learn how much the house & Utilities will cost

Take the time to gather all of the current utility bills, tax bills etc for the house you're looking at buying. See what the costs are.

There are also down payment, closing costs, inspection costs etc with the mortgage.

If you're clear on the costs, then there won't be surprises later on.

- Learn and understand the mortgage contract

Contacts are not easy to understand. You should NEVER sign a contract that you don't fully understand. Doing so means that you're vulnerable to whatever you agreed to.

If you're not sure what the contract language means, ask a lawyer. This is a cost of due diligence. If you need to save up additional money to afford the lawyer, then take the time to do so.

Ask the lawyer what the fine print means, and what are the things you should watch out for.

A lawyer is trained in legal speak and will be able to give you advice that the mortgage company may not come forward with.

- Learn about the fees and future/renewal costs of the mortgage.

This is something you should also ask a lawyer. What are the hidden fees, if any? What are the fees should you decide to refinance, or sell the property?

You might just ask the lawyer to itemize all of the potential costs that the contract holds.

This may cost a few hundred dollars, but the lawyers analysis could save you a ton of hard ship in the future.

I don't believe for a second that the mortgage crisis is the bank's fault. It's not the mortgage companies' fault. It's the consumer's fault all the way. They made the choice to buy the houses in the first place.

Each and every consumer who got involved with a toxic mortgage made the decision to do so. They could have known what the costs were before they took the mortgage. They could have insured for mortgage with critical illness insurance, and life insurance..

There's enough information in the market place to make an informed decision. If the consumer DECIDED NOT TO TAKE THAT INFORMATION, it's their fault!

Comments (1)

CMA Blog Home

Consumerism Withdrawal - Do you suffer from it?This is one problem with the economic downturn that I thought of. Consumerism Withdrawal.

The premise of the economy for the last 20 years has been consumption. Living the American dream. People have done a pretty good job spending, and consuming.

There have been many posts in the blogosphere where people explain that they're going to cut back spending and go on a spending diet. They talk about how they're not going to go shopping for a month, or not buy anything on credit for the next three months. Ultimately with those posts, I just roll my eyes, and wonder about their resolve.

Once you've tasted luxury and spending, it's hard to give it up.

With all of the lay offs and the credit crunch that we're experiencing, I'm sure that many people are suffering from consumerism Withdrawal.

This is more like being forced to go on a diet because of food shortage. In this case, credit is tight, and people have overspent.

If you're suffering from consumerism withdrawal, there are a few things you can do to help the situation:

- Learn to enjoy life with what you've got

The problem with consumerism is that we're always looking for the next big toy, or the next fashion. We're satisfied for a small time with what we've purchased. Much of what people have purchased is to satisfy wants and not needs.

The best thing to do is to learn to appreciate what you've got already.

That's a pretty hard thing to do, if you're used to a constant diet of new things all the time.

I've found that I really only enjoy a few of the possessions that I own. the rest are just sitting in a closet doing nothing.

Enjoying what you've already got, means that you won't need to spend any money on goodies.

- Take the time to strengthen your balance sheet

If we're going to be in a recession for the next year or so, why not take the time to pay down debt and save up some money.

This is really not fun, and it's pretty boring, compared with shopping all the time for the latest gadget.

My thinking is this: if you've got money saved up, and you're not in debt,

you'll sleep better, and won't need to go through withdrawals at the retail store.

Having some money saved up, means that you'll be able to go into the store and make some moderate purchases, based on your available cash.

Buying things with cash will give you a little taste of having something new, without the pains of paying down credit later.

- Take the time to enjoy the free things in life: family and friends.

I've gone on a cash diet for the last few years, by choice. In doing so, I've learned to really enjoy free things. Going for a walk, visiting with a friend. I enjoy looking at flowers more.

There are many things you can do for free. Sometimes we look at these FREE things as boring and unexciting. If you're used to hyper spending at the stores and for entertainment, then going to the museum would probably be boring.

If you detox off of the sugar rush of retail spending for a few months, perhaps the free things in life will start to look good again.

Yes, that's what I'm saying.. hyper retail spending using your credit card is like eating alot of refined sugar products. They taste great, give you a sugar rush for the moment, and then give you a big let down afters. You get addicted to sugar, and retail shopping for the buzz it gives you.

The free things in life are more wholistic. They're not as exciting, but they are better for you in the long run.

I see Canadians and Americans going on a consumerism diet for the next year or so. Let's take the time to get back into shape financially and as well, start to enjoy less expensive more healthy activities again.

Comments (0)

CMA Blog Home

Are we NOW happy with Less? - The EconomyThe other day I was chatting with my son, Alex.. He deleted his facebook account, and is cutting out other instant messaging type programs that's he's grown up with.

I was curious about why he would give up facebook.com especially because this type of program is meant for his generation.

He indicated that he's grown up with internet, video games, TV, cell phones. He's getting tired of all of the programs and software that replace human interaction.

I was intrigued by this.

Growing up in the 60's and 70's, we didn't any of these modern tools and conveniences and toys. Nowadays.. the kids are flooded with them.

The Point is:

North Americans have had 20 years of free spending. We've bought what ever we've wanted, and are now slaving away to pay for the credit cards we used. We've had 20 years of endless consumption. We know what consumption is. We know that we can get what ever we want if we work hard enough for it. Learn more about capital gains

We've been there, done that!

I'm just wondering if people will be content to sit back and take a break for a while, consumption wise. This would be hazardous to the economy.

Consumers need a rest. I'm sure alot of people are suffering burnout from trying to make payments on all of their debts. The satisfaction of getting that new 52" TV is gone, especially because many people have already purchased one and had that experience.

My question is:

As my son is tired of all of the new gadgets that he's been bombarded with his whole life.. are consumers tired of being in the buying / paying off cycle? Are consumers going to want to take a break from being on a continuous spending spree?

An even more intriguing question:

Are consumers going to be HAPPY with less?

I don't mean "are they going to suffer, and put up with less?".

I mean, "are they are actually going to be happier with less stuff, less debt payments, less noise in their lives?" These are some thoughts I've been having lately about the economy. If people are happy with less, then that will spell bad news for the current economy that relies heavily on consumer spending!

Comments (8)

CMA Blog Home

Found on: CBC.ca and milliondollarjourney.com

This is completely ridiculous... this much taxes is choking Canadians!!

As a Canadian I enjoy the high standard of living that our country affords. After travelling to a few different countries and seeing documentaries on poor African nations etc. it's not hard to begin to appreciate all of the blessings our country enjoys.

But at what cost?

According to this article: 45% of our money is going to taxes whereas in 1961 35% of our money was going to taxes. That's a 10% increase in taxes over a 46 year period. Where does it stop?!!

SEE: The Canadian Economy in Brief - www.fin.gc.ca

SEE: Canadian Federal Debt and other statistics - canadianeconomy.gc.ca

The government needs our tax dollars to pay for costs of infrastructure, administration, and also to pay down the Canadian national debt.

It is my opinion that the governments should be prudently paying back the debt as they get surplus income. Keep the same services but use surplus money to pay down the debt which according to this Federal Government website is $481,499,000,000 as of 2006

A MUST SEE! Where your tax dollar goes - Canadian Federal Government MultiMedia presentation

There are many people who visit this site who have run on hard times and are getting hounded by collection agencies. I'm curious to know when the "collection agencies" are going to start hounding the federal government to pay down their debts a little?!!

It is not the purpose of this blog to be political, however, it seems that the government can get away with the same kind of spending and debt creation that that would cause criticism with a regular Canadian citizen!

QUESTIONS:

- Wouldn't it be better to have a "debt free" policy where the federal government eventually becomes debt free, and starts to make money on its surplus funds?

- Should the Canadian public take on the same spending policies as the federal government and spend ourselves into the ground? (Ooops, maybe we've already done that.)

- If the Canadian Federal government paid down it's debt substantially, would that set a good example for the Canadian people?

That's the end of my rant!

Comments?

Average Canadian family spends more on taxes than necessities of life: survey

Published: Monday, April 16, 2007 | 8:47 AM ET

Canadian Press

VANCOUVER (CP) - Taxes are taking a bigger chunk out of the average Canadian family income than food, clothing and housing combined, a new survey suggests.

The Fraser Institute says the Canadian Consumer Tax Index is up significantly in the past 45 years.

The average Canadian family earned $63,000 in 2006, with nearly 45 per cent of that going to taxes.

Just over 35 per cent was spent on food, clothing and housing.

In 1961, the institute says just 33.5 per cent of income went to taxes.

The tax index includes direct taxation, such as income taxes, sales taxes, Employment Insurance and Canadian Pension Plan contributions, as well as hidden taxes, such as import duties, gas taxes and excise taxes on tobacco and alcohol.

Comments (1)

CMA Blog Home

Get Reviewed At ReviewMe!

Financial Tag... You're it!

Tagging a site has been around for a while. What a fun game!

I thought I should start a financial tag game.

I thought it would be interesting to find out these questions:

What are your favorite financial magazines, books, or websites?!!

To answer the question myself,

I've read alot of books over the years. I like books that talk about the fundamentals of personal finance.

- Richest man in Babylon - by George S. Clason

I read this book many years ago, but the impression that still remains is to be patient with your money and pay yourself regularly. Most importantly, make your money make you more money.

Patient means, don't let money burn a hole in your pocket all the time... Save for a rainy day. Save financial reserves to keep yourself out of trouble.

Make your money make you money means get a return on investment from your money. Compounding interest. Of course in order to do this, you need to have your financial situation in control.

- My Micro Economics text book from Red River Community college!

I reviewed this book the other day. It talks about Supply and Demand. I thoroughly at that book up in college and it gave me a better understanding of how business works, pricing with regards to supply and demand.

- Fortune Magazine, Entrepreneur, Forbes

I don't get magazines very often as I spend far too much time on the internet. However, when I'm on a plane I'll pick up a Fortune magazine, Entrepreneur magazine or Forbes and inhale them cover to cover.

These magazines are like candy. They're sweet and easy to read.

- http://money.cnn.com

This is a site that I'll visit each day to keep up to date with news and financial events. This site has enough info on it to keep a person busy reading for days!

- The Millionaire Mind book series.

I think I've got the whole series of this book, including the CD or cassette.

I was completely intrigued to read about how millionaires actually live and how they actually make their money.

Most millionaires surveyed in these books didn't drive the big fancy cars, or live in big fancy houses. They're down to earth, practice the fundaments of money management, and build their wealth.

To dispel myths of how the rich really live, these are great books!

So with that, I'll start Financial Tag by tagging the following bloggers:

| BigCajunMan, | Investing Intelligently | Canadian Capitalist |

| Free Money Finance | Everyone Loves Your Money |

UPDATE: April 27, 2007

I got an email back from FreeMoneyFinance.com who declined to participate in this match of Financial Tag. Here's what he had to say:

Monty --

I got your tag and didn't want you to think I was blowing you off, but I'm going to pass on the offer. After 4 or 5 of the "tell us more about yourself" posts, I'm kind of burned out on them.

For reference, though, here's a list of my favorite books:

http://www.freemoneyfinance.com/2006/03/my_list_of_must.html

And here's a bit more about me that you may have missed:

http://www.freemoneyfinance.com/2006/12/five_things_you.html

Cheers!

FMF

I can see FMF's point.. He is probably bombarded by requests all the time for these blog events. I really appreciate FMF getting back to me.

Coincidentally, FMF and I have two favorite books in common.. The Millionaire Next Door , and The Richest Man in Babylon. Great minds think alike.!

Comments (0)

CMA Blog Home

Total Credit Recovery Gets Slapped -$4400 Fine!!

Here's an article that many of you have been waiting for!! Carole Roach takes Total Credit Recovery to small claims court in B.C. AND WINS!!. This matter had to go as far as the B.C. Supreme Court!

DISCUSS:: Carole Roach Success vs Total Credit Recovery here:

This is encouraging to everybody who has been harrassed by a collection agency!

Globe and Mail - Total Credit Recovery gets slapped!!

I saw this mentioned over at

Ask a Bill Collector's Blog

Collection agency slapped for being too aggressive

CP

Vancouver -- A credit collection agency has been ordered by the B.C. Supreme Court to pay a woman it harassed over a Canadian Tire credit-card bill.

A small-claims court earlier ordered Total Credit Recovery to pay Carole Roach $4,400 minus the $1,200 she owned to Canadian Tire after falling behind on her credit-card payments.

Total Credit appealed the judgment, and the higher court reduced the award to $1,585 saying there was no reliable evidence that Ms. Roach lost her reputation, but confirmed Total Credit used excessive and unreasonable pressure in attempting to collect the bill.

The court heard the company called Roach's workplace leaving urgent messages and faxed documents to her employer. CP I would like to congratulate Carole Roach for taking this collection agency to small claims court and winning!!

Other Links to news articles:

Credit card agency ordered to pay woman

According to CBC.ca - Carole Roach vs Total Credit Recovery

A 60-year-old Vancouver woman who suffered harassment by a collection agency has been awarded $2,000 by the B.C. Supreme Court.

Carole Roach owed $1,200 on her Canadian Tire credit card, and claimed she was put under undue pressure by Total Credit Recovery (B.C.) Ltd.

The agency contacted her at home and at work several times about the bill, said her lawyer, Jess Hadley.

"They phoned her at work and faxed her at work, and really stressed her out quite badly. And they persisted in calling her and contacting her even after she'd written a request asking they only contact her in writing.

"And that's something she's entitled to do under our consumer protection legislation, and they basically breached those protections."

Under the Collection Act, an agency must not put unreasonable pressure on the person in debt, their family or their employer.

The legislation also forbids calling the workplace except to confirm employment.

Comments (7)

CMA Blog Home

digg story

GOOGLE IS THE WORLDS MOST VALUABLE BRAND!!

According to the Globe and Mail, Toronto, Google is now the world's most valuable brand. Google's brand is worth worth $66.4 billion dollars or Approx $74.5 Canadian dollars. Googles' brand is now worth more than Coke, General Electric, Pepsi, IBM, Mac etc. Google now has a marque worth $66.4-billion (U.S.) What's 10 years old and worth more than Coke?

Google now has a marque worth $66.4-billion (U.S.), and has bumped GE from the top spot, a global market research study discloses KEITH MCARTHUR

MARKETING REPORTER A decade after its launch, Google has overtaken General Electric as the world's most valuable brand. The marque is worth $66.4-billion (U.S.), according to a study by global market researcher company Millward Brown Optimor. Its study calculates the value of brands based on their ability to drive profits and their growth prospects.

"It's been coming for a while, if you look at the growth in stock market value relative to all the other technology companies out there," said Alan Middleton, a marketing professor at York University's Schulich School of Business. Google ranks ahead of technology rivals Microsoft (No. 3), IBM (9), Apple (16) and Yahoo (42). But the list also places Google - a brand so famous that it was added as a verb in the New Oxford American Dictionary - ahead of some of the world's most storied brands, including Coca-Cola (No. 4), McDonald's (11) and American Express (19).

This is quite impressive since the Google has only been in the market place for 10 years, while the other companies have been in the market place for several decades. As of April 24, 2007 , according to CNN Money - Google Stock Quote - Google's market cap is $149,385,190,000. This makes googles brand value worth approx 44% of it's market cap?!!

Comments (0)

CMA Blog Home

FROM: canada.com - American Express News

American Express earnings rise

Reuters

Published: Thursday, April 19, 2007

NEW YORK (Reuters) - American Express Co. , the fourth largest U.S. credit card company, said on Thursday that first-quarter profit rose, helped by higher card holder spending.

The New York-based company said net income rose to $1.057 billion, or 87 cents a share, from $873 million, or 69 cents a share, in the year-ago period.

Analysts on average had expected earnings of 79 cents a share before one-time items, according to Reuters Estimates.

A sample America Express-branded credit card is seen in an undated publicity photo. American Express Co., the fourth largest U.S. credit card company, said on Thursday that first-quarter profit rose, helped by higher card holder spending. REUTERS/PRNewsFotoView Larger Image View Larger Image

A sample America Express-branded credit card is seen in an undated publicity photo. American Express Co., the fourth largest U.S. credit card company, said on Thursday that first-quarter profit rose, helped by higher card holder spending. REUTERS/PRNewsFoto

Email to a friendEmail to a friendPrinter friendlyPrinter friendly

Font:

* *

* *

* *

* *

Revenue, net of interest expense, rose 10 percent to $6.67 billion.

Total cards in force rose 10 percent to 79.9 million from last year's first quarter. Average basic cardmember spending rose 8 percent to $2,817.

Comments (0)

CMA Blog Home

NEXT Tour: May 7, 2007

Canadian Tour of Personal Finance blogs

This event will be hosted by:

THE MONEY DIVA: themoneydiva.blogspot.com

We need 10 participants:

There are about 4 bloggers that have signed up that didn't participate in the April 16, 2007 tour. These bloggers will be invited first to participate in article writing.

We still need 6 new Canadian Finance bloggers to give us a fresh set of 10.

If you want to sign up for this event, please visit:

/tour-register.html

UPDATE

New Email address created for the Tour.

You can use this email address to correspond with the host and submit your articles.

Comments (0)

CMA Blog Home

Stock market versus investment funds

by Mark Plummer

The term "stock market" refers to the business of buying and selling stock. It is a market for the trading of company stock and derivatives of it. Both of these are securities listed on a stock exchange as well as those only traded privately.

Bonds are still traditionally traded in an informal, over the counter market known as the bond market. The worldwide size of the bond market is estimated at $45 trillion and the size of the stock market is estimated as about half that.

In the stock market, the participants range from small individual stock investors to a large hedge fund traders, who can be based anywhere. Usually their orders end up with a professional at a stock exchange, who executes the order. The purpose of stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. The exchanges provide real time trading information on the listed securities, facilitating price discovery.

You might wonder why should you care about the stock market. May be you are too young to be investing, or can't see the market relates to your everyday life. But, the fact is that if the stock investors have no money in the stock market, or are in school, the stock market does affect you. It affects everything you do from going to the mall to buying a new outfit.

The stock market is considered to be one of the most vital sources for companies to raise money. This allows businesses to go public or raise additional capital for expansion. The exchange provides liquidity that affords investors to quickly and easily sells securities. This is a good feature of investing in stocks compared to other less liquid investments such as real estate. The price of the shares and other assets is an important part of the dynamics of economic activity and can influence or be an indicator of social mood as shown in history. Rising share prices for example, tend to be associated with increased business investment and vice versa. The wealth of households and their consumption is affected by share prices. The fluctuations in the stock market occur partly because companies make money or lose money, but it is much more involved than that. The worth of a stock is what someone will pay for it.

There are many factors that have an effect on the stock market such as the state of the economy. If there is more money floating around, there is more flowing into companies making their prices rise. Another factor is time of year and publicity. Many stocks are seasonal which means that they do well during certain parts of the year like the ice company, which does well during summer.

Mistakes to be avoided by investors to make money in the stock markets

1. Don't buy a stock based on its past experience 2. Beware of stock market experts 3. Never be unrealistic with your expectations 4. Understand the consequences of failure on your portfolio

For more details please visit www.wealthcapfund.com

The term "stock market" refers to the business of buying and selling stock. It is a market for the trading of company stock and derivatives of it. Both of these are securities listed on a stock exchange as well as those only traded privately.

Bonds are still traditionally traded in an informal, over the counter market known as the bond market. The worldwide size of the bond market is estimated at $45 trillion and the size of the stock market is estimated as about half that.

In the stock market, the participants range from small individual stock investors to a large hedge fund traders, who can be based anywhere. Usually their orders end up with a professional at a stock exchange, who executes the order. The purpose of stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. The exchanges provide real time trading information on the listed securities, facilitating price discovery.

You might wonder why should you care about the stock market. May be you are too young to be investing, or can't see the market relates to your everyday life. But, the fact is that if you have no money in the stock market, or are in school, the stock market does affect you. It affects everything you do from going to the mall to buying a new outfit.

The stock market is considered to be one of the most vital sources for companies to raise money. This allows businesses to go public or raise additional capital for expansion. The exchange provides liquidity that affords investors to quickly and easily sells securities. This is a good feature of investing in stocks compared to other less liquid investments such as real estate. The price of the shares and other assets is an important part of the dynamics of economic activity and can influence or be an indicator of social mood as shown in history. Rising share prices for example, tend to be associated with increased business investment and vice versa. The wealth of households and their consumption is affected by share prices. The fluctuations in the stock market occur partly because companies make money or lose money, but it is much more involved than that. The worth of a stock is what someone will pay for it.

There are many factors that have an effect on the stock market such as the state of the economy. If there is more money floating around, there is more flowing into companies making their prices rise. Another factor is time of year and publicity. Many stocks are seasonal which means that they do well during certain parts of the year like the ice company, which does well during summer.

Mistakes to be avoided by investors to make money in the stock markets

1. Don't buy a stock based on its past experience 2. Beware of stock market experts 3. Never be unrealistic with your expectations 4. Understand the consequences of failure on your portfolio

For more details please visit www.wealthcapfund.com

The term "stock market" refers to the business of buying and selling stock. It is a market for the trading of company stock and derivatives of it. Both of these are securities listed on a stock exchange as well as those only traded privately.

Bonds are still traditionally traded in an informal, over the counter market known as the bond market. The worldwide size of the bond market is estimated at $45 trillion and the size of the stock market is estimated as about half that.

In the stock market, the participants range from small individual stock investors to a large hedge fund traders, who can be based anywhere. Usually their orders end up with a professional at a stock exchange, who executes the order. The purpose of stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. The exchanges provide real time trading information on the listed securities, facilitating price discovery.

INTERESTED IN AN ACTIVE TRADING SYSTEM?

You might wonder why should you care about the stock market. May be you are too young to be investing, or can't see the market relates to your everyday life. But, the fact is that if you have no money in the stock market, or are in school, the stock market does affect you. It affects everything you do from going to the mall to buying a new outfit.

The stock market is considered to be one of the most vital sources for companies to raise money. This allows businesses to go public or raise additional capital for expansion. The exchange provides liquidity that affords investors to quickly and easily sells securities. This is a good feature of investing in stocks compared to other less liquid investments such as real estate. The price of the shares and other assets is an important part of the dynamics of economic activity and can influence or be an indicator of social mood as shown in history. Rising share prices for example, tend to be associated with increased business investment and vice versa. The wealth of households and their consumption is affected by share prices. The fluctuations in the stock market occur partly because companies make money or lose money, but it is much more involved than that. The worth of a stock is what someone will pay for it.

There are many factors that have an effect on the stock market such as the state of the economy. If there is more money floating around, there is more flowing into companies making their prices rise. Another factor is time of year and publicity. Many stocks are seasonal which means that they do well during certain parts of the year like the ice company, which does well during summer.

Mistakes to be avoided by investors to make money in the stock markets

1. Don't buy a stock based on its past experience 2. Beware of stock market experts 3. Never be unrealistic with your expectations 4. Understand the consequences of failure on your portfolio

For more details please visit www.wealthcapfund.com

The term "stock market" refers to the business of buying and selling stock. It is a market for the trading of company stock and derivatives of it. Both of these are securities listed on a stock exchange as well as those only stocks traded privately

Bonds are still traditionally traded in an informal, over the counter market known as the bond market. The worldwide size of the bond market is estimated at $45 trillion and the size of the stock market is estimated as about half that.

In the stock market, the participants range from small individual stock investors to a large hedge fund traders, who can be based anywhere. Usually their orders end up with a professional at a stock exchange, who executes the order. The purpose of stock exchange is to facilitate the exchange of securities between buyers and sellers, thus providing a marketplace. The exchanges provide real time trading information on the listed securities, facilitating price discovery.

Talk about Investing Here:

You might wonder why should you care about the stock market. May be you are too young to be investing, or can't see the market relates to your everyday life. But, the fact is that if you have no money in the stock market, or are in school, the stock market does affect you. It affects everything you do from going to the mall to buying a new outfit.

The stock market is considered to be one of the most vital sources for companies to raise money. This allows businesses to go public or raise additional capital for expansion. The exchange provides liquidity that affords investors to quickly and easily sells securities. This is a good feature of investing in stocks compared to other less liquid investments such as real estate. The price of the shares and other assets is an important part of the dynamics of economic activity and can influence or be an indicator of social mood as shown in history. Rising share prices for example, tend to be associated with increased business investment and vice versa. The wealth of households and their consumption is affected by share prices. The fluctuations in the stock market occur partly because companies make money or lose money, but it is much more involved than that. The worth of a stock is what someone will pay for it.

There are many factors that have an effect on the stock market such as the state of the economy. If there is more money floating around, there is more flowing into companies making their prices rise. Another factor is time of year and publicity. Many stocks are seasonal which means that they do well during certain parts of the year like the ice company, which does well during summer.

Mistakes to be avoided by investors to make money in the stock markets

1. Don't buy a stock based on its past experience 2. Beware of stock market experts 3. Never be unrealistic with your expectations 4. Understand the consequences of failure on your portfolio

For more details please visit http://www.wealthcapfund.com

About the Author

Asia based independent Offshore Investment advisor.Has been involved in the financial services and financial planning business since leaving full time education in 1977.It was his intention to provide an insight in to both the mainstream products offered by the general population of financial advisors out there and also the alternative investment areas that are often overlooked or ignored.

Comments (0)

CMA Blog Home

Credit Card Reward Programs

by David Tanguay

Apply for American Express Credit Card Reward Program

When you are applying for new credit cards, take a look at the reward programs they offer. Almost every major credit card company like Secured MasterCard or Secured Visa Credit Card offers some type of reward program. Some offer cash rebates and others offer merchandise. See which one helps you out the most.

Cash rebates offers with credit cards vary depending on the company. Most offer between 1% to 5% cash back on qualifying purchases. That means that during the year if you spend $20,000 on your card you could earn up to a $1000 back. Make sure you read the terms, though, because many have a cap on how much you can actually earn back. The key to really taking advantage of this option is not to carry a balance and give all your rewards back in interest.

Many people I know save the cash back money and use it to take their yearly vacations. If you are not carrying a large balance on your credit cards and losing it on interest, you will actually be taking your vacation on them. And if you have $1000 to travel with, you can have one heck of a vacation

Credit card rebates

I personally prefer using cards that offer merchandise for your purchases. Usually you will receive one point for every dollar you spend. Then once you accumulate a certain total you can choose some merchandise. Many of them offer an online catalog to shop from. The credit card companies offer the merchandise in tiers. For instance, you might be able to get a $50 dollar gift certificate for 5000 points, but for 100,000 points you have the option of getting a high-tech outdoor BBQ grill.

I use the merchandise points I accumulate for gifts throughout the year. Especially for last minute Christmas gifts. Everyone likes a gift certificate, so there is a quick and easy gift idea.

I know many people who have learned to maximize these Air Miles credit Card rewards to the fullest. For example, you are use to just writing a check to pay for your utilities every month. Instead, just use the credit card to pay them, and just pay it off each month. It is not an added expense; you are just changing whom you write the check to. They also pay things like their homeowners policies on them and if you can, another big point gainer is paying your property taxes on them. You then can add a lot of everyday purchases and get your point totals very high.

So decide which type of reward program is best for you. You may want the cash rebate over the merchandise. Either way, make sure that you actually get to benefit from them. Check all the terms of your credit card, not all purchases you make will qualify for points or the cash rebate options.

About the Author

David Tanguay is dedicated in helping individuals & businesses get out of debt. To compare hundreds of credit card offers & rates please visit Apply for a Credit Card at http://easycreditcompare.com

Apply for American Express Canadian Credit Cards with Rewards Points and cash back offers also low interest.

Comments (0)

CMA Blog Home

Credit Card Offers: What To Look For And What To Avoid

by Mario Churchill

In this day and age, credit cards are considered to be one of the most important financial tools in our society. With it, you can purchase almost everything you need in your everyday life even if you still don't have the cash for it. What you do is you have to pay back the credit card company every month for the money they lent you with interest when you used the credit card to purchase something.

This tool is great especially during emergencies and you have to consider the fact that when you lose your cash, you won't be able to replace it, but when you lose your credit card, your credit card issuer will be able to provide you with another credit card.

Today, there are different varieties of credit cards available in the market. All you need to do is choose one that you can afford and one that suits your everyday needs. In fact, you don't actually need to find credit cards as credit cards will find you. Because of the competition for potential cardholders, credit card companies are now mailing people randomly with credit card offers. In fact, a salesperson may have already knocked on your door to offer you credit cards.

When you are interested in applying for a credit card, you have to know what kind of credit card is right for you. Always remember that there are different kinds of credit cards designed for different kinds of people. The first question you have to ask yourself is if you can afford to have a credit card.

You also need to look at the different credit card offers as there may be some information that will be left out in the advertising or in the offer. Usually, credit card companies will offer you low interest rates, no annual fees, low APR and other attractive offers. In fact, some even offer zero interest rates and zero APR. If you think that this is too good to be true, then there is a great possibility that it is.

Ask the company that is offering you the credit card about their offers and ask if the low interest rates they offer in their credit card is either promotional or fixed. If it is fixed, then you may have struck gold and will be enjoy a lot of benefits with low interest rate monthly bills. If it is not, ask how long the promotional interest rate will last in order to know what to expect on your credit card bills in the future.

Never get blinded by other kinds of promotional offers that credit card issuers offer, such as free TV, free toaster ovens, free t-shirts, free microwave ovens and other freebies. This is only a marketing strategy to blind people in realizing that they are signing up with a credit card that has a high interest rate and high annual fee.

Always remember that you should only get a credit card that you can afford. Never sign up for anything just because it offers a lot of rewards and points when you use it. If you do this, you will just end up spending a lot of money from the purchases you made and accumulate high amounts of credit card debt. The best thing you can do when applying for a credit card is read the agreement stated on the credit card you are interested in. By doing this, you will be able to know the real deal inside the credit card outside the promotional offers.

About the Author

Mario Churchill has written many articles about the benefits of business and college student credit card offers and runs a website on locating the best credit card offers for your lifestyle.

Be careful for life insurance scams such as: Fraud, Phishing and Financial Misdeeds

Discuss Credit Cards Here:

Apply for Canadian - American Express credit cards Here:

Comments (0)

CMA Blog Home

Lender's Get Aggressive To Help Borrowers That Are At Default Status On Their Mortgages by Dale Rogers

If the borrower has committed to staying in the property and fighting through the difficult period of pending foreclosure many lenders and their servicing agent are offering possible solutions. Early on, with mortgage lates, borrowers are being contacted with possible workout solutions to get caught up on their payments. However, many mortgage products with accelerating payments make it difficult for any mortgage borrower to recover. In the past, forbearance was the tool of choice to be utilized for a borrower to get caught up with payment arrears.

For example, if a mortgage payment of $1,500/month is three months down and soon to be four, the mortgage company might take this arrearage of $1,500 x 4 = $6,000 and spread it out over say a years time and a catch up payment of $6,000/12= $500/month. The regular payment of $1,500/month needs to be made plus the $500/month in the forbearance portion for a total of $2,000/month to get caught up and avoid foreclosure. In the past, this might have worked, now however, many borrowers are being crippled with accelerating payments of the first of say an Option ARM, or a 2/28 ARM that is adjusting way up and forbearance won't do the job. Rather, in many cases, a whole new loan product has to be put in place to even have a chance of rectifying the adverse mortgage situation.

Now the "old" forbearance has been modified to become even more flexible. Mortgage companies, with the current inventory of unsold homes, do not want to foreclose and end up taking an even bigger hit when and if the home sells after foreclosure. The writing has been on the wall for many lenders in this past year, work out the loan or eat huge losses. If someone is in the home and making payments, it can soften the massive write-downs that will follow in this extremely soft market.

Things were going ok for Jim and Terri until the auto accident that put Jim out of work and laid up with a broken leg and a disc problem. What savings they had were burned through in less than a month. The auto insurance covered very little of the medical bills and Jim's insurance at work carried a sizable deductible. The biggest challenge came for their family when Jim was not able to work for what was predicted for six months. The luxury items were the first to go. Because Jim was upside down on his car that was totaled there wasn't enough insurance settlement to pay for the debt. Jim was still on the hook for the difference and monthly payments were being demanded by the auto finance company.

Jim's attorney shared that there might be a chance for some type of settlement until he discovered the driver of the other car that had caused the accident was not insured due to a recently lapsed policy. The insurance carrier was not going to pay anything. Jim's attorney, a high school buddy, was going after the assets of the at fault driver but it would take some time to even begin the process. Jim and Terri had worked hard for five years to buy their first home and were just getting ahead when the auto accident occurred. With several months passing, the young couple was not able to pay even the minimum payment of their four credit cards.

The mortgage payment had not been made for the past three months. The phone was now ringing off the hook for medical collections, the auto finance company and the mortgage company was now threatening to foreclose. Terri took a part time job in addition to her full time job as an office manager at a collection agency. She knew that game inside out. With two kids it was becoming very clear that bad things were under way and if something didn't happen to turn the situation around, her family would be moving back into a small apartment again with trashed credit to boot.

Fortunately, Jim and Terri's families were close by and could help out with babysitting while Terri worked. Both of their parents were of modest means and not able to offer any financial help but were happy to pitch in with the kids and some of the maintenance work around the house. Jim was flat on his back with recovery time many months down the road. Jim had the phone close to his bed and he had been screening telephone calls for bill collectors and such. On a Friday, Jim received a call from the mortgage company that held their loan and at first Jim was going to ignore it. Jim figured he had quite enough "gut calls" for the day. The caller was in the process of leaving a message on the answering machine and was going on at length over the details of a plan from the mortgage lender that would help Jim and Terri get back on their feet. In the middle of the message, Jim lifted the phone and spoke with the caller.

It was a friendly voice. Jim spent almost an hour on the phone with explaining his situation and sharing the tale of woe and their streak of bad luck. The caller's name was Toby and after the conversation concluded, he suggested he would call back by Monday and would give Jim and Terri a concrete proposal to try and mediate the mortgage foreclosures short fall. After Jim hung up, he could only wonder if anyone could help him out of this financial mess. Sure enough, Toby called back Monday with a proposal. Toby explained his mortgage company decided to be very proactive with customers who had fallen behind and found it in their best interest to try and bridge the gap between their current situation and possible foreclosures. Another hour was spent going over Jim and Terri's family budget just to determine the short fall and rank what items could be quickly cut to generate a better monthly cash flow. At the conclusion of the call, Toby suggested that if Jim and Terri could tighten up their budget and eliminate in the short term, cable, cell phones, eating out, sell the one remaining car that had some equity and get a transportation vehicle the bank would substantially help with the payments.

This would allow Jim and Terri to bridge to a time when Jim could get back on his feet and return to work. Since the loan in question was an FHA loan, the lender was going to advance an interest free loan in the amount equal to twelve months of principal and interest payments including taxes and insurance. This was made possible by the lender making a "partial claim" to the FHA insurance fund, that is borrower funded, to help Jim and Terri get back on their feet. This was not a gift. Every penny would need to be paid back down the road. When borrowers use the FHA program they normally pay 1.5% of the mortgage amount up front called the UFMIP (Up Front Mortgage Insurance Premium) plus they pay .5% of mortgage amount spread out among monthly payments. The bulk of these insurance premiums are by and large used for foreclosure actions. Loans that are insured by FHA pay the lender the difference of the foreclosure sale and the loan balance plus costs. This can be 25% to 30%+ loss for FHA. The thinking here by FHA is that if they can extend a hand and get these folks back on their feet in say a years time, it would be saving FHA a ton of money.

This proactive approach is showing positive results. Jim and Terri seized on the proposal and in time were able to work out their financial situation and Jim was able to return to work. FHA was made whole in time; the credit card companies cancelled the accounts and agreed to take smaller payments for as long as necessary to get them settled at a reduced nominal interest rate. Terri was a good negotiator. Jim's attorney was able to get a judgment and squeeze enough money out of the ticketed driver and get some funds from the uninsured motorist fund. This allowed Jim to payoff the "up side down" portion of the totaled vehicle with enough additional cash to buy an older pick up truck with the remainder monies.

Terri was able to give up her part time job and the family slowly pulled themselves up by the bootstraps and they got back on their feet. The trailing medical bills were negotiated down after several over charges were discovered and a low monthly payment was set up. All in all, Jim and Terri considered themselves lucky in that the mortgage company stepped forward to offer a workable plan to save their home. It could have gone the other way very easily.

Lenders have recognized that the "bottom line strategy" of trying to work with borrowers who are in trouble pays off. From specially trained customer service representatives, like Toby, who are engaged counselors and not just adversaries. A customer service representative armed with tools like forbearance plans, to reworking old loans to new loans, to FHA, Fannie Mae, Freddie Mac, all pitching in to help resolve and mitigate any salvageable financial situations. The borrowers will need to make an effort to meet the lender half way and do what they need to do to keep their home. For any homeowner, financial disaster can be just a car crash away. Fortunately, lenders are now stepping up their efforts to help families in trouble with paying their mortgage. Again, bottom line, the lender and the borrower can win.

Dale Rogers www.brokencredit.com

About the Author

Dale Rogers is a thirty-year mortgage veteran and frequent contributor to the Broken Credit Blog. The BCB is a free website created to assist the general public with information about credit repair and responsible mortgage lending.

Discuss Mortgages and Foreclosures Here

Comments (0)

CMA Blog Home

Business Debt Management - Business Debt Management Restores Focus by Debbie White

You are a businesses person who has thought up and developed a business plan that has materialized into a quietly growing concern that serves the community well. However, for several reasons, the business is not growing quickly enough to cover the start up and monthly costs. Perhaps the business is growing slowly and customers are just now becoming aware of the service. Or, the business may have had a number of customers, but a few have been unable to pay the bills.

For whatever reason, the business assets are not enough to pay the monthly bill and business debts are beginning to accumulate. And even worse, you, as the head of this business, now find that you are spending more time thinking about business debt management than about the other aspects of the business. You may find yourself spending the hours in the day that should be focussed upon attracting new customers mired in the quagmire in debt negotiations with creditors. Or the hours you usually provide customer service and backup to your existing customers are being eaten away while you try to collect payment for services that have been provided. In either case, your focus is upon business debt management and not upon your business. With your attention divided in this way, it will not be long before serious business help will be necessary.

Now is the time to browse the Internet for business debt management. There are many services listed that offer counselling regarding business debt management, all forms of business help, solutions for resolving commercial debt, and who offer programs that result in business debt settlement. A business debt management firm will assess the business, the amount of debt and the ratio to assets. Most business debt management consultants will say that bankruptcy is almost never the correct step to take. It further weakens the local business fabric by unloading more unpaid accounts upon it. Furthermore, it is becoming increasingly difficult to get debt relief through declaring a business bankruptcy.

The business debt management consultant will come up with a plan that will reduce the amount of time that you, as the head of the business will have to spend on the worrisome tasks of dealing with your creditors and with those individuals who owe your business. The business help that the consultant provides will be aimed at paying off the commercial debt of the business in the quickest way that will still allow the business to keep running. The business help plan may take the form of business debt consolidation or business debt settlement, or a combination of both, depending upon the individual situation created by the business and its creditors. The debt management consultant will negotiate with the business creditors to develop a new payment plan that is tailored to a budget that is based upon the business assets. Often this payment plan will be accompanied by an interest rate that is reduced for some or all of the payment period.

The business debt management plan will certainly involve collecting at least a part of the debts owed to the business as well as paying those owed, over time. The consultant may offer quite generous terms to the clients who owe your business to recoup some payment assets. The business debt management consultant will put your creditors minds at ease and will institute a plan that will ensure payment in full of the business debts. Most importantly, the business help that you will receive from the business debt management firm will return your focus to the details of growing and maintaining your business, where it belongs.

Check these links to learn more:

CuraDebt.com - US Residents only

===================

About the Author

Debbie White is a contributing writer to http://www.curadebt.com and is currently writing some special articles to guide businesses on how to manage debt and avoid bankruptcy. For Business Debt Information and Debt Help Consultation,

call toll-free 1-877-850-3328. U.S. Residents ONLY

Comments (0)

CMA Blog Home

Eliminate Your High Interest Debt by Marie Megge

Monthly credit card payments have recently skyrocketed, which has resulted in millions of people looking for some type of debt relief.

While consumers struggle to make even their minimum monthly payments, issuers of credit cards are realizing all-time record profits. For instance, credit card companies earned a staggering $90.1 Billion in profits from interest charged to consumers during the year 2006. What's worse is that these same companies earned $55.2 Billion in fees charged to their customers, such as over-limit fees and late fees.

If you're a consumer contributing to these ridiculous profits through high interest credit card debt, and you're struggling to meet your monthly financial obligations, it's time to reassess your current situation. I recommend that you gather all of your credit card bills and carefully review each statement. You'll want to determine exactly how much interest and/or fees are accruing on your accounts each month. After doing so, you should be able to have a clear understanding of whether or not you can realistically pay off these debts in a reasonable amount of time, and eliminate some of the interest you're paying. For a free Credit Card Interest Rate Worksheet, visit the following link: www.donaldsonwilliams.com/Credit_Card_Interest_Rate_Worksheet.html.

This simple worksheet will help you clearly review your finances and determine if you're being strangled by high interest.

If you find that your current credit card debt is nearly impossible to pay off through regular monthly payments to your creditors, it's time to seek help. The following solutions have helped many people to eliminate their debt:

It's time to take action now so that you can realize a debt-free lifestyle and eliminate your concern and anxiety due to money concerns. I wish you the very best in your endeavor to eliminate debt and concern.

About the Author

Marie Megge is a consultant in the credit services industry. Over the past several years she has assisted many individuals in resolving their debt-related matters. For more information regarding credit and debt visit http://www.donaldsonwilliams.com

DISCUSS Eliminating High Interest Debt HERE:

Discuss credit cards here:

Apply for a Canadian Credit Card here:

Comments (0)

CMA Blog Home

IS GETTING A CAR LOAN TO FIX BAD CREDIT A GOOD IDEA?

Can you get a car loan when you can't even pay your monthly bills?

What Gary did is the worst thing possible to do. He lied on his credit application. And from the sounds of it, the car dealership recommended that he lie about his financial information.

This video is U.S. based, however, the same ads to help build your credit by getting a car loan appear in the newspapers in Canada.

The reason this guy has bad credit in the first place is because he's very interested in cutting corners. He's willing to lie about his financial situation to get himself a new car which he can't afford in the first place.