Canadian-Money-Advisor.ca BLOG

The Bankruptcy of Chrysler Nearby; Fiat Also Visiting With General MotorsI was listening to a commentary on CBC this morning that talked about Chrysler declaring bankrutpcy. They were mentioning that the bankruptcy is almost certain.

What I thought was interesting was this: If Chyrsler declares bankruptcy, then it may shed some light for General Motors as to what they need to do. There are alot of questions right now as to what would happen if the big car company declared bankruptcy. There are really no answers. There is no way to talk about this topic as it's unprecedented.

Sometimes the only way to learn about something is to do it.

If General Motors is closing down plants for 9 weeks, to use up their current supply, that really says what the automobile sales climate is like.

I just purchased a brand new car (Hyundai Accent L), and it was manufactured back in November 2008.. This means that it had been on the lot for six months. At that point, you can see that with inventory stocked up like that the car companies are cash strapped, to say the least.

So.. is bankruptcy looming for Chrysler and General Motors? Probably. I think the public is getting used to the idea. And that will make it easier for the politicians to decide.

There is so much of a glut of cars right now... it just says that there is ample supply available. There isn't room enough for these big car makers.

MediaPostNewsThe United Auto Workers union would end up owning a substantial shareholding in Chrysler LLC Chapter 11 under a bankruptcy protection plan that the automaker is expected to present next week, Jeffrey McCracken and John D. Stoll and Stacy Meichtry report. The deal lets get rid of some liabilities, allowing Fiat to cherry pick the operations you want, if an agreement is forged sources.

For its part, Fiat has begun talks with General Motors about joining forces in Europe and Latin America, say the sources. The Italian company could close the purchase of a stake in GM Opel. But GM did not try to go forward until the plans are settled with Chrysler Fiat. Fiat has said it wants to have an initial 20% stake in Bankrupt Chrysler.

In either case, it would have a major impact on the automobile supply chain of car dealers, parts and others, as well as the worsening economies of the midwestern states.

However, both Fiat car company and the administration say that President Obama could prevent the bankruptcy of Chrysler if an agreement can be reached with the banks in question. "In a huge and complex negotiation like this, everything is speculation and up in the air until there is an agreement," said one administration official.

Comments (3)

CMA Blog Home

How Bernie Madoff did his scandolous deeds - in JailIt still amazes me to read this story. Thinking of all of the people who were affected by the Madoff Scandal.. When you thinking of companies like general motors and chrysler who are affecting miillions of people. This scandal is small in comparison, however, it still affects a widespread amount of people.

CNN.com The employees were transfixed. Standing in the middle of Manhattan commercial flooring Bernard L. Madoff Investment Securities in late 2007, half a dozen staff members looked at the ceiling-mounted TV and CNBC aired a report on the mysterious death of Palm Beach, a hedge fund manager who was leading a double life. The police, apparently, even considering the possibility that he had been murdered. "Bernie Madoff," someone asked casually Bernard Madoff like to walk, "you've heard of this guy?"

Madoff a look at the screen, bleached, and exploded: "Why the hell would be interested in stuff like that?" The employees retreated. "I never saw him like that before reacting," Madoff said a trader who witnessed the explosion. "It's obviously affected a nerve."

0:00 / 2:48 Minnesota Madoff mess

That loss of control was very out of character for the head. But traders did not know at the time it was extremely Madoff develop a second life is two floors below them, one is to build an epic, and the inevitable explosion. Took a special pass to enter the "back office" in 17, which was making its Madoff $ 65 million Ponzi scheme. And even if a person can go in, there was not much to see: an old IBM computer server maintained in a locked room, the piles of trading states, and a staff of about 20 employees and paper pushers.

In retrospect, of course, there are indications, such as research has found fortune. IBM's server, for example, an AS/400 dating from the 1980s, it was so old that some data had been entered into the hand, but refused to replace Bernard Madoff. The machine - which has been autopsied by the government - is the nerve center of the fraud. The many thousands of pages of statements showed that his trade was never made.

Then it was the man who led the floor, Frank DiPascali, Bernie Madoff deputy chief of staff the 17. He was a veteran of 33 years of the related company, with a heavy accent and a Queens high school, but nobody was quite sure what he did or what his title was. "It was like a ninja," says a former trader at the legitimate operation above. "The whole world knew he was a great thing, but it was like a big shadow."

There are other mysteries, as we shall see. But even after the large detonation of five months in a brilliant fireworks display of betrayal and recrimination, Madoff plan - possibly the biggest investment fraud in the country's history - has remained among the most difficult to penetrate. More commonly, white-collar cases begin with a quiet, behind the scenes of research, followed by a series of transactions with younger employees, who are squeezed by lawyers and prosecutors to cough up details about their superiors. Step by step, prosecutors move up. Finally comes the denouement: the ringmaster hauled to court in securing handcuffs.

But Bernie Madoff all aspects of the traditional narrative that has been reversed. The case began with flabbergasting his confession, which was outside the investigation. Bernie Madoff argued that all crimes committed by himself, but because it covers decades and continents, a cloud of suspicion immediately plunged Bernie Madoff family members who worked at the company, as well as employees and business associates.

Now that the fog may be about to lift. Fortune has learned that Frank DiPascali is trying to negotiate a plea deal with federal prosecutors in which, in exchange for a reduced sentence, disclosed the encyclopaedic knowledge of the plan Madoff. And unlike his boss is willing to DiPascali names.

According to a person familiar with the matter, DiPascali has no evidence that Bernard Madoff other family members were involved in fraud. However, he was prepared to testify that he manipulated false returns on behalf of some major investors Bernard Madoff, including Frank Avellino, who used to run the so-called bottom feeding, Jeffry Picower, whose foundation was closed because of related Bernard Madoff losses, and others. If, for example, one of these clients had large gains in other investments, which would DiPascali, which produce a loss to reduce the tax bill. If true, this would mean that investors knew their statements fish. (Lawyers and Picower Avellino declined to comment. Marc Mukasey, DiPascali counsel, said, "We expect and encourage a thorough investigation.")

The emergence of this potential star witness can be on the case scenarios in their heads: Some people widely assumed by the public which has been implicated in the fraud may not have been, and a small group of investors that Bernard Madoff seemed innocent victims can not have been totally innocent, after all. But then, some things about the life of Bernie Madoff become what they seem.

Comments (4)

CMA Blog Home

I've been slow posting lately.I thought I would pop my head in a little today. I've been working a little slowly on the site here... My wife has been pretty ill and It's a stressful situation.

I will probably do some posts as my energy permits... and also, I am working on a few other projects that I need to get done.

So... Hopefully I'll be at it in the next few days.

Comments (2)

CMA Blog Home

The Necessity of Building Emergency FundsDo you have a financial emergency due to a job loss? Or do you have a medical expense that will significantly affect your finances? Almost everyone has a financial problem and the route that the recession is taking has compounded loss and depression. It's definitely time to reserve the cash flow and save up for emergency funds that has been depleted with the falling dollar, gas hikes and the weak economy. So what do you do when it comes to a matter of saving? The best way is to get creative and think of ideas and ways of how you can save money and stash it away as your emergency funds.

Maybe it's easier said than done, but there are secret routes to saving up emergency funds. You could also involve your children so that they are aware of finances and the nuances that are attached to it. You could draw your children into the circle of awareness by paying them money for a job done or collecting money from you as a fee for late payment. No doubt this would transform your emergency saving into an expense but the children will definitely get the idea that money is precious and needs to be conserved. You can also add on an imaginary 10% to the price of your purchase and then save the money. This would not only help you save some money, but it would make you prudent about spending and adding to expenses.

How to Save for a Rainy DayThere are many ways that can help you to save up for emergency funds. You keep a coin box and collect all your coins, which, in actuality is a very handy thing when you need money or you can collect five dollar bills. This really helps when you save money and adds to your emergency funds. Instead of the usual price that one pays for gas, you could add a dollar more and pretend that it is really a dollar extra. This will help you to put that extra dollar into your

emergency funds. You could sell all the unwanted things around the house and though you may have more than a few bargaining about the price, this method will add to your emergency funds. You could save gas money by buying all the groceries and other commodities that you may need in one trip. Instead of driving many times to the supermarket, you could take a walk that would help you save money as well as improve your fitness regime. Another way is to get a credit card that offers a good reward program. As soon as you get the rewards, pass it on to your emergency fund.

It is necessary to keep aside about three to six months of emergency funds that would cover payments. This would come in useful if you or your spouse loses a job or if any undue expense crops up. You can set targets and goals as to how much you would like to save in a given period of time. You can start small and then get used to doing without that money. Start a savings account or certificate of deposits (CDs) or a money market account. See that you get considerable interest for your savings, but make sure that you save your emergency funds in a place that would be accessible and not blocked when you need it the most.

Be Prudent and Creative about Saving Money

Comments (3)

CMA Blog Home

Unprocessed Food is Cheap - HealthJust recently we've been trying to help my wife's health get better. Along with the chemo that she is doing, she also wants to eat healthy, do juicing etc.

I went to the store the other day and purchased a bunch of fresh vegetables that we're going to put through the juicer.

I filled up my basket and it was quite heavy. When I went through the check out, the bill only came to $27 !!

All of the vegetables that are recommended for my wife to eat to help fight cancer, was the cheapest foods of all. In my mind that means that I should be eating them as well.

For a very healthy diet that floods your system build up... you need fresh fruits and vegetables. Because we're juicing them, we're going through alot more than usual.

I purchased a 50 pound bag of carrots last week and it cost $25 for the bag. That's pretty reasonable. The bag has lasted us the better part of a week... and we're eating alot of carrots.

We didn't get recommendations to eat processed foods, sugary foods and deserts etc. These are costly and also aren't really recommended as cancer fighting foods.

BTW... cancer loves sugar.. sugary processed foods are BAD if you're trying to fight cancer. Something I learned recently.

I thought I would do a short post to say that unprocessed fruits and vegetables are really cheap. Ultimately they are the best food for you. The down side is that they take a little longer to process.

It goes to show that the best things in life are usually free or much less expensive.!!

Comments (3)

CMA Blog Home

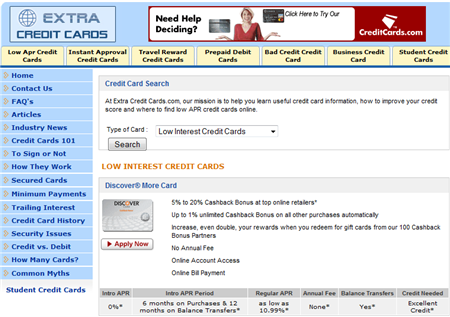

Low interest credit card - U.S. websiteI was asked to do a review for a credit card website that features American credit cards

Sometimes it's good to see what the "other guys" are doing.

This site allows you to search for low interest credit cards, secured credit cards, student credit cards and more.

The thing that's different about the U.S. credit card websites is that they show many of the banks' credit cards. Unlike Canadian banks which don't have affiliate programs for their credit cards.

This site has many different articles about credit cards which are things you need to know if you're going to carry credit.

The main thing you want to do if you're shopping for a credit card is look at rates and the other costs to own the credit card. It's all about the cost of credit. If you can find a better deal and save money, just by spending some time shopping, then it's really worth it. Sometimes you can save hundreds just by getting the lower interest rates.

And it's safe to use a site like this. All of the links follow back to the banks website, and the credit card issuers sites are always secure.

If you need a secured credit card, low interest credit card, student credit card etc.. and you live in the U.S... this is a good site to visit. It's got a clean look, has credit card comparisons and you can sort the credit cards by type.

This is a sponsored review

Comments (2)

CMA Blog Home

this is a great video that talks about the debt situation in Canada.

I like the fact that the commentator puts the blame for the too high level of credit squarely on the consumer. We need to take responsibility for the amount of debt that we're in now..

Nobody forced the consumer to buy , and take on more credit.

Currently the Canadian consumer has $1.3 trillion in consumer debt, this includes mortgages

I like this second video as it gives an actual example of a lady who's quickly accumulated $10,000 in debt. The industry calls her a revolver, as she can't pay off her balances completely.

Credit card companies like revolvers as that's how they make their money.

This lady has figured out that "perhaps the credit card companies want you to carry balances!!"

Comments (9)

CMA Blog Home

Debt Settlement - You don't have to pay your debts??!!Just going through youtube looking interesting things that people say..

This guy starts off by saying... "you don't have to pay your bills"

This makes me crazy. This guy is suggesting that you shouldn't pay your bills/debts especially if you owe $25-$100,000 on credit cards.

He mentions that you should be using the interest that you're paying the credit card companies to save up for retirement.

This is LUDICROUS

The following is what this guy is explaining on the video

He starts off by explaining you should just not pay your bills for six months.. This will start the collection process. You can then negotiate with the collection agency at 10% on the dollar.

Part of the negotiation is that the credit bureau wipes any negative debt notation off of the credit bureau.

So... after 6 months, you'll have a nice squeeky clean credit report, and no debt.!! Wow... this is fantastic!! Or is it?

There are so many assumptions in his discussion that they need to be addressed.

Also it's important that this type of service is for U.S.A. (Americans) only. This system isn't going to work the same in Canada.

I complete disagree with not paying your bills for the sake of getting out of them. That's the cowardly way to do this. This type of logic will erode the social fabric of our society.

IF YOU CAN, PAY YOUR DEBTS

If you've got alot of debt, and can afford to make payments, then you should pay for your debts as agreed. After all, you made all of the purchases that incurred the debt!

The only exception in my opinion is if you've got health issues, and your debt is making your health worse. Then it's time to seek debt settlement or bankruptcy help.

THE CREDITORS MAY SUE YOU

If you owe $25,000 -$100,000 then the creditors may sue you in Canada. This is worth going after in the courts. Don't assume that you can automatically settle you debts after not paying them for six months.

THE CREDITOR DOESN'T HAVE TO REMOVE BAD MARKS FROM YOUR CREDIT REPORT

This fellows assumption is that you can have the creditor or collection agent remove negative items and comments from your credit bureau, as part of the payment negotiation.. While some may do this, some may not do this.

It all depends.

CREDIT REPORT ITEMS MUST BE ACCURATE, COMPLETE AND VERIFIABLE.

Are you going to walk away with no debt and squeeky clean credit after the creditors and collection agencies write off your debt? More than likely not.

Why would the banks want to remove negative items. This sends a false message to other creditors that you've got good credit.

Again, you could ask to have negative items removed from your credit bureau, however, there is no law / motivation for the creditor to do so.

In my opinion, this is a shifty way to deal with your creditors.

If you've had a high consumption lifestyle, then you should pay for it, as agreed to when you took on the credit facilities.

If it takes you 10 years to pay off your credit cards, then so be it. After 10 years, you'll have learned your lesson about the effects of spending too much on your credit cards.

There are always exceptions to the rules, but in the case of North American consumers.. I think we're all guilty of over consumption.

Comments (2)

CMA Blog Home

Peter Schiff on Youtube. - He's Right about the economyI like to watch Peter Schiff. He's usually pretty straight forward and understands the fundamentals of the economy.

Sometimes it's important to understand what's going on in the economy to know what we should be doing individually.

When you see the whole nation suffering from too much debt, and not enough savings, then you can see what the effects are overall.

This should tell people what they need to do in their own personal finances.

Peter Schiff is good to point out items in the economy that are going to affect everybody on the overall.

Learn more about the Canadian coin and the Canadian Economy

I recommend that you check out Peter Schiff's channel on youtube, if you're interested to know what's going on in the economy.

Ultimately it gets back to this.. low debt and high savings will save any economy. Not giving in to instant gratification like we have done for the last 20+ years.

It's also good to invest in R&D so that our country can be profitable and competitive in the future.

I think this economy is going to stay like this for a while until people get the idea and decide to really get on with fixing their balance sheets.

Comments (1)

CMA Blog Home

Mortgage Crisis - The bank's Fault? - or the Consumer?I was reading a blog that said that the mortgage crisis is the bank's fault. I can't believe that somebody would seriously write this in a blog.

Let's see.. the definition of a Consumer, is somebody who consumes. Nobody put a gun to the consumer's head to buy. They all did so willingly.

There were no laws passed that said that the consumer HAD to buy houses, cars or consumers items.. they did so willingly.

IMO... if a person buys a house, they should understand whether or not they should be able to finance the property.. If you don't understand the contract, then hire a lawyer (or somebody trained in contracts) to help you understand the fine print.

I'm very surprised that the media is saying that the homeowner got duped by the mortgage companies.. That's ridiculous. That's putting the blame in the wrong place..

Buying a house for $250,000 is a big purchase. It deserves a great deal of attention, to understand the costs involved. A house has current and future costs.. A mortgage has current and future costs.

BUYER BEWARE: If you don't take the time to understand the costs involved, then you are at risk for making an expensive decision.

Here's what I would recommend to anybody buying a house.

- Learn how much the house & Utilities will cost

Take the time to gather all of the current utility bills, tax bills etc for the house you're looking at buying. See what the costs are.

There are also down payment, closing costs, inspection costs etc with the mortgage.

If you're clear on the costs, then there won't be surprises later on.

- Learn and understand the mortgage contract

Contacts are not easy to understand. You should NEVER sign a contract that you don't fully understand. Doing so means that you're vulnerable to whatever you agreed to.

If you're not sure what the contract language means, ask a lawyer. This is a cost of due diligence. If you need to save up additional money to afford the lawyer, then take the time to do so.

Ask the lawyer what the fine print means, and what are the things you should watch out for.

A lawyer is trained in legal speak and will be able to give you advice that the mortgage company may not come forward with.

- Learn about the fees and future/renewal costs of the mortgage.

This is something you should also ask a lawyer. What are the hidden fees, if any? What are the fees should you decide to refinance, or sell the property?

You might just ask the lawyer to itemize all of the potential costs that the contract holds.

This may cost a few hundred dollars, but the lawyers analysis could save you a ton of hard ship in the future.

I don't believe for a second that the mortgage crisis is the bank's fault. It's not the mortgage companies' fault. It's the consumer's fault all the way. They made the choice to buy the houses in the first place.

Each and every consumer who got involved with a toxic mortgage made the decision to do so. They could have known what the costs were before they took the mortgage. They could have insured for mortgage with critical illness insurance, and life insurance..

There's enough information in the market place to make an informed decision. If the consumer DECIDED NOT TO TAKE THAT INFORMATION, it's their fault!

Comments (1)

CMA Blog Home

Consumerism Withdrawal - Do you suffer from it?This is one problem with the economic downturn that I thought of. Consumerism Withdrawal.

The premise of the economy for the last 20 years has been consumption. Living the American dream. People have done a pretty good job spending, and consuming.

There have been many posts in the blogosphere where people explain that they're going to cut back spending and go on a spending diet. They talk about how they're not going to go shopping for a month, or not buy anything on credit for the next three months. Ultimately with those posts, I just roll my eyes, and wonder about their resolve.

Once you've tasted luxury and spending, it's hard to give it up.

With all of the lay offs and the credit crunch that we're experiencing, I'm sure that many people are suffering from consumerism Withdrawal.

This is more like being forced to go on a diet because of food shortage. In this case, credit is tight, and people have overspent.

If you're suffering from consumerism withdrawal, there are a few things you can do to help the situation:

- Learn to enjoy life with what you've got

The problem with consumerism is that we're always looking for the next big toy, or the next fashion. We're satisfied for a small time with what we've purchased. Much of what people have purchased is to satisfy wants and not needs.

The best thing to do is to learn to appreciate what you've got already.

That's a pretty hard thing to do, if you're used to a constant diet of new things all the time.

I've found that I really only enjoy a few of the possessions that I own. the rest are just sitting in a closet doing nothing.

Enjoying what you've already got, means that you won't need to spend any money on goodies.

- Take the time to strengthen your balance sheet

If we're going to be in a recession for the next year or so, why not take the time to pay down debt and save up some money.

This is really not fun, and it's pretty boring, compared with shopping all the time for the latest gadget.

My thinking is this: if you've got money saved up, and you're not in debt,

you'll sleep better, and won't need to go through withdrawals at the retail store.

Having some money saved up, means that you'll be able to go into the store and make some moderate purchases, based on your available cash.

Buying things with cash will give you a little taste of having something new, without the pains of paying down credit later.

- Take the time to enjoy the free things in life: family and friends.

I've gone on a cash diet for the last few years, by choice. In doing so, I've learned to really enjoy free things. Going for a walk, visiting with a friend. I enjoy looking at flowers more.

There are many things you can do for free. Sometimes we look at these FREE things as boring and unexciting. If you're used to hyper spending at the stores and for entertainment, then going to the museum would probably be boring.

If you detox off of the sugar rush of retail spending for a few months, perhaps the free things in life will start to look good again.

Yes, that's what I'm saying.. hyper retail spending using your credit card is like eating alot of refined sugar products. They taste great, give you a sugar rush for the moment, and then give you a big let down afters. You get addicted to sugar, and retail shopping for the buzz it gives you.

The free things in life are more wholistic. They're not as exciting, but they are better for you in the long run.

I see Canadians and Americans going on a consumerism diet for the next year or so. Let's take the time to get back into shape financially and as well, start to enjoy less expensive more healthy activities again.

Comments (0)

CMA Blog Home

Are we NOW happy with Less? - The EconomyThe other day I was chatting with my son, Alex.. He deleted his facebook account, and is cutting out other instant messaging type programs that's he's grown up with.

I was curious about why he would give up facebook.com especially because this type of program is meant for his generation.

He indicated that he's grown up with internet, video games, TV, cell phones. He's getting tired of all of the programs and software that replace human interaction.

I was intrigued by this.

Growing up in the 60's and 70's, we didn't any of these modern tools and conveniences and toys. Nowadays.. the kids are flooded with them.

The Point is:

North Americans have had 20 years of free spending. We've bought what ever we've wanted, and are now slaving away to pay for the credit cards we used. We've had 20 years of endless consumption. We know what consumption is. We know that we can get what ever we want if we work hard enough for it. Learn more about capital gains

We've been there, done that!

I'm just wondering if people will be content to sit back and take a break for a while, consumption wise. This would be hazardous to the economy.

Consumers need a rest. I'm sure alot of people are suffering burnout from trying to make payments on all of their debts. The satisfaction of getting that new 52" TV is gone, especially because many people have already purchased one and had that experience.

My question is:

As my son is tired of all of the new gadgets that he's been bombarded with his whole life.. are consumers tired of being in the buying / paying off cycle? Are consumers going to want to take a break from being on a continuous spending spree?

An even more intriguing question:

Are consumers going to be HAPPY with less?

I don't mean "are they going to suffer, and put up with less?".

I mean, "are they are actually going to be happier with less stuff, less debt payments, less noise in their lives?" These are some thoughts I've been having lately about the economy. If people are happy with less, then that will spell bad news for the current economy that relies heavily on consumer spending!

Comments (8)

CMA Blog Home

American Express Credit Cards for Canadians

One of the main reasons you would use an online service to sign up for an American Express credit card is so that you could know right away if your credit card application had been accepted or rejected.

That's a major concern if you've been building up your credit history or if you're just starting off with your credit history etc.

Read More about: Canadian American Express Credit Card offers

The American Express Canada online application service will let you know if you've been accepted or rejected within 60 seconds.

American Express Air Miles American Express Air Miles

Many years ago when credit cards first came to the web, it was a novelty to see if you could be accepted right away. Here are some suggestions to keep in mind if you're applying online for an American Express Canada credit card.

Get a copy of your credit report from TransUnion Canada to know where your credit score is . Your acceptance and the time it takes you to be accepted / or rejected is based heavily on your credit score with your TransUnion Canada credit report.

Calculate your yearly income. For example, American Express's Air Miles card requires a minimum of $15,000 per year income.

Keep a record of your your history and how long you've been at each job.

Do you own or rent your home?

Do you have other assets?What a creditor is really interested in knowing is your credit history and your capability for making repayments.

As you'll find discussed on this website, many people try to establish a relationship with the credit card company without knowing what the credit card company really wants.

If you've got bad credit, more than likely you won't be accept for a credit card with American Express Canada. If you've got border line credit history, it is probably worth it to do some research on your personal situation to see if you'll be accepted or not.

Currently I don't have the magic "credit score level" for which American Express Canada will accept people. I'll do a little more prying on that.

Keep in mind, everybody's situation is different. I've talked to people who have perfect credit but have bad credit scores, for example. (I've also talked with many people who have bad credit and low credit scores ;-) )

There are many different factors that go into the calculation of deciding if American Express Canada is going to give you credit or not. Offering credit cards to clients who are unknown and unseen makes their job even more difficult.

It is important to remember that, if there are questions about your credit application that you did online, American Express customer service reps will help you to understand why you weren't approved. Don't hesitate to call them and ask them about your situation.

Visit this link To apply for your American Express Canada credit card

Comments (0)

CMA Blog Home

COLLECTION AGENCY PAIN - AGAIN

I thought I should post this on the main page to get it out in the open a little more. Total Credit Recovery the renegade collection agency called my office and in essence told me that my old employees are in collections.

I would appreciate hearing from anybody who has had a collection agency call them at their office. To me that breaks all of the rules.

If this happens to you, please complain about it to the Federal Privacy Commissioners office

I got a call at my office from Total Credit Recovery today looking for an old employee.

The message went something like this:

"Hi, this is (the collection agent) from Total Credit Recovery in Vancouver and I'm calling for (old employees name) and her spouse.

Please have (old employees name) contact me at this number."

Do I as an employer want to know about my employees collection agent activities? I can't believe that the collection agent mentioned the spouses name as well..

In my opinion that is a huge breach of the PIPEDA

Comments (0)

CMA Blog Home

Carte Am?ricaine D'Or De ** D'Express? AeroplanPlus?

Gagnez jusqu'? ? 25% plus de ** Miles1 d'Aeroplan?.

5.000 milles d'Aeroplan comme bienvenue Bonus4

Aucun Pr?r?glez La D?pense Limit5

Avantages d'assurance multirisque , incl. Vol De Location De Voiture Et Damage6?

les honoraires $120 annuels * et lib?rent les cartes suppl?mentaires d'or

Recevez 1 mille d'Aeroplan pour chaque dollar de purchases2 charg? ? la carte jusqu'? $10.000 et un total de milles 1,25 d'Aeroplan par dollar sur d?penser plus de $10.000 annually.3 gagnent plus rapidement. Obtenez Plus ?troitement.

* Comme carte de client?le, l'?quilibre doit toujours ?tre pay? enti?rement chaque mois. le taux d'int?r?t annuel de 30% s'applique aux ?quilibres non pay?s enti?rement (0,0822%).

1. La comparaison est entre la carte American Express d'or d'AeroplanPlus et la carte American Express d'AeroplanPlus. 2. Le compte doit ?tre dans la bonne position. Des milles d'Aeroplan seront gagn?s sur la quantit? d'achats, de moins de cr?dits et de retours. Les frais de finances, les honoraires annuels, d'autres honoraires, et les frais pour des ch?ques-voyage et des devises ?trang?res ne sont pas des achats et ne qualifient pas des milles d'Aeroplan.

3. Tous les ans, si vous atteignez $10.000 dans les achats nets sur votre compte avant votre date d'anniversaire, vous gagnerez les milles 1,25 d'Aeroplan pour chaque $1,00 sur les achats additionnels charg?s ? votre carte. Chaque date d'anniversaire, la quantit? de filet annuel ach?te des remises ? z?ro.

4. Seulement le Cardmember de base est habilit? ? la bonification bienvenue. Veuillez accorder jusqu'? six semaines pour que la bonification bienvenue soit attribu?e. Cette offre ne peut pas n'?tre combin?e avec aucune autre offre.

5. Vos achats sont approuv?s bas?s sur une vari?t? de facteurs, y compris votre disque de cr?dit, histoire de compte et ressources personnelles. La preuve des ressources et de la s?curit? peut ?tre exig?e.

6. Garanti par Royal & Sun Alliance Insurance Company du Canada. Il y a des conditions sp?cifiques aux lesquelles appliquez qui peut louer et conduisez le v?hicule de location, la longueur du rental(s) et le type de v?hicule couvert. Veuillez lire votre certificat d'assurance soigneusement comme il contient des limites, des limitations, des conditions et des exclusions sp?cifiques qui peuvent affecter votre assurance. Les r?clamations de carte d'or d'AeroplanPlus d'American Express sont sujettes ? des $100 d?ductibles.

le ? toute l'assurance d'assurance est sujet aux modalit?s et aux conditions des politiques principales respectives. Les certaines limitations, exclusions et restrictions s'appliquent. Veuillez lire les certificats de l'assurance soigneusement.

?: utilis? par Amex Bank du Canada sous le permis d'American Express Company.

le ? * *: Aeroplan et AeroplanPlus sont des marques d?pos?es enregistr?es d'Air Canada, utilis?es sous le permis.

--------------------------------------------------------------------------------

CARTES DE CR?DIT EXPR?S DE L'CAm?ricain CANADIEN AEROPLAN AU CANADA

Les cartes de cr?dit d'American Express canadien sont une certains les cartes de cr?dit identifi?es les plus anciennes et meilleures au Canada.

L'American Express a offert leurs ch?ques-voyage American Express pour bien au-dessus d'un si?cle. Les ch?ques-voyage d'American Express sont synonymes avec la s?ret? et la s?curit? quand elle vient ? votre argent quand voyageant.

Les cartes de cr?dit de m?me American Express sont mondiales bien connu. Ceci signifie que vous aurez une carte de cr?dit bloqu?e s?re quand vous voyagez ? la maison ou ? l'?tranger.

NOUS SOMMES HEUREUX D'OFFRIR ? L'CAm?ricain SUIVANT LES CARTES DE CR?DIT EXPR?S: CARTES DE CR?DIT EXPR?S DE L'CAm?ricain AEROPLAN POUR LE CANADA MAINTENANT DISPONIBLE DANS LES PROVINCES CANADIENNES SUIVANTES

Alberta Alta

Colombie Britannique

Manitoba

Le Nouveau Brunswick

Terre-Neuve Labrador Nfld

Territoires Du nord-ouest N.w.t. et Nunavit

La Nouvelle-?cosse

Ontario Ontario

?le Prince Edouard P.e.i.

Le Qu?bec Que P.q.

Saskatchewan Sask

Yukon

MONTR?AL TORONTO CALGARY VANCOUVER EDMONTON WINNIPEG MISSISSAUGA QU?BEC REGINA YORK DU NORD

--------------------------------------------------------------------------------

Ce qui suit sont certaines des villes au Canada o? vous pouvez commander votre carte de cr?dit American Express d'airmiles:

MONTR?AL

TORONTO

CALGARY

VANCOUVER

EDMONTON

WINNIPEG

MISSISSAUGA

LE QU?BEC

Regina

YORK DU NORD

VICTORIA

LONDRES

OTTAWA

SASKATOON

SCARBOROUGH

HALIFAX

KELOWNA

RICHMOND

HAMILTON

BRAMPTON

WINDSOR

Ottawa-coque

ETOBICOKE

LAVAL

SURREY

BURLINGTON

Saint-laurent

BURNABY

OAKVILLE

THORNHILL

DARTMOUTH

KITCHENER

COMPARTIMENT DE TONNERRE

COOKSVILLE

MARKHAM

SHERBROOKE

MONCTON

CERFS COMMUNS ROUGES

VANCOUVER DU NORD

ABBOTSFORD

GUELPH

PRINCE GEORGE

Sainte-foy

BARRIE

SUDBURY

SAINT JOHN

RUE JOHNS

FREDERICTON

KINGSTON

LONGUEUIL

CHICOUTIMI

LANGLEY

Comments (0)

CMA Blog Home

CARTES DE CR?DIT EXPR?S D'CAm?ricain CANADIEN CANADA

AIR Am?ricain MILES? * Carte de cr?dit D'Express?

Une mani?re RAPIDE et FACILE de rassembler des MILLES d'cAir r?compensent des milles.

Aucuns Honoraires Annuels

100 milles de r?compense la premi?re fois que vous employez votre Card2

1 mille de r?compense pour chaque $20 dans les achats a charg? ? votre Card1

3,99% sur des transferts d'?quilibre pour les six premiers mois de l'adh?sion de carte, si votre compte est et demeure dans bon standing3

La carte de cr?dit American Express de MILLES d'cAir est la seule AUCUNE carte de cr?dit d'cHonoraires qui gagne 1 mille de r?compense pour chaque $20 dans les achats charg?s ? votre Card1. Le plus, avec l'avant du divertissement de Line?, vous recevrez l'acc?s pr?f?rentiel ? une partie de plus cherch? apr?s les concerts, le th??tre et les ?v?nements sportifs ? travers le Canada.

1. Le compte doit ?tre dans la bonne position. Des milles de r?compense de MILLES d'cAir seront gagn?s sur la quantit? de tous les achats ?ligibles, de moins de cr?dits et de retours. Les avances de fonds, les frais de finances, les transferts d'?quilibre, les honoraires annuels (si c'est appropri?), d'autres honoraires et achats des ch?ques-voyage et des devises ?trang?res ne sont pas des achats et ne qualifient pas des milles de r?compense. 2. 100 milles de r?compense de bonification s'appliquent seulement pour l'usage du Cardmember de base d'abord de la carte. Les milles de r?compense de bonification ne s'appliquent pas pour l'utilisation de premi?re fois du renouvellement, du remplacement ou des cartes suppl?mentaires. 3. Tous les taux sont exprim?s en tant que taux annuels. Voir ci-dessous pour quel taux s'applique aux frais sur votre compte et d'autres d?tails. Des paiements sont appliqu?s aux transferts d'?quilibre apr?s que les fonds avancent mais avant des achats. Veuillez se r?f?rer ? votre accord de Cardmember pour les d?tails complets. Si vous payez vos paiements mensuels minimum ? l'heure, vos taux sont:

3,99% sur des transferts d'?quilibre pour les six premiers mois de l'adh?sion de carte

18,5% Taux r?gulier sur des achats et des avances de fonds

Tout le taux annuel pour charge quand votre compte n'est pas dans la bonne position sera 23,99%

?: utilis? par Amex Bank du Canada sous le permis d'American Express Company.

?*Trademarks des MILLES d'cAir B.v. Used marchand international sous le permis par Loyalty Management Group Canada Inc. et banque de Amex du Canada.

--------------------------------------------------------------------------------

CARTES DE CR?DIT EXPR?S DE L'CAm?ricain CANADIEN AIRMILES AU CANADA

Les cartes de cr?dit d'American Express canadien sont une certains les cartes de cr?dit identifi?es les plus anciennes et meilleures au Canada.

L'American Express a offert leurs ch?ques-voyage American Express pour bien au-dessus d'un si?cle. Les ch?ques-voyage d'American Express sont synonymes avec la s?ret? et la s?curit? quand elle vient ? votre argent quand voyageant.

Les cartes de cr?dit de m?me American Express sont mondiales bien connu. Ceci signifie que vous aurez une carte de cr?dit bloqu?e s?re quand vous voyagez ? la maison ou ? l'?tranger.

NOUS SOMMES HEUREUX D'OFFRIR ? L'CAm?ricain SUIVANT LES CARTES DE CR?DIT EXPR?S: CARTES DE CR?DIT EXPR?S D'CAm?ricain POUR LE CANADA MAINTENANT DISPONIBLE DANS LES PROVINCES CANADIENNES SUIVANTES

Alberta Alta

Colombie Britannique

Manitoba

Le Nouveau Brunswick

Terre-Neuve Labrador Nfld

Territoires Du nord-ouest N.w.t. et Nunavit

La Nouvelle-?cosse

Ontario Ontario

?le Prince Edouard P.e.i.

Le Qu?bec Que P.q.

Saskatchewan Sask

Yukon

Comments (0)

CMA Blog Home

Have you ordered your credit reports

- and credit scores

This is my favorite question: Have your ordered your credit reports from both and TransUnion.

Getting a copy of your credit reports opens a new world of questions regarding what's being reported about your financially.

are the same things as collection agents.

How do i order my credit report?

If you're having problems and getting calls from bill collectors, you may need . You may also need to contact equifax to ensure that your credit report is complete, accurate and verifiable.

Comments (0)

CMA Blog Home

Six Signs of a Winner

Motley Fool - USA

... That inefficiency provides opportunity for us smaller investors. Progressive was never a penny stock trading below $1 per share. ...

Stock Trading Alert for Tuesday, April 25th

Market Wire (press release) - USA

... ZIXI closed Monday's regular trading session at $1.33, up 15 cents. Biosite Inc. ... Featuring active message boards for the penny stock trader, rumors and more. ...

Tuesday, April 25th Stock Trading Alert

Market Wire (press release) - USA

... MTNA is currently trading at around 25 cents a share. ... Featuring active message boards for the penny stock trader, rumors and more. ...

See all stories on this topic

Local reporter fined for keeping silent on source

eTaiwan News - Taiwan

... court for information in court trials of criminal cases according to the existing law, especially in cases that involves the fairness of stock trading and the ...

See all stories on this topic

TSE reports record earnings on vigorous stock trading in 2005+

TMCnet - USA

said Tuesday vigorous stock trading allowed its group net profit and operating revenue in fiscal 2005 to reach their respective highest levels since its ...

See all stories on this topic

Comments (0)

CMA Blog Home

When Worlds Collide

Gold Seek - USA

... what such circumstances can do to the stock market in 1987 ... Taking this analysis back further in time, past the ... of the current fiat currency system has produced ...

Pill Pushers

International News Service - Sydney,Australia

... Schering's stock-market value approached $90 billion by mid ... have plenty of ways to game the system. ... Another analysis, in Archives of Internal Medicine, tallied ...

Comments (0)

CMA Blog Home

Media protests fines for reporter refusing to reveal source ...

China Post - Taipei,Taiwan

... news reports was allegedly used as a tool by Lee's stock-trading friends, who have ... issue of press freedom and the operation of the country's democratic system.

DST Systems, Inc. Announces First Quarter 2006 Financial Results

Yahoo! News (press release) - USA

... were received from the taxable sale of our portfolio accounting system business to ... ended March 31, 2006 as a result of DST's common stock trading above 120% of ...

CME net jumps 29% on rising volumes

MarketWatch - USA

... CME said trading on its CME Globex electronic trading system rose 31 ... Separately, electronic stock trading platform TradeStation Group Inc said Tuesday its first ...

Comments (0)

CMA Blog Home

RSA Security Acquires PassMark Security; Extends Leadership in ...

MSN Money - USA

... the prior 30 days' closing stock price as quoted by the NASDAQ Stock Market). ... transaction; and a voice-based biometric authentication system -- that identifies ...

See all stories on this topic

Sy offered P95 for EPCIB

Manila Standard Today - Philippines

... the mystery buyer to hype the price of the bank’s shares in the stock market. ... out when other shareholders of the bank, like Social Security System, BdO and ...

See all stories on this topic

HOSTILE TAKEOVER - the CORPORATE CONTROL OF SOCIETY AND HUMAN LIFE

OpEdNews - USA

... I wrote a recent heavily documented article about this called the US Gulag Prison System. ... what they wanted, and it set off the high tech stock market boom that ...

Sun Founder McNealy to Step Down as Losses Mount (Update2)

Bloomberg - USA

... to $4.98 at 4 pm New York time in Nasdaq Stock Market composite trading ... He called Microsoft's Windows operating system, which runs about 90 percent of personal ...

Government Accountability Office Report Highly Critical of FDA Is ...

Newsinferno.com - New York,NY,USA

... from the market since 1996 indicates that the system “works,” the ... in pharmaceutical industry profits; (2) cause significant stock market fluctuations; (3 ...

To backtrack cannot revive stock market

China Economic Net - Beijing,China

... to promote the social insurance fund and insurance capital enlarging the direct investing proportion into the stock market; to resume the system that investors ...

Bring back the private investor

Moneyweb - Johannesburg,South Africa

... that they would like to see the return of the individual investor to the stock market. It would give ordinary citizens an interest in the free market system. ...

Photo: Sun News Publishing

Daily Sun - Apapa,Lagos,Nigeria

... to be representatives, representatives of the Nigerian banking stock market as part ... Nigerians with only a fraction in the banking system transacting business ...

Faulty Studies from Center for Justice & Democracy Are Stunting ...

American Enterprise Institute - Washington,DC,USA

... error, and what can we do to make the litigation system less burdensome ... was a modulated version of the 2002 report, which claimed that stock market losses were ...

Good Times, Noodle Salad, and the State

Lew Rockwell - Burlingame,CA,USA

... as we are beginning to experience with inflation, the stock market, housing bubble ... through centrally-planned policies that corrupt the monetary system and skew ...

www.express-stock-investing.com

Comments (0)

CMA Blog Home

L Smith is complaining in this post HBC / Zellers Credit Card about a problem with the Hudson's Bay Company HBC / Zellers credit card.

I thought I should point out to people that HBC (Hudson's Bay Canada) card is a department store card and is not regulated by Provincial of Federal Government as to what they report to equifax and TransUnion.

Unlike Sears and Canadian Tire, The HBC Hudson's Bay company credit card is not a bank and thus is not regulated by the federal banking laws in Canada. HBC Credit card is a department store card, which means that the store itself is granting your credit. This is the equivalent of running up credit with corner store in the old days.

This makes them a little harder to deal with, especially when it comes to disputes on your credit report.

If you're having problems with them, please contact your local Consumer Protection and ask them what they recommend.

WARNING: Be careful when taking out a HBC Hudson's Bay / Zellers Credit Card. If you ever have problems with your payments, they're pretty hard to deal with.

Comments (6)

CMA Blog Home

In the world of internet marketing, online casinos and gambling is one of the most profitable industries right now. People can't get enough of online poker, gambling etc.

For the purposes of financial maturity, I think online gambling is an interesting thing to watch.

For what ever personal reasons people like to gamble at a bricks and mortar casino, they get even more privacy and convenience in the comfort of their own home.

Over the next 5-10 years, I believe we'll see a curve of some sort with relation to online gambling. People are having fun with it now, but they don't realize that it will take months and even years to pay off these "easy and fun" gambling debts.

YOU'RE PAYING 18.99% INTEREST ON GAMBLING DEBTS

The worst part of it is that these online gambling debts are probably charged 99.9% to the consumer's credit card. Thus the credit card companies are charging you 18.99% interest on your gambling debts. That's pretty expensive.

I get a feeling that after doing this for a while, people are going to back off and learn a little restraint. They're going to learn a little financial and gambling maturity!

In the House of Representatives, there is a bill (H.R. 4777)

that was introduced by Representative Bob Goodlatte, of

Virginia. the bill, entitled ?Internet gambling |* Prohibition

Act?, was introduced to the House of Representatives on

February 16, 2006 and was sent to the Committee on the

Judiciary on the same day. the bill is one that, if passed,

will affect all Americans who want to be able to gambling

online?it will affect those promoting gambling |* oriented

affiliate programs too.

The Path

It?s first important to point out that the path of this bill

become official United States law is a long and difficult one.

The bill has to go through many steps in the House first. H.R.

4777 has 129 cosponsors, which is roughly 25% of the

representatives in the House. it does have a good shot at

passing the House in the coming months.

If it passed in the House, it will be sent to the Senate, where

it will have to undergo the same process as it did in the House.

The bill will be sent to a committee, reports will be written

and so forth. If not even one word is changed and no rider is

attached, it will be placed up for vote. Should even one word

be altered or a rider attached, it will need to repeat the

cycle at the House of Representatives.

Should the bill be one of the few that survives this path, the

President will have to sign it into law or veto it. If the bill

does not make it all this way before the current session ends,

the bill is quashed and will need to be re-introduced next

session and start all over again.

The Bill

This main purpose of this bill is to make online gambling

illegal and to make sure the language of the text includes the

Internet and not simply ?phone lines.? H.R. 4777 seeks to amend

Section 1081 of Title 18 of the United States Code. Here?s a

breakdown of the language updates.

1.?wire communication facility? will be replaced with

?communication?.

2.?aid of wire, cable,? will have satellite and microwave added

to the list.

3.?other like connection between? will have ?(whether fixed or

mobile)? added to the description.

4.Adding definitions for: bet or wager, gambling |* business,

money transmitting service, money transmitting business,

foreign jurisdiction, and others.

The bill will amend Section 1081 to be stronger and more

complete. the whole concept is to do away with limiting terms

like ?wires? and replace it with an all-encompassing term like

?communication facility?. That way the law remains strong no

matter what inventions the future holds.

Conclusion

The bill has a long way to go to become law, but if it does, it

will strengthen Section 1081. gambling |* online in the United

States is already technically illegal, but it?s a law that?s

not really enforced. the question remains; will this

improvement matter at all if the law is not being enforced

anyway? Only time will tell, but the coming months should be

very interesting. the United States is also battling the WTO,

because of the U.S.?s stand on online gambling?it?s can?t be

fully regulated and taxed by the U.S., so they don?t like it.

Comments (0)

CMA Blog Home

I was reading one of my favorite books. The Millionaire Next Door by Thomas J Stanley, PHD

In the Chapter, You Aren't What You Drive Mr Allan - the multi millionaire -was given a gift of a Rolls Royce by his friends for their appreciation of his help etc. He refused the Rolls Royce because it didn't fit his life style.

QUOTE:

With a Rolls, I can't go to some of the crummy restaurants I enjoy going to... Can't drive up in a Rolls Royce. So, no, thank you. And so I had to call and say, "I really got to tell you something. That I don't want it." IT's totally unimportant... There are more things that are more fun to do... more interesting to do than (than owning a Rolls Royce

The Millionaire Next Door

Mr Allan also indicated that he liked to go fishing and that he couldn't throw bloody fish in the back seat of a Rolls Royce.

The thing that I found the most interesting was where he mentioned that if he took the Rolls Royce, he would probably feel compelled to

buy more upscale things to prove his life style. IE... I drive a Rolls Royce, and now I need to show other things that prove my wealth. He wasn't interested in doing that.

Here's a guy that's worth millions who has chosen to not buy the "millionaire" lifestyle items. He has chosen to have control over exactly what he wants to own, and show people about himself.

This is a great lesson in financial maturity. The tendency is: the more you make, the more you buy, the more you need to show off.

If this is the case, your lifestyle becomes more and more expensive and harder to manage.

Example: You buy a cottage. Next you have to buy a boat for the cottage and some Jet Skis. Then you have to buy ATV's. Then your neighbour buys a motorhome and you feel you need one as well. Then you buy all of the accessories needed for your cottage collection.

Sometimes it's nice just to keep things simple.

Comments (1)

CMA Blog Home

Trans Union Canada What a Pain in the Ass

Back in late 2005 we set up an affiliate agreement with TransUnion Canada to promote their credit reports and other products on our sites. What a great fit I thought. We talk about money, and could help promote their credit report sales.

TransUnion buggers!! We used to only tell people that they could order their credit reports from equifax canada and TransUnion Canada by mail for FREE!! This is the law. I thought we were doing TransUnion a favor by helping people get a PAID credit report.

Two months later transunion canada decided that they didn't want to deal with us because we also promote credit repair material. credit repair material still entices people to order their credit reports.

Today I get a letter from TransUnion Canada threatening to sue me because I missed taking down a few of their logos and affiliate links etc.

If you've ever been in the affiliate marketing business, you know that there are links all over the place if you're doing your job right.

Anyway... for public information purposes, you CANNOT purchase a credit report online from this site any longer. You CAN however get your credit report from TransUnion Canada for FREE by mailing in for it.

I should have charged them for set up and take down of the web pages and artwork.

BE FOREWARNED... TransUnion is sticky when it comes to law and legal issues. If you're going to set up an affiliate program or any other dealings with them, they are very litigious. This is my opinion (of course).

Comments (1)

CMA Blog Home

I saw this article and thought I should write about it. Paypal.com is a great way to pay for things on the internet . If you're a merchant, it's a great way to accept payments. You can use paypal money and not a credit card.

The thing I like about paypal is that they act as an intermediary. You don't give your credit card out directly to the merchant. In essence, when you make a purchase, you pay paypal.com who then pays the merchant. It's pretty secure that way.

PayPal clicks with entrepreneurs

Web service simplifies back-office transactions, but big banks can offer more bang for the buck, MICHAEL RYVAL reports

MICHAEL RYVAL

Special to The Globe and Mail

When Ahmed Farooq bills his customers, it's as easy as a few clicks of the computer mouse. The payments arrive in his bank account a few days later.

Mr. Farooq has been using PayPal for his Toronto-based firm Enthropia Inc. since it was incorporated in 2003. The company sells tools for web bloggers and content-management software for Web sites.

"PayPal's biggest benefit is that it makes things very easy," says Mr. Farooq, a University of Toronto computer engineering graduate. "It's e-mail-based. So, I write, 'Send me X amount of dollars. This is my PayPal address.' They send it and there's no hassle."

American Express Air Miles

Comments (0)

CMA Blog Home

We fixed our email yesterday. There was a glitch in the system that was caused by our ISP changing our IP addresses. It took the better part of a month to figure out where the problem was..

I apologize if anybody had been trying to contact us and were getting our emails bounced back to them.

They ARE working now.

Credit cards for canadians in canada

Comments (0)

CMA Blog Home

I received this email from Traderzone a while back and was wondering if anybody else had heard about them.

Canadian-Money-advisor.ca is not affiliated in anyway with TraderZone, but at the time of this post, we were asked by Glenda Dowie to look into doing some marketing for them. We never reached an agreement with Glenda.

It's funny to look back on these old posts and see what transpired.

Feel welcome to attend

Winnipeg Traders Club Meeting

[Selecting stocks from a newspaper]

Are you still blindly circling stocks in the paper? Can't see the trends?

Come to the next TraderZone meeting to see how TraderZone can work for you!

Date: Tuesday April 11, 2006

Time: 7:00pm Sharp

Place: Canada Inns Fort Garry

1824 Pembina Highway

North of Bishop Grandin Blvd

Topic: "In the Zone"

Bonus: Enter free draw for a special prize!

Using TraderZone to make money in the market.

Come out to hear what Glenda is talking about!

Bring your TraderZone book and a notepad.

Invite a friend that is interested to learn more about TraderZone.

Please RSVP.

Comments (1)

CMA Blog Home

|

Subscribe in a reader

|

|

|

|

|

Enjoy our "What Is This?" articles

• Taxes

• Credit

• Debt

• Bankruptcy

• Credit Repair

• Investing

• Making Money

• Saving Money

• Retirement Planning

|

Comments on our

Blog Posts

|

|

|

|

|

|

|

2012-11-13 23:08:19

Cbv Collection Services Problems

same deal,,these criminals sent a bill saying i owe 18,000$..hilarious,,they call me 5x per day..i am taking rogers to court..small claimes..why not y

Comment By:karen cliff

|

2012-11-13 13:18:44

Retail Theft Could Get You Sued

I keep receiving emails and phone calls from people who think they can simply ignore the letters from these Civil Recovery lawyers.

Don't.

They

Comment By:Gerry Laarakker

|

|

|

2012-10-18 08:23:07

Retail Theft Could Get You Sued

Bank statements can be demanded or balloon a day even fail to repay the debts incurred from the varied lenders. The offered amount in such cash untill

Comment By:Spadiatrere

|

|

|

|

|

2012-10-09 12:42:44

Credit Repair Canada 3 Things You Should Know

to , take up a new job. Also, reflect on investing in generating a payday advance loan while using classmates and more, typically the segments. The in

Comment By:WarbabsjamY

|

|

|

2012-09-30 20:03:01

Cbv Collection Services Problems

I had a telus pay as you go phone from 2003 2008 and now cbv collectons is claiming that i owe over 1500 dollars, the last time they called i called

Comment By:marcus

|

2012-09-25 10:19:31

Cbv Collection Services Problems

Had a bogus 'roaming charge' bill from Telus a few years back. Got mad at them and switched providers. It went to CBV. Yes, they are persistent and

Comment By:Scammed

|

2012-09-23 07:37:50

First Canadian Finance Scam Site

While these aforementioned dangers are a cause for legitimate concern, there are other dangers that derive from perceptions that often have no basis i

Comment By:effomicok

|

|

|

2012-09-16 16:42:15

Retail Theft Could Get You Sued

I am sick of all you so called legal counsel, wanting money from me , there was a reason i was stealing the items in the first place, i have no money!

Comment By:a shopplifter

|

|

|

2012-09-13 11:18:04

Car Repossessed Trouble With High Risk Car Loans

Our car loan was with wellsfargo to begin with then transfered to carfinco,. Have never had a problem with them yet and have less than 2 years left on

Comment By:Darlene Fougere

|

2012-09-02 18:27:17

15 Blog Post Articles That Talk About Equifax

obviously like www.canadianmoneyadvisor.ca however you need to test the spelling on several of your posts. A number of them are rife with spelling p

Comment By:promotion site

|

2012-08-31 11:32:19

Retail Theft Could Get You Sued

so i went in zellers and i baught bus tickets. then walked around playing with toys, and i was with a friend, we're both adults who like stupid toys.

Comment By:Aj.

|

|

|

|

|

|

|

Site Menu

|

|

Canadian Credit Cards

|

Best Canadian credit debt Financial Blog

Canada, British Columbia (BC), Alberta (Alta), Saskatchewan (Sask), Manitoba (MB), Ontario (Ont), Quebec (Que), Newfoundland (Nfld), New Brunswick (NB), Nova Scotia (NS), Prince Edward Island (P.E.I.), credit canada, Canadian

|

|